What will be the volume of public syndicated offshore RMB bond issuance in 2016? (2015: Rmb111bn excluding MoF auctions) (Total responses: 1,509)

Considering last year’s steep fall in offshore renminbi bonds it is hardly surprising that respondents are far more bearish on the outlook for dim sum debt in 2016. When Asiamoney asked this question in 2015, the majority (43%) thought volumes would be Rmb200bn, followed by 35% at Rmb250bn and 22% picking Rmb150bn.

But since then the market has faced tougher conditions and volumes fell 46% year-on-year in 2015 and at the time of writing there had only been one public syndicated offshore RMB bond this year. The market has been buffeted by a number of headwinds. Last August’s surprise devaluation of the currency and the subsequent volatility and uncertainty about future policy direction has deterred both issuers and investors.

Adding to that is the fact that funding in onshore renminbi is much cheaper which means the Chinese companies that made up the bulk of issuers are choosing to raise debt domestically. What funding there has been in offshore renminbi has largely been confined to private transactions and bankers say this trend looks likely to persist.

Will China widen the RMB's trading band in 2016? (Current +/-2%) (Total responses: 1,652)

Last year’s high expectations that the trading band would be widened appeared to be justified when in July the State Council announced that it was planning to expand the range in which the renminbi could trade. The proposal was viewed as part of China’s strategy to

None of that has been enough to change the mind of our respondents with the same percentage as last year expecting a widening to at least 3%. The main change this year is that more people think the widening will be greater than 3%, with the percentage up from 28% last year. There could be a number of factors which would drive regulators to widen the band despite the current focus on currency stability.

For a start, the renminbi still needs to meet all the criteria of being ‘freely usable’ when it enters the SDR in October and as band widening has tended to lead to renminbi depreciation, this could be one way for regulators to get the currency lower while avoiding accusations of manipulation.

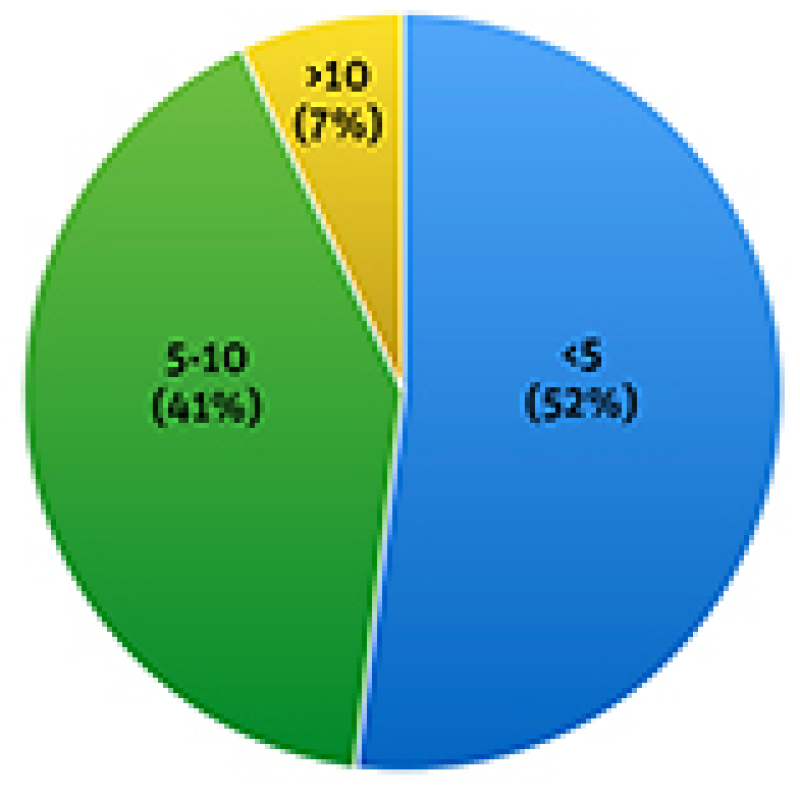

By how much do you think the renminbi will depreciate against the US dollar this year? (Total responses: 1,674)

Most of the discussion this year has been about when rather than if the renminbi will depreciate. Last August’s surprise weakening of the currency against the US dollar caught markets off guard but at the time was interpreted as a sign the Chinese economy was in trouble which increased the downward pressure. Add to that hedge funds and other investors shorting the currency and it was only by expending huge amounts of reserves that the People’s Bank of China was able to stabilise the renminbi.

While volatility has settled down — and at the time of writing the renminbi was showing a mild year-to-date appreciation against the US dollar — what is clear from the answers to this question is there is still a high level of expectation that the renminbi will end the year lower. No doubt hedging strategies will continue to remain at the fore for some time but markets will have to wait to see whether depreciation will be gradual or through another one-off move.

How many Panda bonds will be issued this year? (2015: Rmb8bn, Year to March 31: Rmb4.9bn) (Total responses: 1,557)

Panda bonds had been dormant for years and then exploded into life in September after Chinese authorities decided the time was right to revive onshore renminbi debt sold by

As yet there are no formal guidelines, the ability of issuers to repatriate the proceeds is on a case-by-case basis and non-SSA issuers need to have financial statements that adhere with Chinese accounting rules. But none of that has stopped a long stream of issuers saying they want to sell a Panda. Sovereign and supranationals have been particularly keen and the pipeline includes Export-Import Bank of Korea, Hungary, New Development Bank Brics and Poland. And there is still plenty of work to be done to open up this funding channel as 30% of respondents do not know what is a Panda bond.

How much will Stock Connect northbound daily trading pick up by this year? (Total responses: 1,510)

Excitement and scepticism greeted the launch of the Shanghai-Hong Kong Stock Connect

No doubt some of that can be attributed to the volatility in Chinese stock markets as investors moved to limit their exposure. The figures for average daily turnover certainly suggest that demand has cooled. Buy and sell orders totalled a daily average of Rmb6.21bn in 2015 but that had already fallen to Rmb3.33bn by the middle of April, a drop of 46%.

This is likely to remain the case until markets provide some calm and stability. But the platform is a key piece of infrastructure as it remains the only way that offshore investors can buy Chinese shares without a quota. And with a Shenzhen-Hong Kong link expected to launch later this year the programme is only going to get bigger.

When do you think the RMB will be fully convertible? (Total responses: 1,662)

Given the shutdown of outbound investment schemes and the aggressive steps Chinese

Full convertibility is of course different from freely tradeable but this year’s curbs on outbound investment have definitely done little to increase convertibility. However at the same time, offshore institutions now have more access than ever to China’s onshore markets thanks to the opening up of the interbank bond market to long-only funds.

Which regions do you expect to be the most active ones in RMB business in 2015? List top 3. (Total responses: 1,662)

It is perhaps unsurprising that East Asia is viewed as the most active region for RMB business despite the attempt to globalise the currency. Hong Kong remains the pre-eminent offshore renminbi hub. It is the testing ground for new initiatives and of course there is the city’s close business and cultural links with China. It is also home to many international companies that are free to conduct RMB transactions through Hong Kong. South Korea has also boosted its renminbi credentials in recent years.

However other regions are viewed as taking a bigger slice of the pie this year. Southeast Asia is second pick with 43%, up from 31% a year earlier. Singapore remains the centre of Asean RMB activity and has stepped up its efforts in the past year while Thailand and Malaysia became RMB hubs in 2015 underlying the importance of this region. EMEA has also seen its proportion rise from 2% to 9% while the Americas remain the laggards on similar levels to last year.

Do you plan to use the Cross-border Interbank Payment System (CIPS) this year? (Total responses: 1,661)

It’s still early days for the Cross-border Interbank Payment System (CIPS) which went live in October but the platform is expected to play a key role in the internationalisation of the

For any treasurer who regularly conducts cross-border renminbi payments with China, CIPS should make the process more efficient and more standardised with existing payment systems. With a third of respondents to the Asiamoney poll planning to use CIPS this year, demand is only set to grow for the payments platform.

How much new RQFII quotas do you think will be approved in 2016? (2015: Rmb144.6bn) (Total responses: 1,517)

Respondents were obviously bullish about China’s inbound investment programme last year with 63% predicting that new quota approvals would reach between Rmb150bn and Rmb450bn. The final amount ended up being just short of this lower range with Rmb144.5bn approved, according to CEIC data. There is far more caution this year with nearly half of those asked forecasting that RQFII approvals will be lower than Rmb150bn. That said, another 46% have opted for more than Rmb150bn.

Of course, while this questionnaire was taking place, the People’s Bank of China announced it was opening up the interbank bond market to almost all types of financial institutions. While many hold the view that this liberalisation makes RQFII largely obsolete, there may still be demand for RQFII products for investors that do not have the expertise and infrastructure to access China’s markets directly.

How many new RMB hubs do you expect to have in 2016? (Total responses: 1,634)

The slowing pace of RMB hub designations last year was predicted by poll respondents with

Despite the well documented turbulence in the currency, countries are still keen to make the most of the strategic and financial benefits that come with being an offshore renminbi hub. For example in December, the Central Bank of United Arab Emirates signed a memorandum of understanding on RMB clearing.