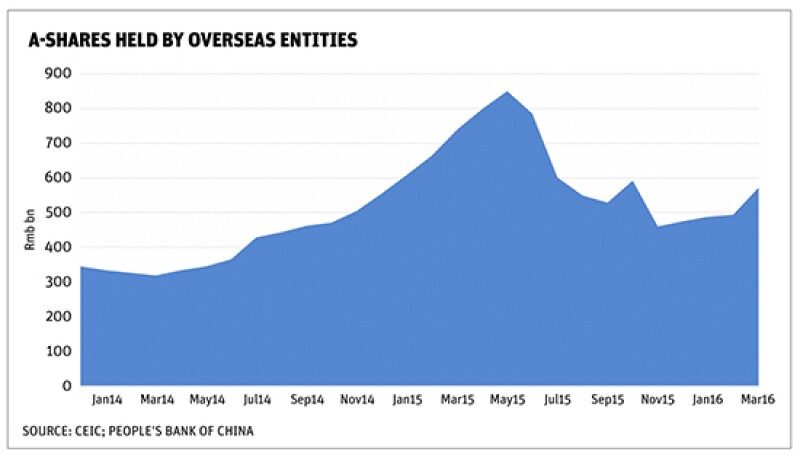

Even before Chinese equity markets were hit with turbulence last year, there were good reasons why foreign ownership of Chinese stocks had remained low. Around 80% of investors in the world’s second biggest equity market by capitalisation are retail, making it unpredictable at the best of times. Add to that the difficulty in gaining access via arcane quota schemes and no wonder global investors have kept their distance.

Then the events that unfolded over the summer seemed to confirm the worst fears about the Chinese market. The Shenzhen and Shanghai exchanges went on a rollercoaster ride, with the Shanghai Composite Index (SHCOMP) surging to touch the record level of 5,166 points on June 12, 2015 before collapsing all the way to 2,655 points just six months later.

The killer blow to foreign investors’ confidence, however, was the decision by the People’s Bank of China (PBoC) to reform its daily fixing mechanism for the onshore RMB (CNY) against foreign currencies on 11 August 2015. That decision brought to an end a multi-year trend of RMB appreciation, with the CNY since losing 4.6% of its value against the dollar.

“The A-shares market last year went to extraordinary valuations and it had not been on the global investor radar until it moved so much,” said Luke Spajic, head of portfolio management, emerging Asia, Pimco. "Second was the currency effect, when the RMB moved it made all risk asset classes follow, and the China story from a macro perspective became much more important."

The combination of the two trends has given global investors quite a scare. Yet, entering the second quarter of 2016, with the RMB stabilising against the dollar and A-shares somewhat less volatile, the inclusion of Chinese equities in global portfolios is once again being discussed.

In a March 31 launch of a new ‘inclusion roadmap’, MSCI said it would seek market feedback on how recent reforms introduced by China’s regulators had addressed concerns about the accessibility of the market. It follows its decision in June last year that A-shares were not ready to join its emerging market indices despite Beijing making progress. One of the critical issues is the availability of investment quotas.

As it stands, investors can only access the China market under specific schemes, such as the qualified foreign institutional investor (QFII) programme or the Shanghai-Hong Kong Stock Connect. As a result, index providers have to consider whether the total amount of quotas available under these are sufficient to meet the demand for A-shares deriving from whatever initial weighting the asset class is given in their emerging market index products.

Marco Montanari, head of passive asset management, Asia Pacific, Deutsche Asset Management (DAM), says the firm’s A-shares products use indices by onshore provider China Securities Index (CSI), such as the one backing the Deutsche X-trackers Harvest CSI 300 China A-Shares ETF. The ETF is the fourth exchange traded fund (ETF) globally investing in Chinese equities, with assets under management (AUM) of $415.7m as of April 20, according to Bloomberg data.

Montanari noted CSI’s standing in China and the availability of related futures had determined its choices so far.

“We took a decision to work with CSI because of a combination of reasons, including CSI's leading position in China, and the related derivatives available,” said Montanari. "At the moment there is no plan to change [index provider] but as the situation and what the clients want evolves, we will keep doing what is in best interest of the investors."

A thorny issue

A more serious problem is the stock suspensions on Chinese exchanges last year. During the worst of the equity rout in the summer of 2015, hundreds of companies chose to self-suspend their stocks from trading.

Generally, stock suspensions rules aim to prevent speculative trading when a company is closing an M&A transaction or going through restructuring, but as a result of fuzzy rules in the Chinese securities market, firms used suspension as a tool to make themselves immune from collapsing stock values, at least temporarily.

“Suspensions affected a lot of stocks and a big percentage of the market. That is a situation that concerns a lot of investors,” said Anthony Yau, head of Asian EM active equity at State Street Global Advisors (SSGA). “Now there is talk of the regulators limiting suspensions to three months, but there is need for a solid framework. Timing-wise, regulators have a high interest to push this forward, there is engagement with exchanges and listed corporates."

FTSE, which runs the FTSE China A50 index comprising the 50 largest companies on the Shanghai and Shenzhen stock exchanges, told Asiamoney that the degree of concern among both investors and index providers was justified by how widespread the suspensions had become.

"Three stocks in the FTSE China A50 index were suspended, and on a broader universe the suspension was more severe,” said Jessie Pak, managing director for Asia at FTSE Russell. “During the most extreme period, some 40% of constituents in the CSI 300 were suspended. From that perspective, it can significantly impact the liquidity in the market. We feel that China needs to review its regulation in this area to ensure it’s harder for companies to self-suspend.”

Other market participants familiar with the MSCI review, however, offered a different view noting that from an offshore perspective, not all market participants had been equally affected by the issue.

"Suspensions have been disruptive for investment banks in their hedging activities,” said Guillaume Derville, head of Asia Pacific equity and derivative strategy at BNP Paribas. “Real money investors – pension funds and asset managers – seem to be less concerned with last summer’s suspensions and understand that China remains an emerging market.”

One step forward, two steps back?

The message seems to be getting through with Chinese regulators showing commitment to make the reforms identified in the index providers’ reviews.

For example, in February the State Administration of Foreign Exchange introduced streamlined rules for the QFII scheme and a new system that automatically grants quotas to licensed firms based on their AUM and for up to a maximum of $5bn. Previously, asset management firms had to apply for multiple quota allowances, with an upper limit of $1bn, through a lengthy process via two different Chinese regulators.

FTSE’s Pak agreed that the recent QFII reform was an important step, adding that the index provider was moving forward with its 2016 country classification review to potentially expand the 5.6% weighting it gave A-shares last year in its FTSE Emerging Markets All Cap China A Inclusion Index.

“The recent QFII enhancements will help to provide bigger quotas to investors according to their size," said Pak. "However, we are still hoping to get some additional clarity on its implementation. For example, some clients are asking us, if they have multiple QFII quotas under different entities, what can be done to get the biggest quotas possible under the new rules."

While clients figure out individual strategies to maximise access via the quota system, the index provider had concerns of its own.

"We believe that it is important to have a framework where Chinese regulators can inform the market on the quotas for each firm since the quota size is an essential factor in calculating index weightings. It would be helpful to have transparency on how big the total quota is," she said.

An expansion of the Stock Connect scheme, launched in November 2014 to allow direct trading of a select pool of stocks on the Hong Kong and Shanghai exchanges, is seen as another missing piece of the puzzle. Market participants agree that a broader set of tradable shares, and its expansion to include Shenzhen — which is expected to happen later this year — could influence the outcome of the index providers’ review process.

"Our research previously said there is a higher probability of a positive decision this year but for inclusion next year,” said DAM’s Montanari. “My personal view is that if the Shenzhen Connect is announced it would be more likely that the inclusion happens."

SSGA’s Yau said that broadening access to the Shenzhen-listed stocks could indeed be a turning point also for the MSCI review, but noted that technical issues remained.

“When launched Shenzhen Connect will complete the puzzle of access to China A-shares,” he said. "That will be a milestone. But in terms of the entire Stock Connect programme, even when completed, the mechanism of daily [net trading quota] limit is still an ongoing issue for global investors.”

Although the existing daily net trading limit on Stock Connect — Rmb13bn ($2bn) for A-shares trades —has rarely been reached, the amount would be too small to cope with any degree of global demand once A-shares are included in the indices.

“Any daily limit will be set up to fail at a critical point when liquidity is really needed,” Yau warned.

Ready or not

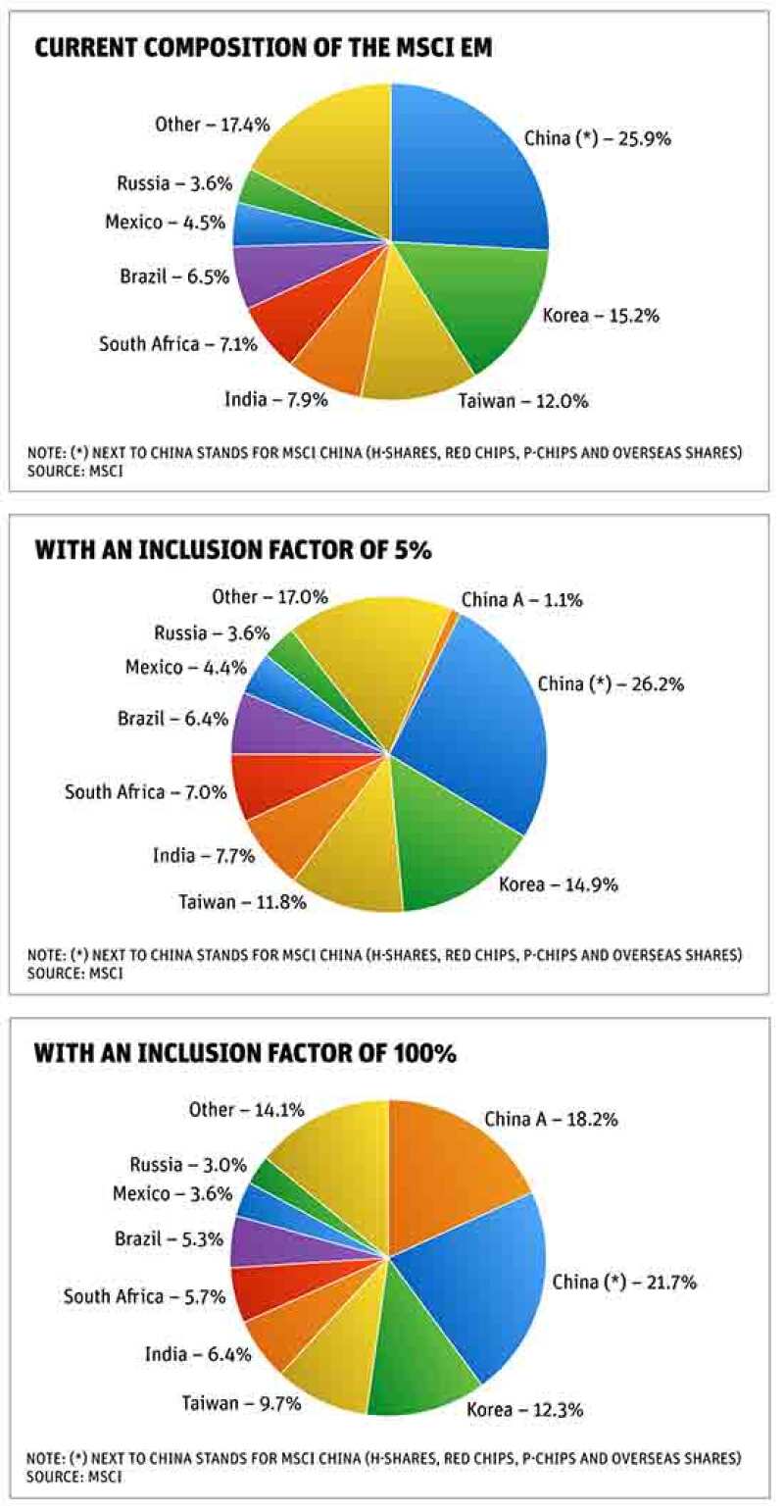

Across the market, the expectation is that MSCI is likely to give A-shares the nod this year, with the actual inclusion going live in May 2017. The proposal is for a 5% initial inclusion factor based on market capitalisation and the existing limit of 30% ownership for foreign investors of domestic stock, which would translate to A-shares having an initial 1.1% weighting in the MSCI EM Index (see charts opposite).

Despite the seeming inevitability, some remain unconvinced that the timing is right.

“There is a very big debate surrounding the timing of the MSCI decision and the initial scale of China’s share on entry to any index,” said Pimco’s Spajic. "FTSE expects some of the funds and investors to adopt its parallel indices, but it takes some time to attract assets. Investors need to know how to put money in and get it out with ease, and all the issues around capital market development in China need to be clarified.”

Jay Lee, a Hong Kong-based capital markets partner at law firm Simmons & Simmons told Asiamoney that concerns ultimately came down to how regulators would avoid a repeat of last summer’s panic. As a worrying side effect, the wide usage of stock suspensions was accompanied by government agencies increasingly stepping in with heavy purchases of blue-chip stocks to try to prevent a full meltdown.

“Index providers would need to consider whether or not there will be so much government intervention and control over the stock markets in the coming years,” said Lee.

Ultimately, Spajic urged index providers to carefully consider the impact their decision would have on investors.

"There is a major rush to jump to conclusions, but index providers need to go through the moves, they need to think about clearing, settlement, counterparty risk, they need to think about all the quirks in this market. The decision has to be driven with the end investor in mind."

In terms of the quirks, MSCI has noted that more clarity is also needed on issues such as the beneficial ownership rights of asset owners that delegate investment to fund managers, and anti-competitive clauses put in place by stock exchanges governing the launch of index products linked to shares listed on their boards.

On May 6, the China Securities Regulatory Commission (CSRC) addressed the first issue, stating that regulators recognise the beneficial ownership rights of foreign investors that use nominees under the QFII and renminbi QFII schemes. CSRC added that the rules applicable to investors and asset managers are those of the jurisdictions where the investment contract is entered into and not mainland China, adding that Chinese authorities would respect such arrangements. In May 2015, the regulator clarified that beneficial ownership was recognised for those investing through the Stock Connect scheme.

And the point regarding anti-competitive clauses is also being discussed by index providers, local exchanges, and the regulators, although there is a sense that the issue relates more to business negotiations between exchanges and index providers rather than a real regulatory roadblock.

The ‘yes’ scenario

Even with a positive decision by MSCI, analysts are expecting resulting investment flows to be modest, at least at first. BNP Paribas’s Derville said his team had estimated initial active flows of around $9.9bn and passive flows of just $1.4bn.

"Our bet is that there is a non-negligible change, which could be above 50%, that MSCI announces in June that inclusion will be implemented in May 2017," Derville said. "I think what is important to highlight is that it is not about if but when. Our conviction is that this will happen in the next 18 months."

Overall, investors agree that actual investment flows will depend as much on index inclusions as on the broader outlook on China’s economy.

“My clients always say that getting access is not a problem if there is an interest,” said DAM’s Montanari. "The macro aspect will dominate every kind of technical consideration. If investors believe in the China economy, that the currency will appreciate and not depreciate, and see that reforms are implemented, then no doubt investors will come back via Shanghai Connect or whatever instrument.

“It is going to happen in the same way that in the past they were getting exposure even synthetically when it was much more difficult.”

The fact remains that a $10tr economy is still largely absent from global investment portfolios. Transitioning China assets to their deserved roles will take years, but it will be beneficial for both sides.

For global investors, it will mean gaining direct exposure to what still is, despite the recent slowdown, one of the world’s fastest growing economies. For China, the benefits will be across many levels, from changing the composition of its investor base away from retail investors thanks to the greater involvement of global institutional investors, to promoting capital inflows that will counter capital flight and stabilise the value of its currency.

On top of that, as a signal of the broader integration of China into the global financial system, there is also the expectation that the review process will signal a new phase of domestic market reform with Chinese authorities bringing it more in line with international standards.

“This is the start of a multi-year process. Now is a good opportunity to build a stronger dialogue and create a process with the Chinese regulators to figure out how to handle the most difficult issues. Last year was the critical start of that process,” said Spajic.

With the Chinese authorities still standing by their commitment that the country will see the full opening of its capital account by 2020, the index inclusion process seems set to play a crucial role in achieving the target.