It’s been a tough year for dim sum bonds. So far this year borrowers have raised just Rmb84.8bn ($13.6bn), a 40% year-on-year decline, according to GlobalRMB. On the other hand, Formosa bond volumes (offshore renminbi bonds sold in Taiwan and listed on the Taipei Exchange), have been on the rise, with a total of Rmb28.2bn so far this year. This has already surpassed the Rmb20.8bn raised during the whole of 2014.

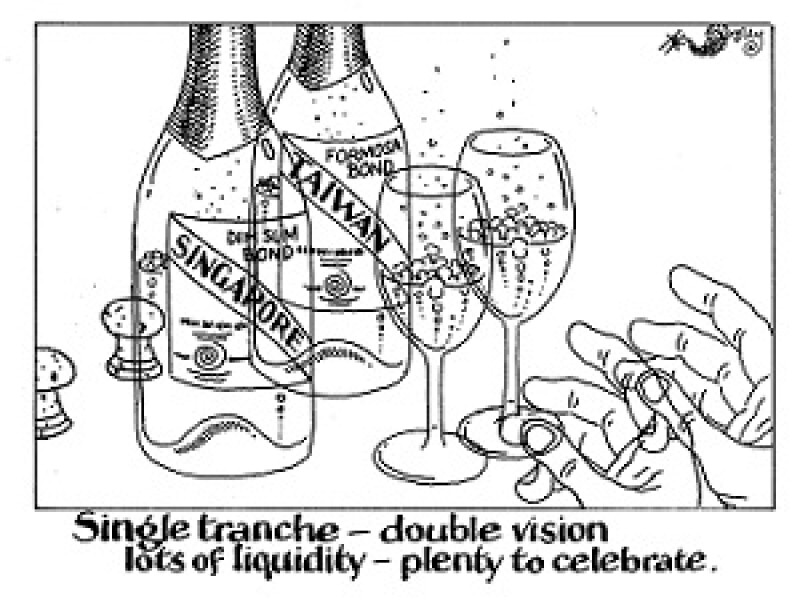

Against this backdrop of rising Formosas and declining dim sum, borrowers have come up with a unique way to take advantage of the liquidity in the two separate markets – a single tranche offshore renminbi bond dual listed in Taiwan and Singapore.

Export-Import Bank of Korea (Kexim) was the first to adopt the structure in February, scoring cost savings through a favourable cross currency swap (CCS) with the added bonus of greater investor diversification. It repeated the feat in July and was followed by compatriot Korea Development Bank (KDB), which issued a copycat bond on August 3.

This way of selling offshore renminbi bonds has plenty to recommend it. First up, issuers can tap into a bigger pool of investors and more liquidity by reaching out to two different investor bases at the same time.

The individual dim sum and Formosa markets are still relatively small in size, with limited liquidity. And this liquidity could be about to shrink even further after the People’s Bank of China surprised the market by fixing the CNY almost 2% lower against the dollar on August 11 — which is expected to lead to a drop in offshore deposits — and announcing a new methodology for its daily fixings.

But by wooing two different investor bases simultaneously, bookbuilding gains momentum more quickly and strongly. For example, KDB increased the issue size from Rmb1bn to Rmb1.2bn on August 3 after receiving bigger-than-expected Rmb2.4bn of orders. According to a source close to the deal, it was the order book passing the Rmb2bn mark that allowed the Korean policy lender to consider increasing the size. This might not seem like much, but in offshore renminbi bonds Rmb1bn is considered benchmark size.

Even better, dual-listing doesn’t necessarily cost an issuer more. This may sound counterintuitive at first because listing in two different countries involves more banks and requires more time and work, which can easily jack up the price tag for the issuer.

But for dollar-funders who can take advantage of favourable CCS rates, the savings can outweigh potential costs. As both Kexim and KDB chose windows when the CCS rates were spiking, they were able to save 10bp-20bp against their existing dollar curves on an after-swap basis, even after taking all the material and non-material costs into account.

This should come as good news to international borrowers that have remained shy of offshore RMB bonds this year. Selling a single tranche into two markets helps solve oft-heard complaints about tight liquidity and small issue sizes.

It’s time for more borrowers to follow Kexim and KDB’s lead. After all, Korean policy banks are some of the most sophisticated bond issuers in the world. And when it comes to offshore RMB, two markets are better than one.