The removal of implicit guarantees gives substance to the package of measures announced at the Chinese Communist Party’s 3rd Plenum in November 2013 which had the declared objective of allowing markets to play a “decisive” role in the economy. It is resulting in greater differentiation in the onshore bond market, which will in turn enhance risk based pricing of debt.

At the same time as China’s leaders have become more tolerant of defaults, the likelihood that companies will default has grown as reform and rebalancing advances. Slower growth is the inevitable consequence of shifting the economy away from its past reliance on investment and exports towards domestic consumption. Although in the long-term this will result in a better balanced, more sustainable economy, in the short-term it may well lead to more corporate distress.

Corporate revenues have weakened in lockstep with nominal GDP growth, with the latter decelerating to 5.8% year-on-year during Q1 2015, the slowest pace since the height of the global financial crisis in Q1 2009.

Weaker revenues have increased system-wide corporate leverage, which stood at 150% of nominal GDP in Q3 2014, according to Moody’s estimations, a 34 percentage point rise over the past five years.

Corporate Revenues Are Contracting...

Note: Nominal GDP is seasonally adjusted.

Sources: Moody's Investors Service, Haver Analytics, Bloomberg

... at a Time When Leverage is Overstretched

Note: Nominal GDP is annualised and seasonally adjusted.

Sources: Moody's Investors Service, Haver Analytics, Bank for International Settlements

Most exposed are high-yield private companies in sectors with excess capacity, such as steel, mining, solar, commodities trading and shipbuilding. Their financial profiles are relatively weak and their access to funding is limited.

There are already some signs of corporate distress showing up in higher levels of non-performing loan (NPL) formation and impairment charges at Chinese banks, and we expect this trend to accelerate in coming quarters. China’s official NPL ratio is low, at 1.39% at the end of Q1 2015, but is rising. A large rise in write-offs in previous quarters also helped to depress Q1 NPL ratios.

The rise in delinquencies will be most evident among small and medium sized enterprises (SMEs). However, problem loans will not be just limited to this sector. Several Chinese banks indicated in their full year results for 2014 that delinquencies from large borrowers and state-owned enterprises (SOEs) are rising.

While corporate defaults in China are likely to increase in frequency, policy easing and government support will prevent them from escalating to a level that would cause systemic risk to the onshore and offshore markets.

The high profile property sector has been one of the first recipients of policy support. This led to market conditions stabilizing during January-April, leading to expectations of a modest recovery in sales volumes for 2015, in sharp contrast to the fall evident in 2014.

The authorities are also demonstrating a renewed bias towards policy easing and flexibility towards structural reform in other sectors in order to engineer a soft landing.

Specifically, in May, the central government issued a directive instructing banks to continue lending to local government financing vehicles (LGFVs) for projects approved as of September 21 2014, and also announced that RLG bonds now qualify as collateral for borrowing from the central bank.

Both of these measures should ensure adequate financing for RLGs, thereby helping to stabilize local economic activity, in turn helping out local corporates.

Looking ahead, the central government has adequate fiscal and monetary headroom and exerts sufficient control over the economy to avoid widespread corporate failure and support the banking system.

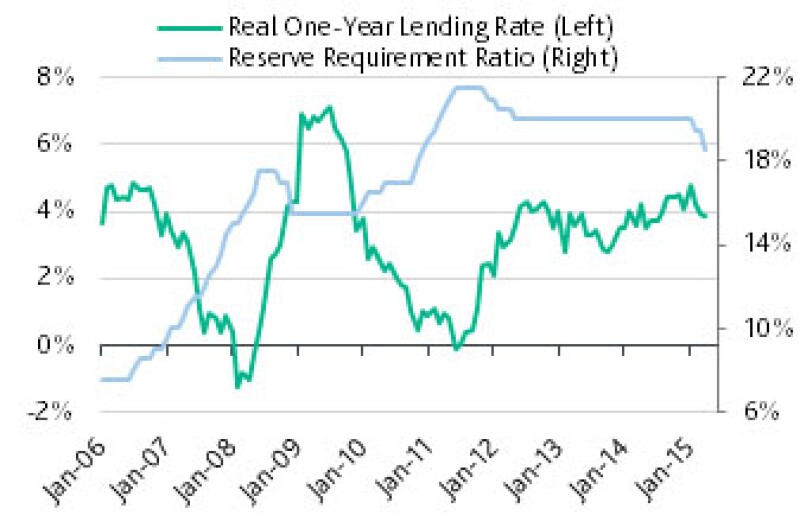

Room is available for a further loosening of monetary policy should macroeconomic conditions continue to deteriorate, given that real lending rates and the reserve requirement ratio remain high by historical standards.

Elevated Real Lending Rates and Reserve Requirement Ratio Suggest Room for Further Monetary Policy Support

Sources: Moody's Investors Service, Haver Analytics

While onshore market developments have broken the myth of the automatic bailout, and the authorities are likely to adopt a more selective approach to supporting SOEs, the offshore issuers in Moody’s rated portfolio remain relatively well positioned.

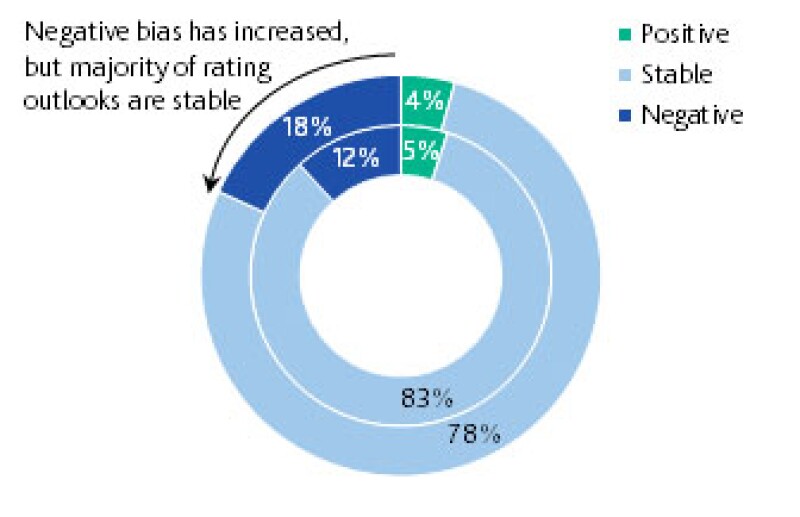

The corporates we rate are generally market leaders in their respective industries, such as in the state-owned enterprise (SOE) or property sectors. Accordingly, 78% of Moody’s rated corporates in China have stable outlooks.

Furthermore, many of the SOEs we rate play an important role in social welfare, national security, and resource development, such as those in oil and gas, infrastructure and utilities, and are thus likely to maintain strong government support.

Nevertheless, further corporate distress cannot be ruled out, particularly in the rated high-yield segment, as credit metrics such as liquidity and leverage weaken and the new policy regime results in defaults becoming more routine.

Most Rated Chinese Corporates Carry a Stable Ratings Outlook Rating: Ratings Outlooks for Rated Chinese Corporate Infrastructure Issuers

Source: Moody's Investors Service

Michael Taylor is managing director for Moody's Investors Service and Moody's chief credit officer for the Asia-Pacific region.

Rahul Ghosh is a vice president and senior research analyst for Moody's Investors Service.