For years, governments and business leaders in Asia and the Middle East have been fond of invoking the spirit of the ancient Silk Road when talking about trade, investment and banking opportunities between the two regions. Malaysia’s central bank, for example, can’t seem to give a single speech without referring to it, seeing the historic trade route as an anchor for growth in Islamic finance; in the Middle East, Bahrain in particular likes to use the same analogy.

China is no exception. Over the last year, details have begun to emerge of a number of programmes with stirring or iconic names: One Road, One Belt, for example, comprising the 21st Century Maritime Silk Road and the Silk Road Economic Belt.

They sound grand, and involve a lot more than China and the Middle East. The Maritime Silk Road, for example, was first mentioned by President Xi Jinping in Indonesia in late 2013, and involves seabound trade that is as much to do with Asean and the South China Sea as it is the Persian Gulf. The Silk Road Economic Belt is probably most significant for Central Asia, since that is the region that has the most to gain from greater interconnectivity and integration.

But the Middle East will be an important part of all these initiatives, and they are beginning to be backed up with practical action.

In November, Xi Jinping said that China would contribute $40bn to its new Silk Road Fund in order to improve trade and transport links through these initiatives. He did so a month after the establishment of the $50bn Asian Infrastructure Investment Bank, whose formation was spearheaded by China and whose founding signatories also include Kuwait, Oman and Qatar, subsequently joined by Saudi Arabia, Jordan, and, in April, the United Arab Emirates and Iran.

Since then, discussions have taken place between China and the Gulf Cooperation Council states to develop free trade zones to promote bilateral trade.

More than oil

Despite what one might expect, it’s not just about the oil. “The relationship between China and the GCC has moved beyond China’s still increasing interest in acquiring Arab hydrocarbons to fuel its growth,” says Chris Macbeth, Cleary Gottlieb Steen & Hamilton counsel in Abu Dhabi. “The new Silk Road is becoming a two-way street with many diverse lanes.”

Yes, China is a big buyer of Gulf oil: the largest crude oil importer in the world in December 2014, buying seven million barrels a day that month, according to Deutsche Bank. And yes, it is a big investor in refineries, petrochemical plants and aluminium smelters in Saudi Arabia. But there is a lot more to it than that, and not all of it in the same direction.

Consider, for example, the plastics factory near Shanghai owned by Borouge, which is a joint venture between Abu Dhabi National Oil Company and Austria’s Borealis. Another is Dubai-based hotel group Jumeirah’s plan to build luxury hotels in Guangzhou, Hainan, Zhejiang and Macau. Saudi private investment firm Ajlan & Brothers has invested $632m in 20 textile factories in China; Dubai’s supermarket operator Al Futtaim is investing in agriculture there.

“The diversification has spread to involve investments — in the GCC and China — in renewable energy, infrastructure, technology, transport, finance and manufacturing,” says Macbeth. “As a result, China is on track to become the GCC’s most important economic partner within the next few years.”

In some respects, this has already happened. “Saudi has now replaced the US as China’s single most important trading partner,” says Raghu Mandagolathur, senior vice president, research at Markaz in Kuwait. China is ranked first for Saudi, Iranian and Omani imports — in Iran’s case, because China doesn’t participate in US, EU or UN sanctions against the country — and is in the top five for other countries in the region, Raghu says.

It’s not as strong as it could be — Gulf demand for Chinese manufactured goods is broadly quite weak, Raghu says, and Chinese growth is of course slowing. But trade links between China and the region have still grown at double digit rates in the last decade, and “trade with the Middle East remains a priority for the world’s largest energy consumer.”

Today, China imports 51% of its crude oil from the Middle East, Raghu says, but he cites IEA data predicting that the figure will reach 70% by 2020 and continue to grow until 2035.

The growth on the trade side is easily demonstrated: one sees it in the Chinese companies locating their warehouses and logistics hubs in UAE free zones, especially at Jebel Ali port. It has been five years since the first Abu Dhabi and China Economic Forum, held in May 2010 in Shanghai with the backing of the Abu Dhabi Department of Economic Development, opened with grand claims that bilateral trade with the UAE alone would exceed $100bn by 2015; we appear to be short of that – the figure was $46bn in 2013 – but it’s not an implausible long-term target.

Investment capital

That’s trade, but what about investment? The $10bn joint fund announced between Qatar’s sovereign wealth fund, the Qatar Investment Authority, and Citic in November is an example of capital transiting between the two regions in search of opportunity. And although Gulf sovereign wealth funds are somewhat secretive, there’s no question that a great deal of their allocation is heading into China.

The Abu Dhabi Investment Authority, for example, has received approval to increase its allocation to A-shares in China to $1bn under the Qualified Foreign Institutional Investor (QFII) scheme, and is openly positive about the country.

Hamed bin Zayed Al Nahyan, managing director of ADIA, wrote in his most recent public comments about the fund last year: “Despite short-term setbacks, emerging markets, and particularly China, are likely to play a much greater role in this global growth cycle than ever before. China is in the midst of a historic shift in its economic governance that will likely result in a loosening of administrative controls and allow markets to play a larger role in allocating capital.” Representatives of the fund’s real estate team have told Asiamoney they are particularly active in China.

The Kuwait Investment Authority, ADIA’s equivalent body in Kuwait, has a still bigger allocation to Chinese A-shares under QFII, having seen its quota lifted to $1.5bn in January 2014. It also has a further $1bn of direct investment quota in China’s onshore inter-bank market.

In the other direction, investment can be seen in a multitude of sectors, among them infrastructure. When Saudi Arabia wanted a monorail project built in the holy city of Mecca, it went to China Railway Construction Corp to do it, although CRCC would later claim to have lost as much as $600m on the project. The contract to supply the metro cars went to Changchun Railway Vehicles.

Since then, Chinese and Iranian interests have agreed to build a railway line from Tehran to the Iraqi border, partly with a view to creating the Silk Road infrastructure China envisages to link the regions.

Raghu at Markaz says that China’s cumulative investment into Saudi Arabia alone was $13.6bn between 2005 and 2012, including $5.2bn in metals, $3.3bn in energy and $2.2bn in real estate.

“Governments in the Middle East have brought Chinese contractors to work on major infrastructure projects in the region,” he says, adding another example on the fringe of the Middle East: Egypt’s partnership with China to develop the Suez Special Economic Zone.

Trade, then finance

Naturally, where trade and investment goes, financial services follow. “New business registrations by Chinese companies have grown rapidly in the UAE, and Chinese banks are setting up in Dubai and Abu Dhabi to administer capital flows,” Raghu says. All four of China’s big four commercial banks are registered within the DIFC, and multinationals like Standard Chartered, HSBC and Citi anecdotally report greater activity that involves both their Chinese and Middle East teams. At StanChart in particular, more and more Mandarin speakers are appearing on the staff in Dubai and elsewhere in the region.

At a central bank level, there are widespread tie-ups with the People’s Bank of China (PBoC). “MoUs, central bank swap lines and infrastructure linkages between Middle East central banks and China are an important signal to the market that their governments support the use of RMB and can provide liquidity to the market if required,” says Anthony Lin, head of corporate banking, trade finance and corporate cash management for China at Deutsche Bank.

He says that central banks in the Gulf tend to reinvest RMB back into China through PBoC quotas and put it into the inter-bank market; both the UAE and Qatar’s central banks have swap lines of Rmb35bn ($5.6bn) apiece.

An interesting additional angle on these links is the internationalisation of the RMB, and how this affects Middle East and Chinese banks. In November, the People’s Bank of China named ICBC’s Doha Branch as the renminbi clearing bank for Qatar, the first such appointment in the Middle East (and one that raised eyebrows in Dubai, which had expected to host the first such bank).

Dubai is hardly likely to miss out in the long run, and being a regional hub for offshore RMB trading is exactly the sort of role that the Dubai International Financial Centre (and perhaps the under-development Abu Dhabi Global Market) exist to fill. Indeed, Asiamoney understands that DIFC held talks with the PBoC about exactly that role in November 2014.

Meanwhile, Agricultural Bank of China has sold an offshore RMB bond in Dubai in September 2014, and Emirates NBD, from Dubai, issued the region’s first RMB bond back in 2012, so it may only be a matter of time until the Emirate grasps the mantle of regional hub for the Chinese currency, with ABC touted as the bank most likely to be given a clearing bank role in Dubai.

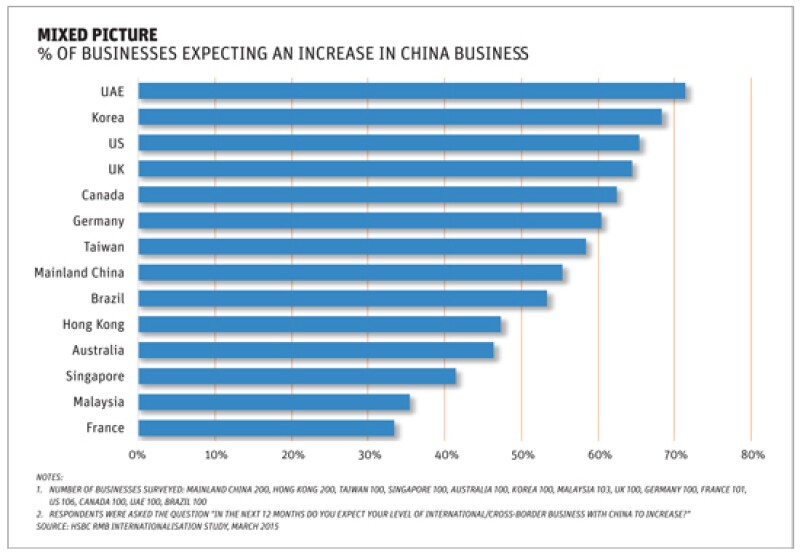

In a study on RMB internationalisation published by HSBC in July 2014, 73% of decision-makers in the UAE said they planned to increase their cross-border activity with China over the next 12 months, with more than half of respondents saying they believed they would see business relationship benefits from adopting the RMB as a settlement currency. About a quarter of senior management teams in the UAE have discussed the RMB as a business enabler, HSBC says.

Limits to growth

That said, banks should be realistic about the role the RMB will play in the region in the short term.

“From our observation, there is no strong requirement for Chinese corporations to settle in RMB at this stage when transacting in the Middle East,” says Lin at Deutsche. “One reason is the lower level of RMB liquidity in the market. Second, the returns offered from holding RMB are not meaningful. And third, local corporate headquarters are often willing to settle in US dollars, considering current low interest rate levels for financing.”

Lin says the use of RMB in crude oil and derivatives has been “negligible. We don’t see much opportunity for the RMB to break into this space in the Middle East.” Partly this is because the dollar is, intractably, the currency of oil pricing. “The US sees this space as a major geopolitical and security issue and it would take a lot to dislodge the dollar.”

Additionally, Lin says, “the offshore markets for RMB investments are nascent, not providing many alternatives for Middle East states to put their RMB to work,” particularly since they already invest onshore in China through the sovereign wealth funds and their QFII allocations.

Indeed, a closer look at the HSBC survey shows that only 10% of businesses in the UAE use the RMB for cross-border activity, a figure that did not increase between 2014 and 2015. Globally, the figure was 22% in 2014, HSBC says.

Still, that’s not to say there isn’t increasing interest. “The Chinese currency is enjoying a rising acceptance in banks and enterprises in the Gulf region, and there is a growing demand for conducting trade with the currency,” says Raghu at Markaz in Kuwait. “The UAE is the biggest export market for Chinese goods in the region, and leading local and foreign banks have recently started to expand their product portfolio to provide accounts for trade financing in the Chinese currency.

"Many believe that cross-border renminbi settlement is expected to account for 20% to 30% [of total settlement for Chinese goods] in the next five years.”

While that view might appear to be at odds with what Lin at Deutsche is seeing, a look at what’s happening on the ground helps to show why it might not be so far-fetched. Partly, it’s about people.

“At the same time as the increase in trade and investment, there has been significant growth in the movement of people to the GCC, and the UAE in particular,” says Macbeth. “The presence of Chinese nationals resident in the UAE is significant, especially in Dubai, and growing.”

Dubai residents can see this in action by looking at Dragon Mart, a fast-growing complex in Dubai International City on the Oman-Hatta Highway, which is already the world’s largest Chinese trading hub outside mainland China and which is not only about to be significantly expanded but upgraded (in Dubai’s parlance that’s a bigger deal that mere semantics might suggest) to Dragon City, a retail, residential, leisure and exhibition development. Retail is, after all, a natural sector to drive settlement volumes.

Another is tourism, of both the leisure and corporate variety: “Few UAE residents,” notes Macbeth, “will have failed to notice the arrival of over 14,000 employees of one Chinese company on one package tour organized last year by their employer.” They booked out Ferrari World in Abu Dhabi in its entirety for three days.

For another indicator, take a look at the region’s route maps: Qatar Airways flies to six Chinese cities, not counting Hong Kong, and Emirates and Etihad to three apiece. Sharjah-based Air Arabia just announced flights to Urumqi, “symbolically,” as Macbeth points out, “as Urumqi was a major hub on the original Silk Road.”

Shifting model

It’s worth noting, though, that both ends of this vibrant corridor are undergoing a period of change. Chinese growth has slowed and its whole economic model is shifting towards one driven by domestic consumption rather than slavish acquisition of commodities, and the Middle East’s economic heft is being undercut by falls in the oil price.

“According to some of the major Chinese companies that we cover, while the lower oil price has not impacted their trading volumes, we have seen an impact on the total amount traded,” says Lin at Deutsche Bank. “Most companies are taking the view that the low oil price is unsustainable in the medium term.”

Raghu argues that the low price has in fact accelerated trade between China and the Middle East, with volumes of oil and petrochemical movements increasing in the face of lower prices.

“China eagerly shored up its stocks of the commodity, which works well for the OPEC nations, as they are keen on increasing their market share rather than controlling supply to regulate prices,” he says. On the other hand, he believes low oil prices have reduced inflation globally and therefore brought the cost of goods and services down, impeding China’s competitiveness in global markets.

Whatever the oil price does next, an increasingly close relationship between China, as consumer and investor, and the Middle East, as hydrocarbon provider and a source of institutional wealth, seems inevitable. There’s just too much to gain, on both sides, for the relationship not to flourish.