Belarus itself is not on any list of EU or US financial sanctions (though there is an EU arms embargo and several members of the government have been sanctioned), but the last time it issued a bond, in 2011, the four lead managers, BNP Paribas, Deutsche Bank, Royal Bank of Scotland and Sberbank, were widely criticised because of the country's violent crackdowns on political dissenters. Some banks shunned the deal.

But Belarus is far from the only country with a poor human rights record that uses the bond markets. And such issues have risen to the top of the agenda for many debt capital markets teams, particularly after BNP Paribas’s $9bn fine last year for violating sanctions on Iran, Sudan and Cuba.

At least three banks have told GlobalCapital they have had to turn down bond deals in Africa and the Middle East as a result of such fears, even when the countries involved were not infamous for human rights problems.

BNP Paribas passed on an Ethiopia mandate for compliance reasons last year, though it was not clear whether these were linked to the ethics of the country’s regime.

Nevertheless, plenty of bond business still gets done for the 52 countries that are classed by the Economist Intelligence Unit's Democracy Index as authoritarian regimes.

Most of this is for countries Western businesses engage with enthusiastically, with the support of their governments, such as China, the United Arab Emirates, Saudi Arabia and Kazakhstan. Bankers say they take more care than ever over due diligence on specific issuers and to avoid corruption. But although most of these countries are viewed favourably in the West at present, recent events such as the Arab Spring and Russian aggression against Ukraine show that perceptions can change very quickly — and that could make financial business much more difficult, and bring ethical concerns to the surface again.

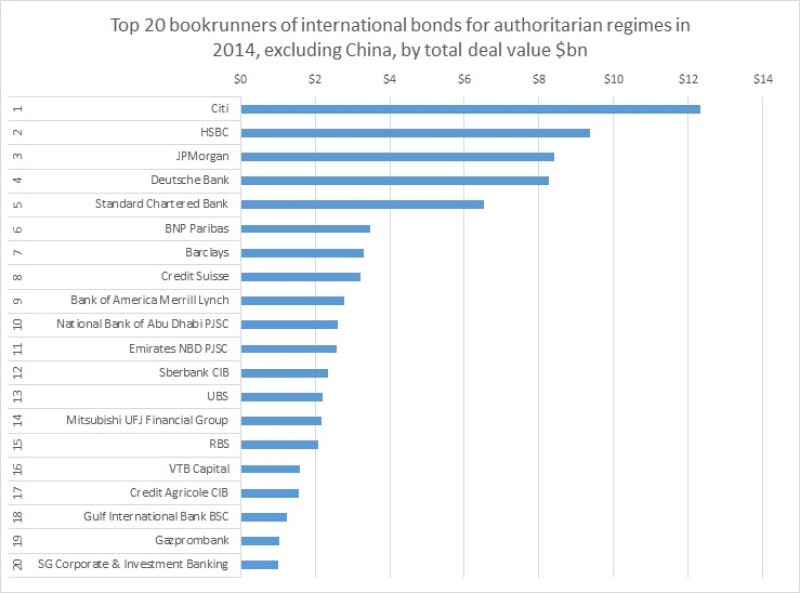

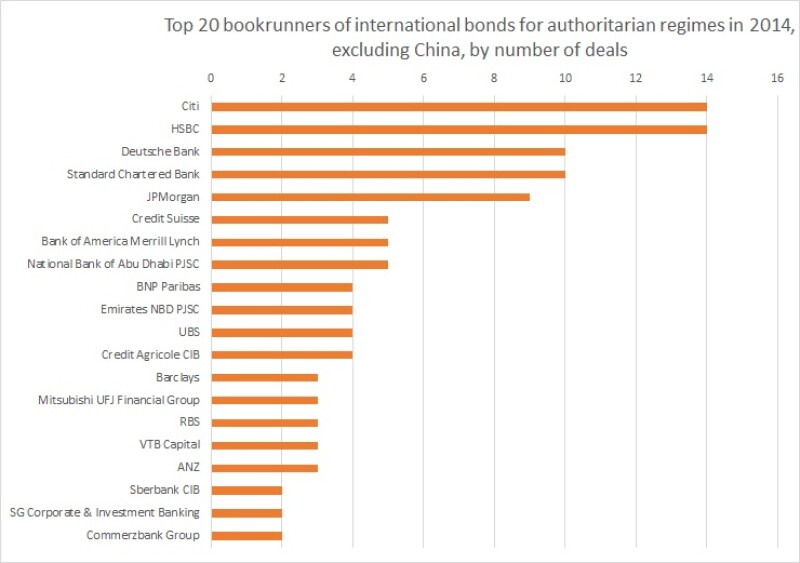

GlobalCapital's tables below are based on Dealogic data on international bonds issued in 2014 for central and local governments and public sector banks and industrials in those 52 countries. The amounts are based on full deal value, rather than the "allocated amount" figures used for league tables.

China and Chinese state entities account for much of the volume, and 124 of the 165 deals. Stripping out China reshuffles the order, with the Chinese banks dropping out.

Splitting the figures by deal numbers tends to highlight the Gulf banks, and reshuffles the order further.

At the very bottom of the Economist Intelligence Unit's Democracy Index, none of the worst 10 regimes issued any international bonds last year.

Last year the only issues from any of the bottom 10, according to Dealogic, were two Saudi domestic financings. HSBC was mandated on one, Standard Chartered on the other, and JP Morgan on both.

Top 20 bookrunners and the regimes they arranged bonds for in 2014 (includes state-owned banks and companies)

| Citi |

Azerbaijan, Bahrain, Ivory Coast, Jordan, Kazakhstan, Kuwait, Russia, UAE |

| HSBC |

Kazakhstan, Kuwait, Oman, UAE, Vietnam |

| JP Morgan |

Azerbaijan, Ethiopia, Jordan, Kazakhstan, Kuwait, Russia |

| Deutsche Bank |

Azerbaijan, Ivory Coast, Ethiopia, Kazakhstan, Russia, UAE, Vietnam |

| Standard Chartered Bank |

Bahrain, Laos, Oman, UAE, Vietnam |

| BNP Paribas |

Ivory Coast, Russia, UAE |

| Barclays |

Azerbaijan, Russia |

| Credit Suisse |

Kazakhstan, Russia |

| Bank of America Merrill Lynch |

Russia, UAE |

| National Bank of Abu Dhabi |

Kuwait, Oman, UAE |

| Emirates NBD |

UAE |

| Sberbank CIB |

Russia |

| UBS |

Kazakhstan, Russia |

| Mitsubishi UFJ Financial Group |

Bahrain, Laos, Russia, UAE |

| Royal Bank of Scotland |

Kazakhstan, Russia, UAE |

| VTB Capital |

Russia |

| Crédit Agricole CIB |

Oman, Russia, UAE |

| Gulf International Bank |

Bahrain |

| Gazprombank |

Russia |

| SG Corporate & Investment Banking |

UAE |