With the world’s regulatory environment ratcheting tighter even as trade levels in Asia rise, banks operating in the region are continuing to be attracted to the once utilitarian area of cash management.

This nuts and bolts area of consumer banking covers everything from helping companies manage their bank accounts, transfer money to other organisations from which they have bought products and to receive cash from their clients in turn.

Effective cash management, in short, drives the world economy. And it is particularly important in the highly mercantile economies of Asia.

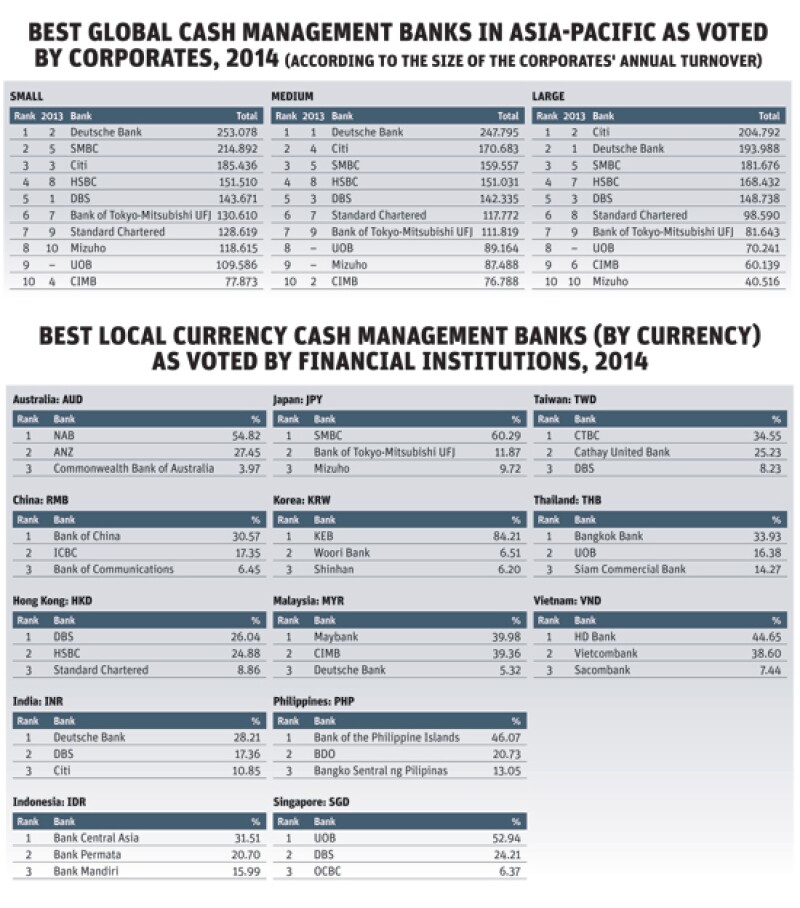

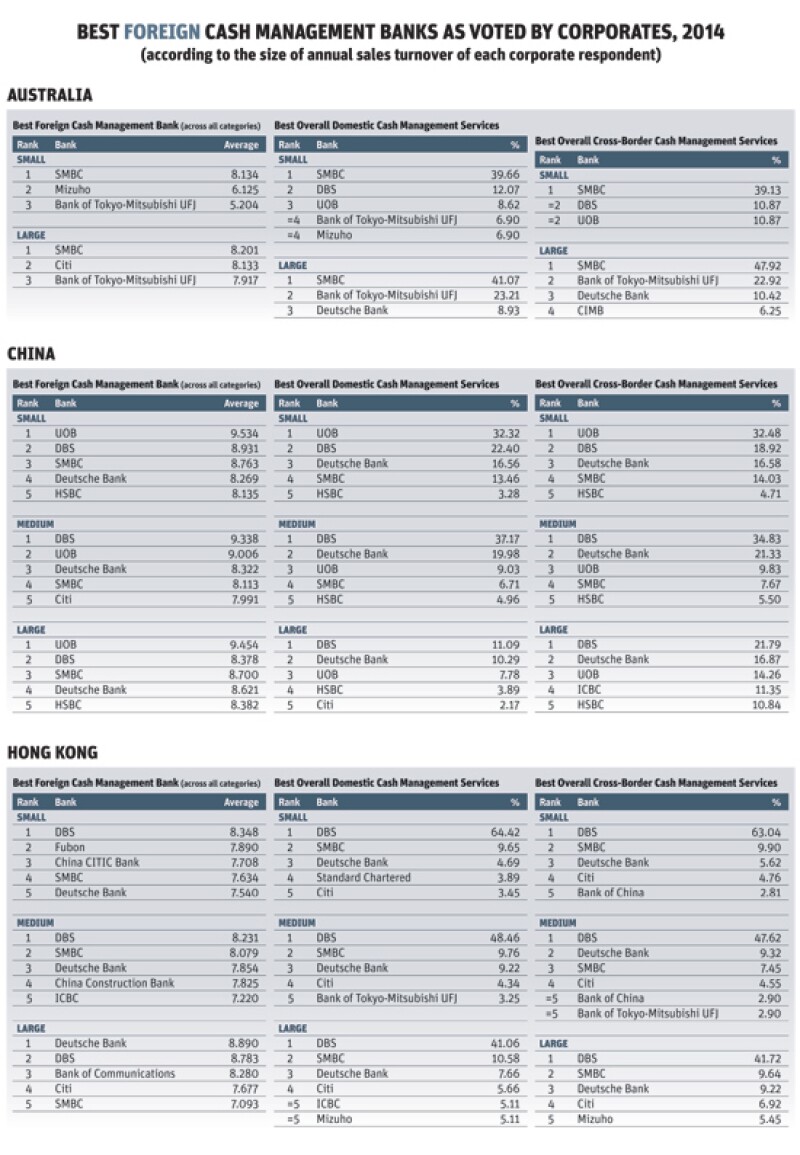

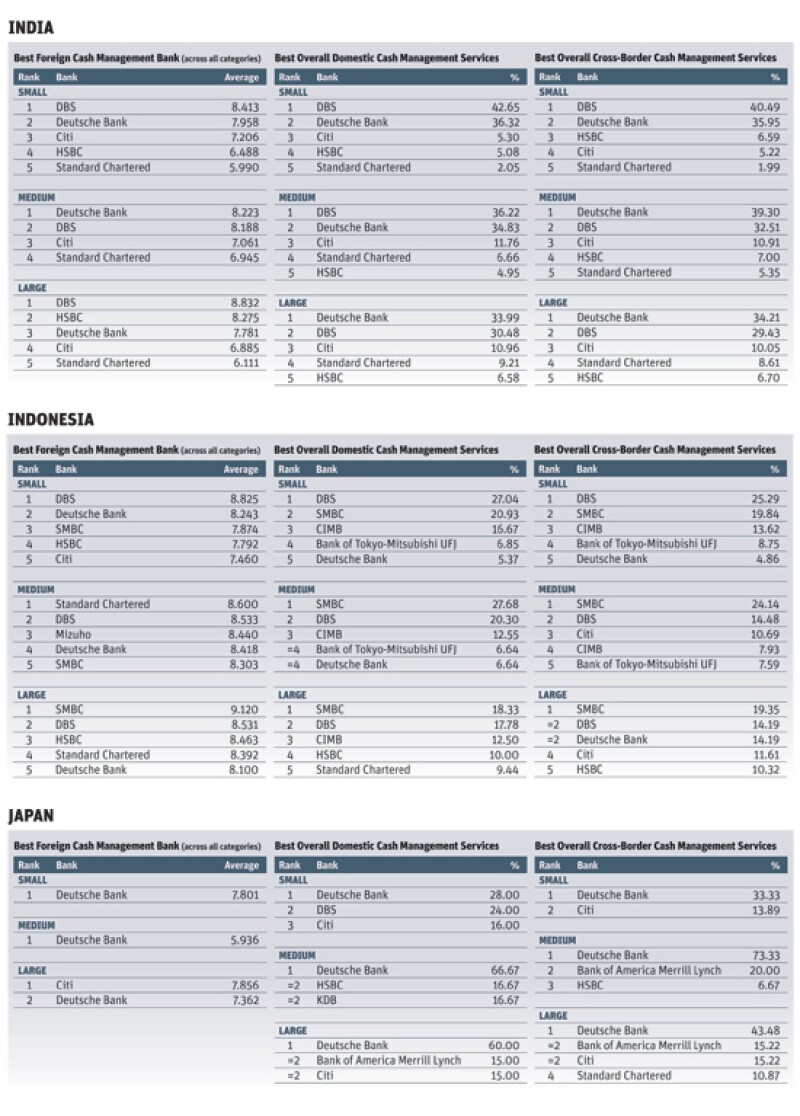

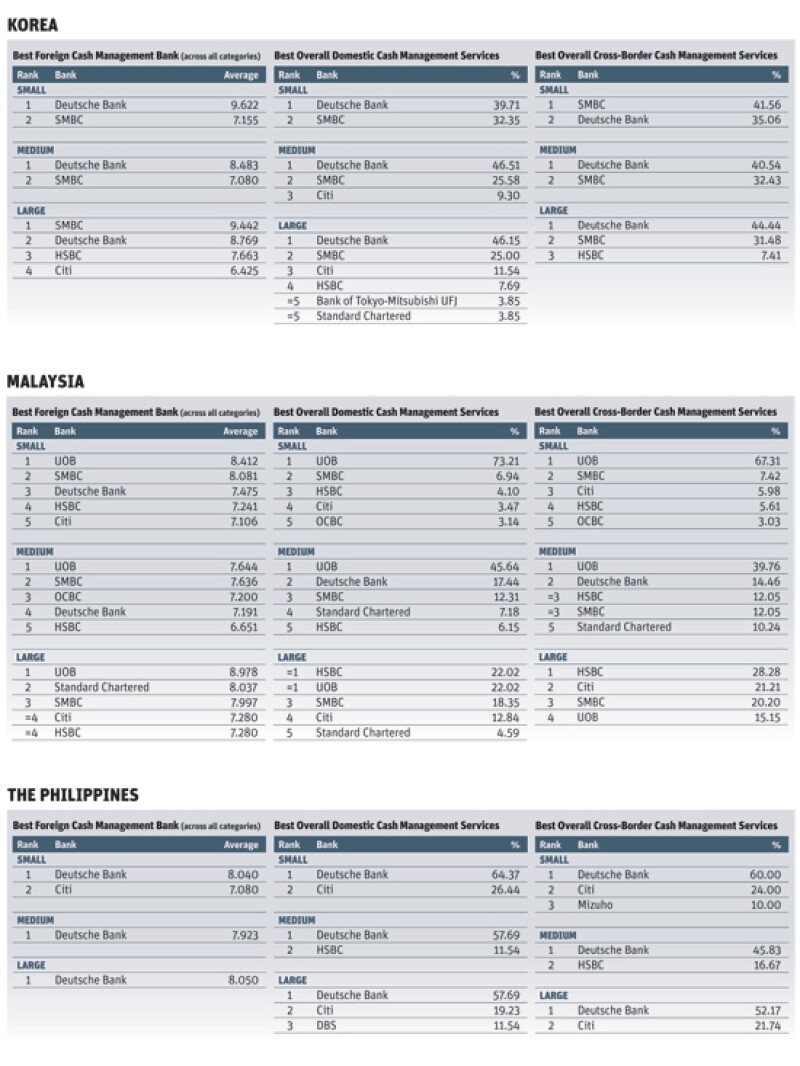

The seriousness with which the market takes this aspect of financial services is evident in this year’s Cash Management Poll. It is Asiamoney’s biggest ever survey. In total we received 10,405 valid responses, 9,028 of which were from corporates and the remaining 1,377 from financial institutions.

The winners of this deep response rate underline how much they enjoy respect in the region. Deutsche Bank in particular stands out among corporate respondents, with small and medium companies placing it as the best bank for cash management services. Meanwhile large corporates rank Citi as the best overall cash management provider, marking its return to the top of this category after a one-year absence.

Meanwhile BNY Mellon stands out for its support with voters from small and medium organisations in the region. Large financial institution representatives back SMBC over last year’s winner Deutsche Bank.

Offering corporates consistency

Mahesh Kini, head of cash management for Asia corporates in Deutsche’s global transaction banking department, says the bank’s strong support among regional corporate clients is the culmination of an expansion in the bank’s regional strategy.

“Our traditional focus has been on multinational companies (MNCs) on a global level. We see huge similarities with how Deutsche Bank aligns with its clients globally and regionally,” he says.

He adds that over the last 12 to 18 months the bank has focused heavily on China, India, Korea and Japan, where there are many Asian companies with an aspiration to grow into Europe and the US. It has offered them a mixture of transaction banking, cash management, flow FX and also advice on local regulations and laws.

Covering these clients has led Deutsche to selectively grow and upgrade its personnel. For example the bank appointed Anthony Lin as its new cash and trade head for China in March.

Kini says the bank’s latest endeavour has been to expand its transaction banking efforts in Australia. While Deutsche has an investment banking team in the country, it didn’t previously have transaction banking expertise there. This became an obvious flaw as more of its global clients and multinational Australian ones wanted holistic support from their service providers.

“The main function of this team is to help Australian corporates take advantage of our network overseas and to help our international clients operate locally with a partner bank,” Kini says.

Citi meanwhile stands tallest with the largest corporates in the region. The bank boasts around a century of history in markets such as Malaysia, India and Singapore and is thus extremely well established. Amol Gupte, head of transaction services for Asia at the bank, says the bank doesn’t rest on its laurels.

“I’ve been here for around two years and even in that time we have conducted a lot of changes, particularly as the appeal of transaction banking has increased,” he says. “We are now seeing new bank competitors investing into this space.”

He believes Citi continues to stand out among the region’s biggest businesses because the bank combines scale, capability and innovation. “In terms of scale you need to be able to offer meaningful services in terms of balance sheet support, such as offering sizeable intraday overdraft limits or intraday sweeping,” he says. “In terms of our capability our lengthy presence in most Asian markets means we’ve had to compete with local banks and build a great deal of understanding with local names as a result.

“And finally we pride ourselves as a bank on being on the cutting edge of innovation. We spend $500m globally each year on our capabilities, about one third of which is spent here in Asia.”

Building banking appeal

On the financial institutions side, BNY Mellon once again gets the plaudits from Asia’s burgeoning set of banks, insurance companies and fund managers.

Fred DiCocco, BNY Mellon’s head of sales and relationship management for treasury services in Asia Pacific, feels the bank has conducted a steady evolution of its services in the region, which has stood it in good stead with clients wanting reliable, predictable and, above all, helpful support.

“I think this award is a sign of our focus on the servicing side of the business,” he says. “It’s how you support and service your customers that really helps you differentiate yourself in this business.”

DiCocco says a recent example of this was BNY Mellon’s establishment of a dedicated regional client onboarding team in the region. The team is designed purely to bring new clients into the business, before handing them on to its existing support service and moving on to new opportunities unencumbered.

“It improves clients' experience working with us and improves efficiency in our organisation,” he says. “The financial objective is to accelerate the time to the start of revenue generation for new deals, as well as preventing relationship managers being bogged down onboarding something for weeks when you can get it up and running in a shorter time horizon.”

SMBC, meanwhile, stands tallest among the biggest financial institutions in the region.

Koichi Nishijima, SMBC’s head of global clearing solutions and network management in its global institutional banking department, says the bank has gained ground in the region due to its regular contact with clients and in particular the yen-related clearing services it can offer.

“SMBC has recruited experienced staff to form a client service team within our head office which is dedicated in assisting relationship managers stationed in each office in Asia to promote and to enhance our customer service capabilities towards financial institutions in Asia,” he says.

He notes that SMBC has been selected by 20 of the 46 foreign banks that have a branch in Tokyo to become their agent for indirect membership in the foreign exchange yen clearing system. Of this 20, 13 are Asian banks, meaning it enjoys extremely strong support among regional lenders for the yen-related cash management services it can provide.

Changing times

The support each of these banks has been able to receive in our poll offers testament to their capabilities in the region. However in this increasingly competitive arena it doesn’t pay to become complacent.

Every one of the banks is desperately seeking ways to differentiate themselves from their rivals in a space that can be rather uniform in terms of the services it offers.

Some, such as Citi and Deutsche, are spending large sums of money offering electronic solutions that are as user-friendly as possible. Gupte notes that Citi Direct, the bank’s transaction banking e-platform, has been expanded to work on mobiles, which is particularly important in many countries in Asia where mobiles have leapfrogged landlines and personal computers as a primary means of communication.

“I was skeptical that corporate treasurers would adopt it, but they have,” he admits. “This year was have seen 140bn B2B (business to business) transactions having been created and approved on cell phones, and 36bn of those have happened here in Asia.”

Citi is so serious about underlining its cash management credentials it is even launching brand new products in the region first. The bank launched its most advanced receivables product in India, which consists of a virtual account that pertains to each seller whenever they receive a cheque or payment from a buyer. That helps them keep track of who has paid what. It’s been a big success in India and is now being rolled out globally.

Gupte still thinks more can be done. Rating the bank’s treasury and transaction services as “seven out of 10”, he notes “if I can increase that to 10 I will leave the competition far behind”. He believes the key is to make the treasury and trade solutions of the bank as accessible and easy as possible.

Deutsche takes a similarly detail-orientated and user-friendly approach to its cash management services. Kini says the bank has worked hard to understand and meet every nuance of its clients’ needs in each country, so as to offer tailored solutions.

One example of this is Deutsche’s app system it has developed on its Autobahn payments solution for its clients. The system is based upon the apps of Apple and Android, and is meant to let treasurers pick and choose which particular tools they need, whether it be research or financial supply chain services.

Kini says such tailored tools are a vital requirement to stand out in the industry. “From 10,000 feet all banks look the same in cash management; it’s only when you go into the details that the differences become obvious.”

DiCocco shares the view, but BNY Mellon’s solution is different. The bank is rolling out a multi-currency e-payments solution, but the bank believes its key differentiating strength lies in focusing on its responsiveness to clients. That requires adding as high a quality of employees as possible, and then seeking to retain them.

“Having longevity in our staff, whether they be relationship managers or sales staff, helps create an intimacy with our clients, which leads to more comfort and a better working arrangement,” says DiCocco.

This year’s winners have evidently helped them to stand out from an increasingly crowded field of players. However cash management remains an appealing area, and more banks will seek to invest into their own capabilities so as to grab a piece of the revenues. For Deutsche, Citi, BNY Mellon and SMBC, the chief task is to remain vigilant.