If PG&E bonds are threatened with losses, you can be sure bondholders will get together to fight their corner.

So why won’t bond investors speak up before it’s too late? Creditors can’t foresee specific environmental disasters. But you would expect them to be on management’s case about safety.

Much more importantly, climate change poses a systemic risk to all financial assets. California is going to get hotter and drier — as are a lot of other places. What bonds will be safe if the world warms by 2C or 3C?

Shareholders are at last starting to put pressure on companies to get real about climate change. Some of them have understood there is no point saying we want to limit warming to 1.5C and going on investing in companies whose business plans make that impossible. Many still pussy-foot, asking politely for more disclosure, but the Climate Action 100+ group are getting tough, telling companies they must realign their business models.

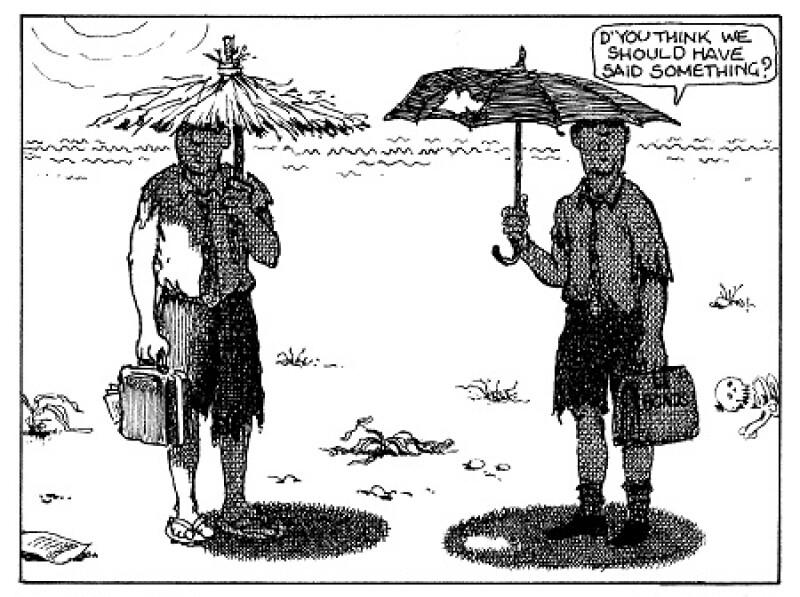

Bondholders are nowhere in this action. As a report by ShareAction laid bare this week, they hold back from engaging with issuers for a bunch of reasons, all of them bad.

Bond investors have cash issuers want. If they threatened to withhold it, they would find power they had never dreamt of. Five years ago, perhaps their timidity could be excused as traditional gentility. Now, it looks like culpable laziness.