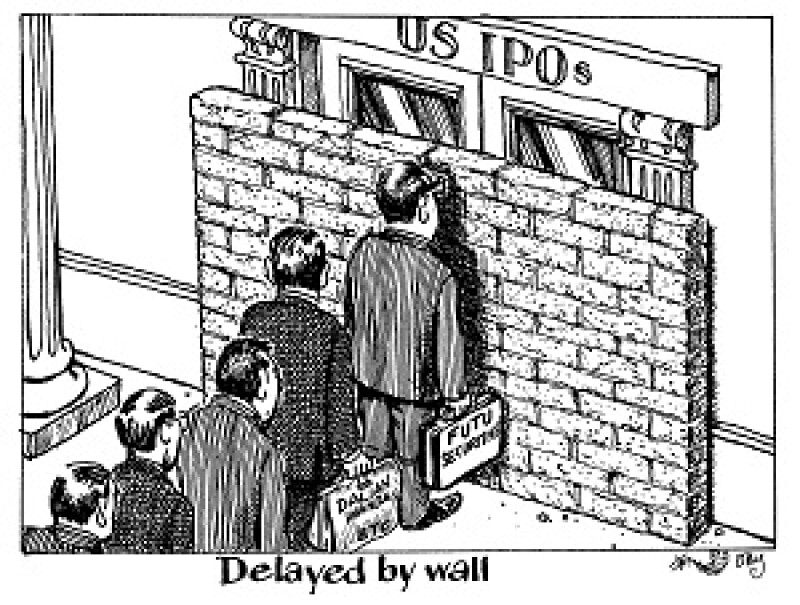

Among those waiting for the US to return to business as usual are Chinese firms gearing up to list in New York early this year. The city’s stock exchanges have fervently pursued mainland companies in recent years, but if the shutdown — triggered by US president Donald Trump’s demand for funding to build a wall with the Mexican border — continues, those considering a US listing may be inclined to list closer to home.

Tencent Holdings-backed Futu Securities stands out as one firm that has been preparing its IPO through the shutdown, having publicly filed its documents on December 28 last year, with plans to launch its US listing as early as Monday. But as of Tuesday in Hong Kong, the deal was yet to materialise.

There are at least two other Chinese companies planning US IPOs that have been delayed, according to bankers in Hong Kong, and a handful of others that have filed confidentially, such as Dalian Wanda Group’s sports arm — and with the SEC all but closed, it cannot get feedback or file the necessary paperwork to move its transaction forward, added bankers.

As the stand-off between Trump and the Democratic party continues, there could be a real threat to the US IPO market, and to the Asian issuers heading there to list. For now, however, things are still relatively calm, thanks to the fact that not that many issuers from the mainland are looking to float this month, as the Chinese New Year holiday falls in the first week of February. Those in the queue could yet get some respite.

However, if the US government still hasn’t restarted by the end of Chinese New Year, then there will be cause for concern.

Such a delay will probably push back all the IPOs expected in the first quarter — from foreign and domestic issuers alike. Not only will the SEC and other authorities have a huge backlog to deal with, but issuers that have already filed their prospectus, or are preparing to do so, will near the 135 day cut-off point for using 2018’s third quarter financial results. More delays then are inevitable.

As Trump and the US Congress squabble over the border wall, they are inadvertently setting the country’s IPO market for an underwhelming start to 2019. Just as stocks have begun to show signs of stabilising after last year’s shocking collapse in global equity markets, the US government has thrown cold water over IPO hopefuls.

All is not lost just yet, but issuers should watch this space — and be prepared to change tack quickly if needed.