Asia Pacific

-

Second deal of the year for the Kazakhstan government-owned issuer

-

Headline risk ‘doesn’t tamper with the appetite for SSA products’ at the moment

-

◆ Four years is the 'sweet spot' ◆ Existing curve ignored during pricing ◆ Slim premium paid over recent deals

-

Issuer blazes through smoking hot market ◆ Deal prices through fair value ◆ Spread to senior curve 20bp inside year's other tight trades

-

◆ Deal prices through fair value ◆ Strong bid for non-European names on display ◆ Trade spotted tighter post-pricing

-

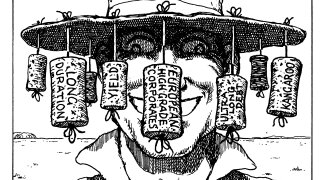

◆ Why investors are piling into SSA bonds despite the tight spreads ◆ AT1 issuers spy chance ◆ EDF pioneers in Kangaroo market

-

Industries familiar to Australian investors could find strong demand in Aussie dollar market

-

EDF proved that demand for ultra-long debt exists in Australian dollars but it won't last forever

-

◆ Deal to build on strong bid for non-European paper ◆ Investor call scheduled for next week ◆ 50bp area start possible, say bankers away from deal

-

◆ Popular trade performs in secondary ◆ Performance erases premium ◆ NAB offers an attractive relative value proposition

-

Company looking to become a frequent face Down Under

-

Aussie covered supply could rise if proposal to lift cover pool cap passes