Mashreqbank’s sukuk debut this week showed that in a world where the dollar market is volatile and unpredictable, having different funding options in your armoury as an issuer will bring huge benefits.

The US Treasury market, the benchmark for most emerging markets issuers, has endured wild volatility over the past fortnight due to US president Donald Trump’s back and forth over tariffs.

This volatility is unlikely to disappear while there is a president as unpredictable as Trump in the White House. We’re only three months into a four year term, even if it feels like a long time since he took office again.

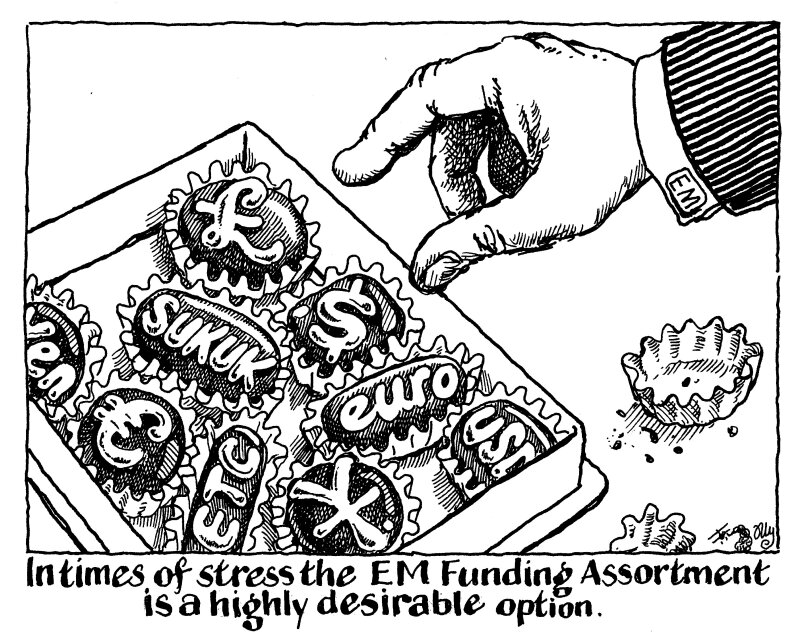

This means those issuers that have done the work to give themselves different options will reap the benefits.

That could mean different issuing in currencies, like euros — a move that has found favour among some EM issuers recently over dollars. That extends out to yen, renminbi or even rarer currencies for EM issuers like sterling.

It also means issuing different products. For issuers in the CEEMEA market, an obvious one is sukuk. Islamic investors do not have a lot to buy and so are less price sensitive than conventional bond buyers. They also tend to buy and hold, and so are less concerned with the daily performance of their sukuk on secondary markets.

Mashreq showed this week how having other avenues of funding can pay off. It did not pay any new issue premium for its sukuk, according to leads — a remarkable feat given how volatile markets have been.

Bankers who worked on it, and bankers who did not, said issuers in the conventional bond market will have to pay a lot more than zero premium to get deals done.

Not everyone can issue a sukuk, of course, but they can look at other currencies, for example.

Over the past few years, particularly since 2022 when interest rates soared and issuing bonds became more difficult and expensive, EM issuers have worked on diversifying their funding.

That work could be about to pay off, if volatility endures in the long term. Those who have branched out will be able to reap the rewards.