The mental gymnastics this week have been exhausting.

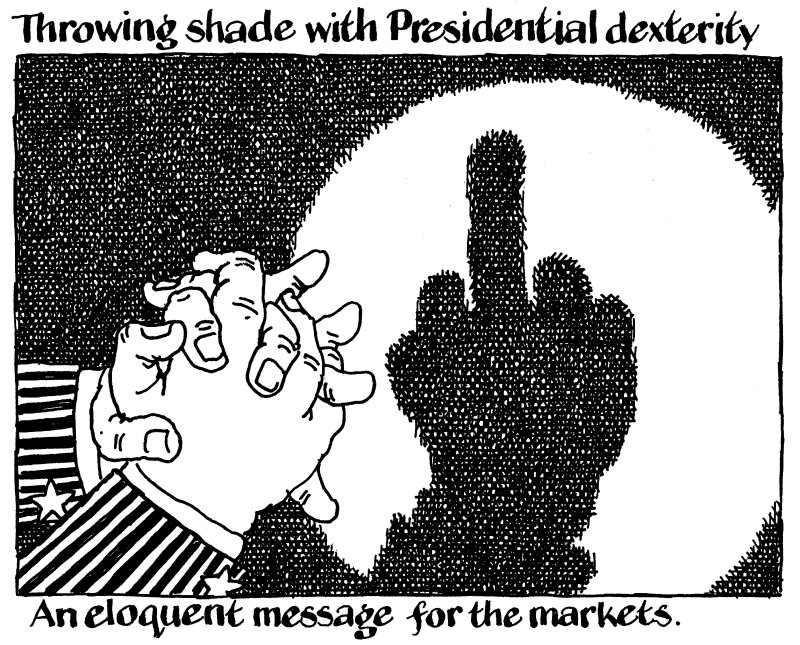

Trying to gauge Donald Trump’s understanding of the risks involved in his trade tariff policy has been no mean feat.

Whether or not he and his administration ever had the dark corners of the dollar repo market in their sights may never be known. But this is where financial crises get going and where the strain began to show this week.

Certainly, the nuances of dollar swap spreads, not to mention leverage in the US Treasury futures basis market, will not have been taught at Wharton in the 1960s.

But even Trump could see that it was one thing for US stock markets to plummet but quite another for Treasuries to begin freefalling in tandem.

At first, the rise in long dated yields was explained away by investor expectations of inflation.

Then came a sharp deepening of dollar swap spreads as positions in Treasuries were liquidated, causing them to drastically underperform swaps. It was just one flash signal that the market could have a funding problem on its hands.

Things had not quite reached crisis point, but by Wednesday all the questions had turned to when, not if, the US Federal Reserve would step in.

Fear of a dash for cash — of a similar kind to those that brought down banks in 2008 and threatened them again in 2020 — had begun to rattle markets.

Although Trump's 90 day pause on tariffs on Wednesday appears to have ameliorated the situation for now, the story may not be over when it comes to his administration's footprint on financial market plumbing, unintended or otherwise.

Worth remembering is that the US effectively serves as lender of last resort through its provision of dollar swap lines to various countries — Canada, Denmark and Mexico included — something the architects of the putative 'Mar-a-Lago accord' seem to be wise to. It is a fact that Trump can exploit as a bargaining chip.

If the past 12 weeks has involved some twisted logic, imagine what markets are going to have to get their heads around for rest of his presidency.