Ever since Kwasi Kwarteng's swift sacking in 2022, UK chancellors of the exchequer have learnt to fear the bond market.

Rachel Reeves, his successor but one, had a light dust-up with Gilt investors at her first Budget in October.

But when she stepped up to deliver her Spring Statement on Wednesday, she was eager to please the market.

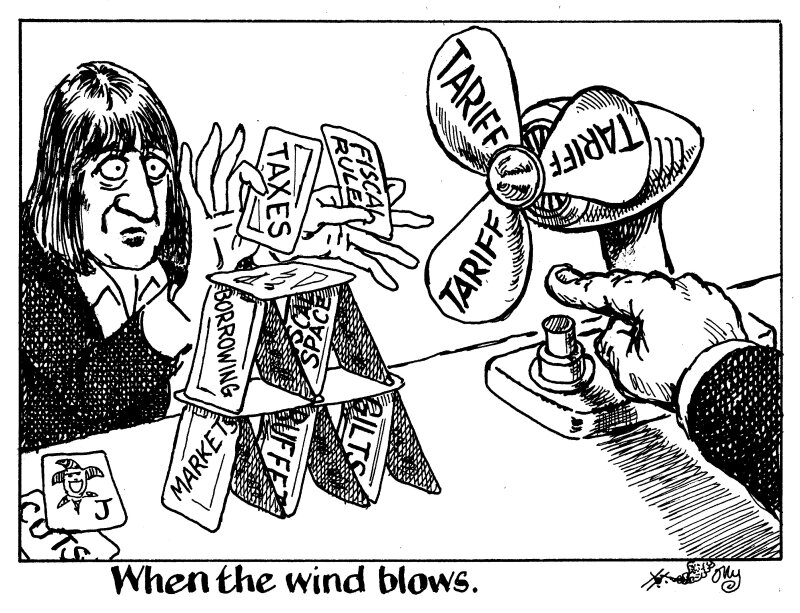

Bracing herself for headlines like 'Balancing the books on the backs of the poor', Reeves cut welfare and government operations.

Her goal: to restore the Labour government’s £9.9bn headroom within the fiscal rule she had herself imposed in October — to balance day-to-day spending with taxes by 2029-30.

Reeves will have been watching the market anxiously, hoping her fiscal probity reassured Gilt investors.

The market did not sneer at her — Gilt yields spasmed during her speech but quickly recovered. But it may have snubbed her.

Whether Reeves keeps her fiscal headroom is unfortunately out of her hands.

The world economy has never felt more interconnected when the leader of its largest player is in one corner with his finger on a big red tariff button.

The truth is, what Donald Trump does torpedo the UK's finances. With his announcement of tariffs on cars this week, transatlantic trade relations are looking grimmer and grimmer.

A Trump-induced trade war could wipe out the UK’s fiscal space again, according to Richard Hughes, head of the Office for Budget Responsibility, the country’s fiscal watchdog.

The government’s relentless adherence to its fiscal rules would then throw the UK into another debate about borrowing, spending and tax because of Trump’s actions.

This would cause endless uncertainty until the next time Reeves makes a speech — and uncertainty is poison to markets.

During Wednesday's Spring Statement, when Reeves announced a cut to the OBR's growth forecast for this year and a rise in its inflation estimate, the 10 year Gilt yield spiked by 7bp, according to Tradeweb, but then recovered fully.

Imagine the market's reaction to a real trade war, which would not only be inflationary, but could knock 1% off UK GDP, according to Hughes.

Investors might hope Reeves' carefully constructed house stands up. But they care a lot more that the big bad wolf might blow it down next week.