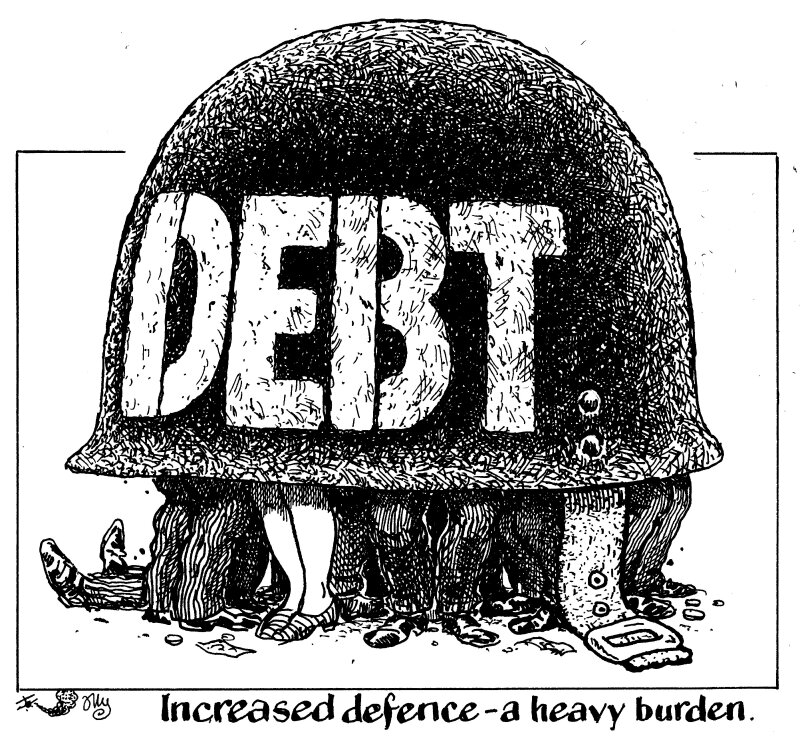

European governments are on a mission to increase defence spending and rightly so.

Even though it is set to rise for the 10th straight year in 2024, it is likely that European governments will have to deploy even more capital as they look to reach and then go beyond Nato's recommended spend of 2% of GDP — a threshold some countries still struggle to meet — and to support Ukraine in the face of waning US support.

The level of commitment to the cause this week has been impressive. The EU has talked of an €800bn defence package. Meanwhile, incoming German chancellor Friedrich Merz has turned his country's debt aversion on its head. He plans to ease the country's debt brake as part of a spree worth hundreds of billions to be pumped into infrastructure and defence.

Those sorts of numbers, however, have already spooked investors, leading this week to the biggest Bund sell-off in decades. The 10 year Bund yielded around 2.4% at the end of last week. By Thursday it was brushing 2.9%

Alongside Germany are France, Italy and Spain as some of the biggest European contributors to Nato. However they too are already stretched thin on the fiscal front.

France, for example, was struggling to get its deficit down even before the sudden enthusiasm for costly defence investment. EU member states are supposed to keep their budget deficits to maximum of 3% of GDP. France is trying to reduce it this year to 5.4%, Italy to 3.3%.

Adding debt, either directly to the government balance sheet, or circuitously via joint borrowing at the EU level or through a multilateral lender, will likely make fiscal and public finance metrics worse, hurting investor confidence.

Rating agency DBRS Morningstar estimates that spending 3% of GDP on defence would mean EU's 23 Nato members needing to find an additional €180bn a year.

It is just as well that some governments have enjoyed an improvement in their own funding conditions in recent years. Spain is one but of course borrowing directly through the Bonos market would put more strain on its own budget.

As borrowing balloons, concerns must be raised once more about debt sustainability.

There may be no immediate fear of this becoming a sovereign debt crisis as it did around 2010-2012. But France is edging ever nearer to levels not seen since the that time.

The differences is that back then its debt was below 90% of GDP. Now it is at more than 110% and there is no central bank buying OATs in the market to suppress yields.

Observers that think this cannot get out of hand should remember the mess the UK government of former prime minister Liz Truss landed the Gilt market in back in 2022, when it promised tax cuts to be funded by borrowing. The Bank of England had to step in and Truss had to step down.

Rising EGB yields this week suggest that investors are on edge, and focussed on the quantum of borrowing rather than military security.

It may be time to rearm Europe but caution is needed so that fiscally it does not harm Europe.