In February 2022, Russian tanks rolled into Ukraine. Capital markets were shocked. Bond issuance in EMEA plunged, stockmarkets fell. Even the mighty S&P 500 dipped.

Almost exactly three years later, with the arrival of Donald Trump as US president, this long-static war of attrition has entered a new and alarming phase.

Trump has opened peace talks with Russia, without consulting Ukraine or European allies. He has called Ukraine’s president Volodymyr Zelenskyy “a dictator without elections”, blamed him for starting the war and said he has done “a terrible job”. He had “better move fast or he is not going to have a country left”, Trump said.

Apparently some of his anger was caused by Ukraine’s reluctance to agree to a lucrative mineral deal for the US.

Olaf Scholz, the German chancellor, was forced to call Trump’s remarks “false and dangerous”.

European government bonds have sold off this week, on expectations that European countries will have to increase defence spending, either at the urging of the US, or — as looks increasingly likely — because the US can no longer be relied on to defend Europe from Russian aggression.

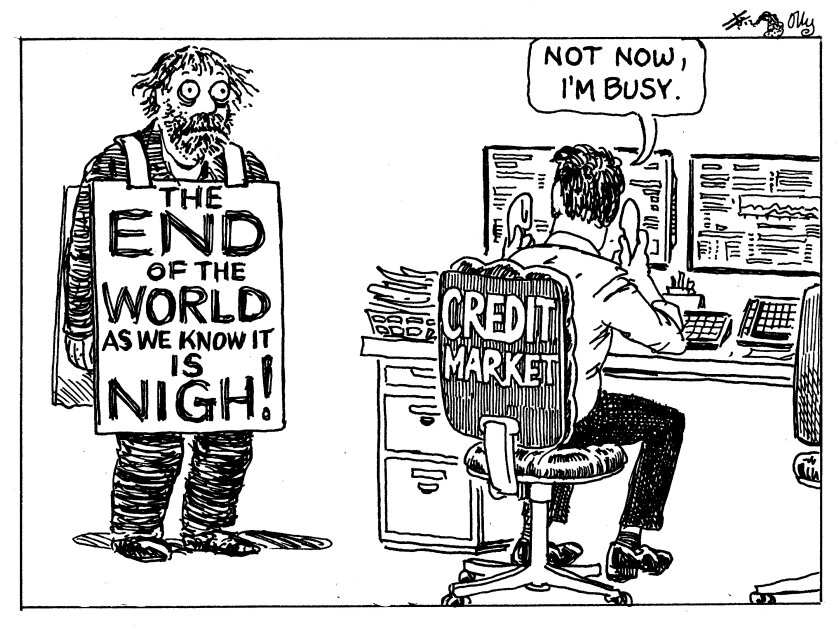

But risk asset markets have not turned a hair. European equities rose at the beginning of the week and credit demand is exceptional.

Deal after corporate bond deal in Europe gets a huge book and is priced at a negative new issue concession. This has been going on for weeks, prompting one syndicate banker on Thursday to call the market “too easy”.

Two eight year corporate bonds in euros this week were issued by triple-A rated Johnson & Johnson and triple-B rated Kraft Heinz. Fair value for J&J’s deal was estimated at 62bp over mid-swaps — for Kraft Heinz, eight rating notches lower, it was 100bp.

Asked how investors are so insouciant about risk when such tumultuous events are going on, bankers say the peace talks are not likely to have a macroeconomic impact, or even that ending the war would be good for the markets.

Credit investors, apparently, are not able to compute that ending the war on the terms Trump has discussed would look very like Russia winning. The risk is president Vladimir Putin will get to keep some territorial gains, prevent Ukraine joining Nato, and leave the upstart southern neighbour that dared to break away from its autocratic influence in ruins.

This would leave Europe in every respect in a far worse situation than it endured in February 2022. Europe’s security is now threatened, not just by Russia, but by its own main ally, which seems bent on rewarding illegal aggression.

This is a seismic moment in Europe’s history. Just don’t try and claim markets are good at pricing risk.