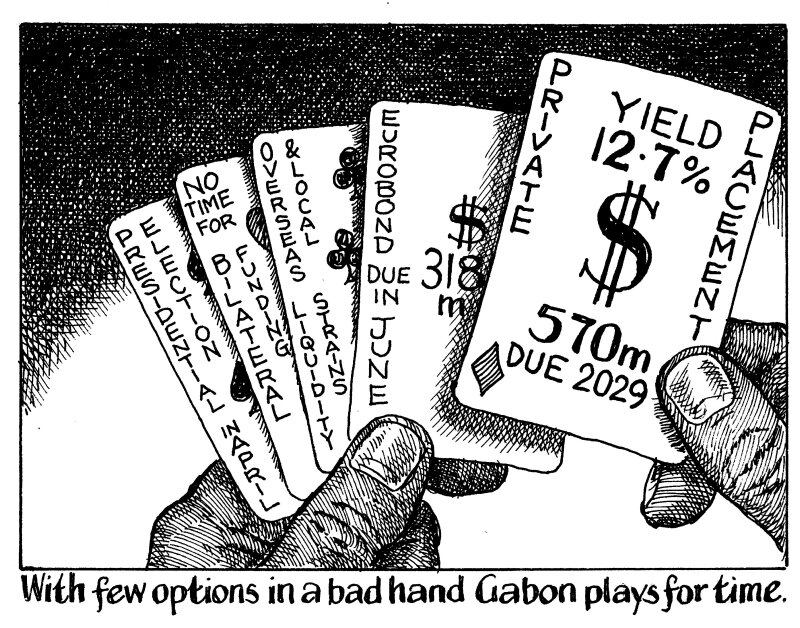

Gabon achieved an unwanted record this week. Priced this week at a yield of 12.7%, its private placement was the most expensive benchmark-sized bond from an African sovereign in history. But the trade served a purpose for an issuer that had little room to manoeuvre.

The $570m 9.5% February 2029 bond was priced on Monday to yield 12.7%, giving the issuer proceeds of $520m.

Not only was that the highest reoffer yield for an African sovereign trade ever, it was the highest yield for 15 years in emerging markets.

Gabon is using some of the cash to pay off the remaining $318m of a Eurobond due in June.

But while the optics, particularly the yield, may draw negative attention, Gabon’s options were limited. The country has suffered liquidity problems and rating agencies have reduced it to Caa2/—/CCC in the last year.

Default was not a fear, but using up cash reserves to repay the bond could have boosted government payment arrears which are already growing.

Whether Gabon could have done a public deal at a better level is a moot pont, argued bankers, who said it does not have access given its public debt yields around 12% for six year paper.

It used local funding for a November tender of the same June 2025 Eurobond. It could have turned to that market again but liquidity is strained there.

April elections and a June maturity meant Gabon had a tight timeframe to find a solution for the Eurobond - especially if it had sought bilateral or multilateral funding.

So, while the pricing is tough, the issuer has achieved what it needed to in perhaps the only way it could in the time it had.

It can now repay investors the last chunk of the June bond, and its next Eurobond redemption payment will not be for three years, when it has to service half the amortising $570m bond it priced this week.

This gives Gabon time to secure an IMF deal and bring in policies to get its bond yields down to something a little more palatable for all concerned.

A yield of 12.7% may have looked like the beginning of the end to some. All must hope it is instead a means to a better end.