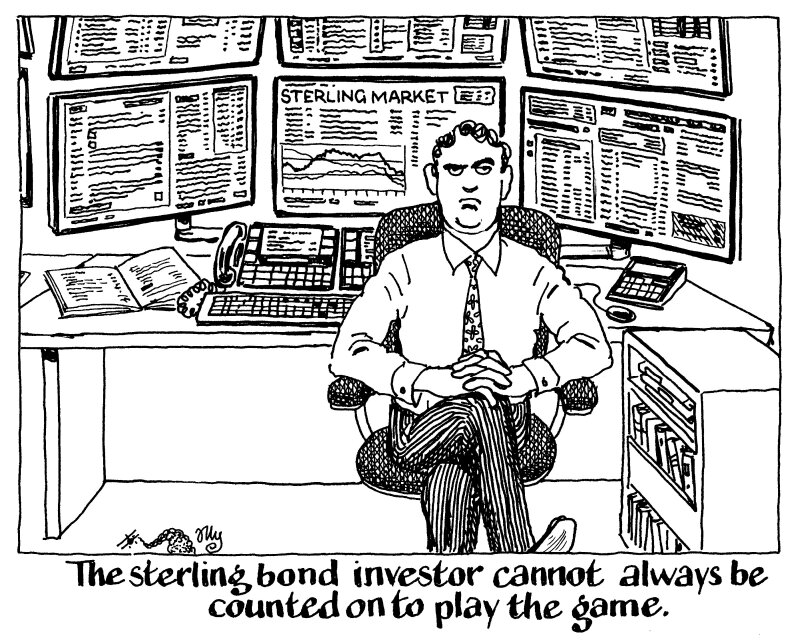

Issuers should not take the record start to sterling issuance this year for granted: the market's investors are famously fickle.

Issuers across sectors have raced out of the blocks to issue sterling bonds this month, pricing almost £14bn, according to GlobalCapital’s Primary Market Monitor.

However, sterling lacks the investor depth of the dollar or euro markets.

When the pricing lines up and results go their way, the small number of powerful and vocal sterling investors are more than eager to jump in — much like they have so far this year. But this support is not consistent — as pricing and performance wanes, so too does their interest.

For now, issuers can come at levels competitive to other markets, while offering investors decent spreads to Gilts or Sonia, plus attractive headline yields.

But for issuers to keep attacking the market with the sort of volume priced this year so far, those relative pricing benefits need to remain.

They almost certainly will not. The sterling bond market is one that closes to foreign issuers as swiftly as it opens. Issuers should enjoy the access it while it lasts.