US banks firm lead in SSAs

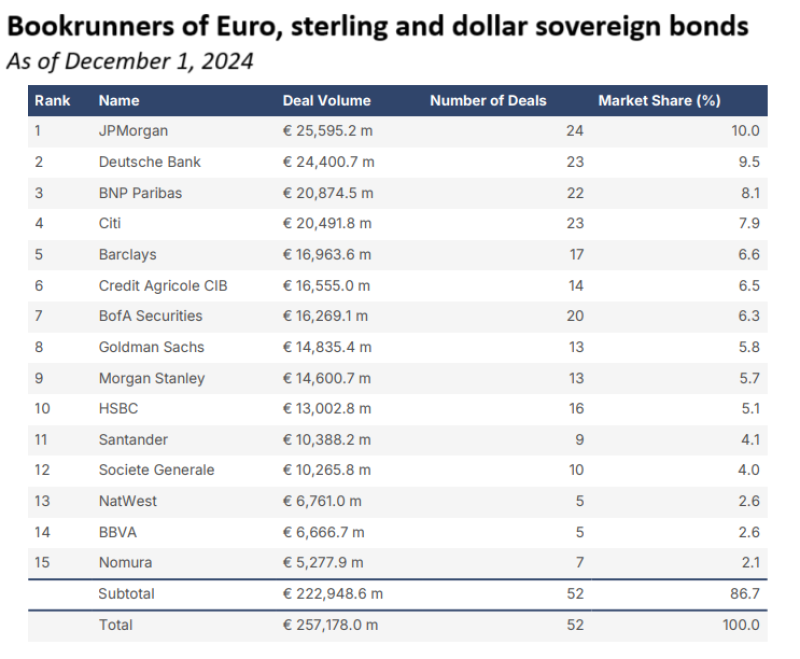

JP Morgan narrowly kept hold of its first-place finish for sovereign syndicated benchmark issuance in dollars, euros and sterling this year in GlobalCapital’s Primary Market Monitor rankings. Between January 1 and December 1, 2024 it arranged €25.6bn of paper for a 10% market share, the exact same share it achieved last year.

JP Morgan’s overall volume grew during the same period this year almost in tandem with the overall sovereign market. In 2023, the US firm arranged €19.3bn-equivalent of sovereign paper between January 1 and December 1, edging out second placed Barclays, which placed €17.6bn of paper.

However, the bank’s lead over second place narrowed in 2024 as Deutsche Bank rose from third in 2023 to finish second this year, just €1.2bn off top place. Deutsche Bank’s market share grew from 8.3% to 9.5% this year as the bank helped place €24.4bn of sovereign paper.

Of last year’s top 10, only two banks did not manage to increase the volume of deals they arranged this year — 2023’s runner up Barclays and 10th placed Nomura. Last year, Barclays finished second with €17.6bn placed. However, this year, the bank arranged roughly €700m less — €16.96bn — placing it fifth. Meanwhile, Nomura finished 10th last year with €8.75bn, before going on to place €5.3bn and land 15th this year.

Elsewhere, the same banks lead in the supranational and agency market across euros, dollars and sterling in 2023 and 2024. Citi led in both years, placing €25.7bn-equivalent in 2024 to December 1 and €24.9bn over the same period in 2023. BNP Paribas leapfrogged last year’s runner up Barclays to come second in 2024, pushing Barclays down into third.

JP Morgan rose from fifth to fourth as it arranged €23.2bn of paper this year, up from €21.9bn in 2023. This allowed it to overtake Bank of America, which fell one place to fifth this year.

Nomura, meanwhile, climbed into the top 10 for supranational and agency paper in 2024, rising from 13th last year. The Japanese bank arranged €14bn this year, up from €12.5bn in 2023.

DZ Bank enjoyed a similar rise to enter the top 20, up from 28th last year. The bank was able to grow its market share, increasing it from 0.4% — or €1.1bn of deals — last year, to 1.4% — or €5.7bn — in 2025. The German house was boosted this year by its involvement in three tranches of euro debt from the European Union that totalled €10.3bn.

The sub-sovereign segment is the only part of the SSA market not dominated by US banks, perhaps in part due to the large amount of issuance from the German federal states. Unsurprisingly, it is a German bank that leads — Deutsche Bank, which topped the table in both 2023 and 2024.

Deutsche Bank arranged €6.8bn of sub-sovereign bonds this year, split across 37 deals, up from €5bn last year.

Last year’s top five was dominated by German banks. DekaBank finished second with €3.7bn, while NordLB placed fifth with €3.4bn. However, despite arranging more deals this year, the pair fell down the sub-sovereign league table. DekaBank sits in fifth with €4.8bn for 2024, while NordLB has fallen to ninth with €3.4bn.

JP Morgan replaced DekaBank in second this year. The US firm rose from eighth, having only arranged €2.7bn last year, to second thanks to a sharp increase in its market share to €6.75bn. LBBW meanwhile, climbed from seventh to fourth, placing €5.4bn this year. TD Securities was also able to move up two spots in the top five, going from fifth to third.

FIG: narrow margins separate top shops

The top of the unsecured senior euro FIG bond table, including self-led deals, appears a lot more congested this year as only €2.4bn separates first from fourth. Last year, first place enjoyed an almost €6bn lead over fourth.

Natixis had claimed the top spot in euro senior unsecured this year, as of December 1, having improved on last year’s fourth place finish. The French arranged less paper this year — €12.90bn compared to 2023’s €14.97bn. Euro senior unsecured benchmark volumes, however, are down from 2023. This year, banks had only issued €199.23bn as of December 1, compared to €219.30bn over the same period last year.

Last year’s leader was BNP Paribas but it had slipped to fifth this year as its market share almost halved. Last year the bank led with €20.89bn of deals for a 9.5% market share, while this year it only mustered €9.36bn for a 4.9% market share.

As of December 1, Deutsche Bank sat in second with €11.20bn, €1.7bn behind first placed Natixis. The German firm enjoys a narrow lead over last year’s runner up Société Générale, which arranged €11.13bn this year, down from €18.89bn last year.

The top of the euro unsecured FIG league table is, unsurprisingly, dominated by European banks. However, a trio of US bond houses managed to climb the table to finish in sixth, seventh and eighth. Morgan Stanley climbed from 10th last year to finish sixth in 2024, pushing last year’s sixth place finisher JP Morgan down into seventh. Citi, meanwhile, rose eight places from last year to end the year in eighth.

The top of the euro league table for bank capital is similarly congested as a handful of banks vied for the top spot. This year, only €600m separates the top five banks.

UBS has come fifth for the sector. And although the 36 deals arranged by the Swiss bank is the second highest of the top five, its overall volume falls slightly short of its peers, as the bank helped to place €3.93bn this year. The Swiss bank was only just edged out by BNP Paribas, which with €4.19bn finished fourth, behind Barclays on third with €4.37bn.

Only €100m separates the top two banks this year, making the race for first far closer than last year. This year’s leader — Deutsche Bank — finished on €4.55bn, ahead of Morgan Stanley on €4.45bn. However, Deutsche Bank’s first place finish is boosted by its role as sole bookrunner for its own €1.5bn additional tier one note in June, which when removed sends the bank down the leader board.

Morgan Stanley, meanwhile, was involved in a greater number of deals this year — 38 versus Deutsche Bank’s 23. The US firm played a role in several smaller, sub-benchmark deals.

French and German banks dominate covered bonds

LBBW has kept its place atop the euro covered bond league table, having helped place €10.28bn across 77 syndicated benchmark tranches. Although the German bank has arranged just over €500m less this year, because of the lower overall level of covered supply in 2024, its market share has increased from 6% to 6.8%.

The German firm just edged out second place Natixis, which rose one place this year to second. Natixis arranged 65 deals as of December 1, totalling €9.19bn, one deal more than last year.

Unlike last year, the rest of the top five is exclusively made up of German and French banks. Last year’s only non-French or non-German bank to feature in the top five was UniCredit but it has fallen out of the top five, from fifth to eighth. The Italian lender has placed €6.54bn of deals this year to date, down from €8.56bn by the same point last year.

Société Générale has usurped UniCredit in the top five, climbing an impressive nine places from last year. The French firm rose from 14th, with €5.59bn placed across 35 deals last year, to fifth this year thanks to €6.75bn of trades split across 41 tranches.

However, because of the lower volume of covered bond issuance this year, the margin required to slip into the top five, or even the top 10, is lower compared to 2023. Overall, covered funders have placed €151.9bn as of December 1, compared to €181.2bn at the same point last year.

This year, only LBBW arranged more than €10bn of deals, while last year three banks — LBBW, Crédit Agricole and Natixis — crossed that threshold. In fact, any of last year's top 10 results would have placed in the top five this year. Last year, the top 10 accounted for just under €90bn of volume combined, with the top 10 this year only managing €75bn. However, in both years, the 10 most active bookrunners have arranged roughly half of the total euro covered supply.

Outside of the top 10, UBS is 2024’s biggest climber in euro covered, rising from 22nd in 2023 to 11th this year. The Swiss bank — the highest ranked non-eurozone bookrunner — placed €5.13bn this year across 34 deals, up from €3.21bn split across 22 trades last year. This performance was no doubt helped by the return of the bank’s domestic arm to the euro market, where it raised €3.75bn across four tranches.

Corporate bond houses make the most of a strong year

Investment grade corporate borrowers started the year strong in the European market, placing €37.2bn in January, €39.6bn in February and €38.2bn in March, compared €38.1bn, €26.3bn and €20.2bn in the same months last year.

BNP Paribas capitalised on this to establish a strong lead at the end of first quarter among its rivals, helping arrange €13.98bn of syndicated benchmarks, compared to second placed Deutsche Bank’s €8.57bn and third placed Barclays’ €8.36bn.

The French firm maintained this lead throughout the second quarter. However, Deutsche Bank and Barclays slipped to fourth and fifth, respectively, as Citi and JP Morgan entered the top five. Citi placed €9.03bn in the second quarter, placing second, while JP Morgan arranged €8.81bn to place third.

Barclays secured second place in the third quarter, placing €6.08bn, while JP Morgan placed third with €5.56bn. BNP Paribas again led the quarter, arranging €8.19bn. Goldman Sachs and Bank of America rounded out the top five with €4.46bn and €3.78bn, respectively.

BNP Paribas’ grip on first slipped in the fourth quarter as of December 1. The bank finished second in the fourth quarter with €5.36bn, as HSBC took the top spot with €6.04bn placed. JP Morgan, Bank of America and Barclays finished third, fourth and fifth respectively.

Overall, BNP Paribas finished top for the year, placing €38.03bn through to December 1 — almost €14bn more than second placed Barclays, which arranged €24.28bn of paper.

Despite a slow first quarter where it finished sixth, JP Morgan’s performance throughout the rest of the year propelled them into third, with €22.98bn. Citi and Deutsche Bank finished fourth and fifth respectively, with €21.78bn and €21.26bn.

BNP Paribas also topped the overall table last year through to December 1, helping place €28.36bn — €9.5bn more than second placed HSBC, which arranged €18.89bn. This year’s third place finisher, JP Morgan, came fifth last year with €16.09bn.

As of December 1, this year, corporate borrowers had placed €337.7bn of paper, spanning 495 tranches, up from only €277.2bn across 410 trades over the same period last year.

Meanwhile, the Reverse Yankee market has grown this year as US issuers flocked to the euro market in search of attractive arbitrage opportunities. Euro supply from the US has risen from €40.5bn in 2023 to €59.6bn this year. The volumes placed by this year’s top five — Citi, JP Morgan, BNP Paribas, Deutsche Bank and Barclays — would have ranked top in 2023, with fifth placed Barclays arranging €2.5bn more than last year’s leader JP Morgan.

Citi has more than tripled the volume of corporate Reverse Yankees its arranged to climb into first place, up from eighth last year. The US bank helped place €7.95bn this year, split across 40 tranches, up from €2.56bn in 2023.

Emerging market bookrunners share the spoils

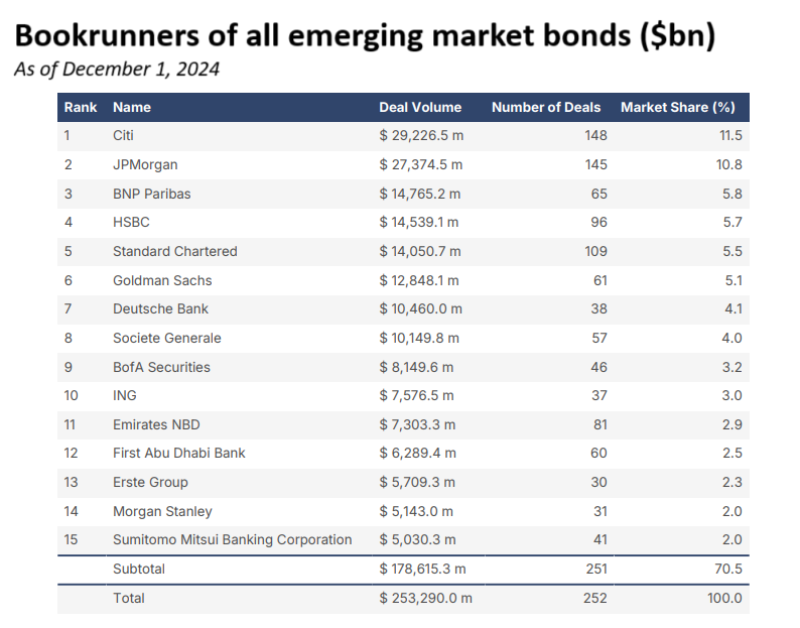

Emerging market bond issuers have an exceptionally strong year that has only just fallen short of the record. As of December 1, these borrowers have raised $253.29bn equivalent, PMM data shows, just shy of the $260.1bn priced in 2020, according to Dealogic.

Issuers flocked to the market this year as investors looked to lock in attractive yields ahead of potential further Federal Open Market Committee (FOMC) rate cuts. Furthermore, emerging market spreads are close to their all time tights, spurring issuers to look at the market.

As a result, emerging market bookrunners have enjoyed bigger volumes, with the amount needed in the top five, let alone in top, far greater than last year.

This year’s leading emerging market bookrunner, which was Citi as of December 1, helped to place $29.23bn equivalent across 148 deals, more than $10bn more than the $19.03bn it arranged last year to secure first place in 2023. Despite arranging almost 50% more deals this year, the bank’s market share has fallen slightly, from 11.8% to 11.5%, as other firms ramped up their activity.

Eight banks this year arranged over $10bn of deals, up from three last year. In fact, two banks accounted for more than $20bn of benchmark business — Citi and second placed JP Morgan, which priced $27.37bn — whereas no firms achieved that feat last year.

BNP Paribas rounds out the top three, with $14.77bn, a slight drop from the $14.80bn arranged in 2023. Last year’s fourth placed bank Standard Chartered slipped one spot to fifth this year as HSBC climbed from sixth to fourth. Despite falling one place, Standard Chartered arranged $4.5bn more deals this year for a total of $14.05bn. HSBC posted a $5.5bn rise, increasing its volume from $9.04bn last year to $14.54bn this year.

Morgan Stanley climbed an impressive 17 places this year, rising from 31st last year to 14th as of December 1. The US bank posted a more than fivefold increase in volume, which leapt from $993.4m in 2023 to $5.14bn this year, propelling its market share from 0.6% to 2%.

The US firm was propelled up the league table thanks to its involvement in a large number of corporate and financial deals, including triple-tranche trades for Saudi Aramco and Adnoc. Last year, aside from trades for Turkey’s TSKB and the Saudi Public Investment Fund, Morgan Stanley focussed its efforts on the CEE bank debt.

Turkish supply shot up this year as the country’s borrowers returned to the market. Issuance from the country jumped from $17.07bn last year to $30.75bn in 2024.

Bank of America and BBVA seized this increased opportunity to propel themselves up the league table for the country. Bank of America rose from the eighth most active bookrunner of Turkish bonds to fourth this year, having placed $2.26bn for a 7.3% market share. Meanwhile, BBVA climbed from 24th last year — having only placed a share of one deal for Turk Eximbank alongside seven other bookrunners — to sixth. This year, the Spanish firm, which operates a local Turkish subsidiary, took part in eight deals for a total of $2.11bn and a 6.9% market share.

Primary Market Monitor league table methodologyGlobalCapital’s Primary Market Monitor is a database of public benchmark bond issuance across the SSA, FIG, covered, emerging market and European investment grade corporate bond markets. League table credit is apportioned by dividing the size of the bond evenly between the named bookrunners. Deals must be syndicated (more than one lead manager) to qualify for inclusion, and be of benchmark size, which is defined as follows in each market.

The only exceptions are in the FIG bond market where self-led benchmark sized senior unsecured deals are included, and any and all subordinated bonds sold publicly are also included. Taps of old bonds that fit the criteria are included. For more information, see the About tab at https://www.globalcapital.com/primary-market-monitor GlobalCapital publishes a range of preset rankings under the League Tables tab on that page and also allows users to build and save their own, fully customisable league tables. |