Financial Institution ESG Bond of the Year

Nordea Bank

€750m 4.125% May 2035 non-call May 2030 tier two green bond

Citi, Deutsche Bank, Goldman Sachs, JP Morgan, Nordea

Nordea has long been at the forefront of issuing debt tied to the funding of environmental, social, and governance (ESG) projects as well as bonds linked to the sustainability targets of the corporates it lends to.

Its appearance in May with a green tier two put to rest some doubters’ questions around banks earmarking their capital for direct ESG financing. The deal fortified Nordea’s aim to green its tier two capital layer and drove broader acceptance of ESG-labelled bank capital.

The deal extended the maturity of Nordea’s tier two debt and was €250m bigger than its first version of such a deal, which it priced in 2023. The ESG label was a magnet that attracted orders, allowing the issuer to tighten pricing to below what had become a psychological barrier of mid-swaps plus 150bp.

The reoffer spread of 135bp was 50bp below where the inaugural trade had been sold. It became the joint-tightest euro FIG tier two deal since 2021, with a reoffer level unsurpassed even later in the year when spreads tightened further.

Tier One Bond of the Year

Axa

€1.5bn 6.375% perpetual non-call January 2033 restricted tier one

Global coordinators: Citi, HSBC

Lead managers: Bank of America, BNP Paribas, Citi, Crédit Agricole, HSBC, JP Morgan

Axa made its debut in restricted tier one (RT1) in January when demand for higher yielding subordinated FIG debt was far from satisfied. That meant there was also a swathe of competing supply in the market, including a further €2bn of subordinated FIG debt on the day Axa was in the market.

But Axa’s novelty appeal commanded investor attention. The insurer lured an €8bn order book in what was described as a “once in a lifetime opportunity” to buy RT1 from the company by a banker away from the deal.

Fair value may have been a theoretical construct in this case, but pricing still came through where market participants thought it should have been. Moreover, the deal served as a benchmark for the flock of RT1s that followed later in the year, guiding a host of credits from across Europe to successful issues of their own.

Tier Two Bond of the Year

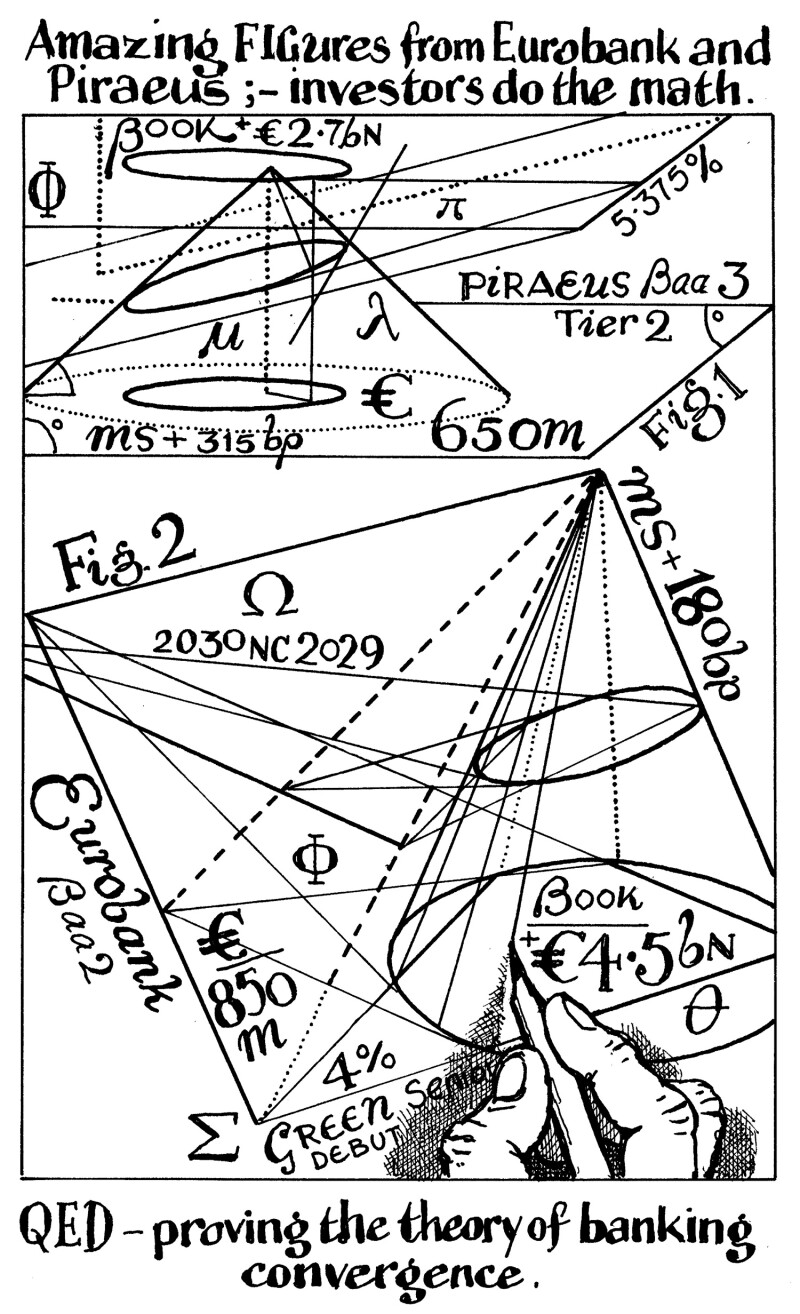

Piraeus Bank

€650m 5.375% September 2035 non-call September 2030

Barclays, Deutsche Bank, Goldman Sachs, Morgan Stanley, Nomura, UBS

This year marked the point at which once weaker southern European banks became some of the most desired credits in investors’ portfolios, with Greece and its lenders returning to investment grade status.

Major global banks may have done bigger tier two deals this year from larger order books, but this deal exemplified a remarkable return to the bond market for the Greek banking sector.

Piraeus Bank’s September deal captured strong bids for bank capital and for the higher yields that southern European banks could pay.

But it was more than just a strong syndication. On the back of Greek bond performance in the secondary market, Piraeus brought the largest capital deal from the country’s banks, showing how the investor base had grown. This was further exemplified by the deal being priced against mid-swaps rather than on a yield basis like earlier Greek bank bonds.

Piraeus’s success helped compatriot Eurobank break the size record for Greek banks in the senior market a week later and set the tone for National Bank of Greece to issue another chunky green senior bond in November.

Senior Euro Bond of the Year

Morgan Stanley

€1.5bn March 2027 non-call March 2026 FRN

€1.5bn 3.79% March 2030 non-call March 2029

€2bn 3.955% March 2035 non-call March 2034

Morgan Stanley

Major US banks have not shied away from doing size in foreign bond markets this year and Morgan Stanley showed its prowess in Europe when it raised €5bn in one fell swoop in March.

The Reverse Yankee was the largest FIG new issue in euros of 2024, combining three different selling points to sway investors. Morgan Stanley, appearing on the same day as JP Morgan priced a €2bn 10 year non-call nine deal, drummed up orders across curve in typical US style by paying a new issue premium to guarantee smooth execution.

The 11 year non-call 10 tranche tapped into the bid for duration and was the most oversubscribed slice of the three, amassing €5.5bn of orders.

Short-dated floaters were another hot product in 2024 as investors swarmed around them. Morgan Stanley spearheaded the charge into that part of the market where Citi and US Bancorp followed in May, JP Morgan in June and Wells Fargo in July.