Supranational Bond of the Year

European Investment Bank

£1bn 3.625% January 2032 Sustainability Awareness Bond

Barclays, BMO Capital Markets, NatWest Markets, RBC Capital Markets

There were many outstanding supranational bonds in 2024 across all three major currencies, but one in particular impressed, not only because of its successful execution but the lasting, positive impact it made on the market.

With this deal, the SSA market took an important — some say long overdue — leap forward in changing how sterling deals are marketed and priced to bring them in line with other core markets.

The EIB took the plunge to price the bond off Sonia mid-swaps, rather than against Gilts. But where the EIB’s leads, others follow and 90% of SSA sterling benchmarks sold this year — excluding Gilt syndications from the UK — embraced pricing against swaps.

The migration was impressively seamless, while boosting efficiency, reducing hedging risks and costs, and increasing execution flexibility.

SSA ESG Bond of the Year

European Investment Bank

€6bn 2.75% January 2034 Climate Awareness EARN

Bank of America, BNP Paribas, Morgan Stanley, Natixis

Seventeen years after its inaugural green issuance, the EIB passed a milestone in August of €100bn of Climate and Sustainability Awareness Bonds issued, across 23 different currencies. This 10 year deal from January was the standout of 2024’s crop. The size alone was impressive — an unprecedented amount from the issuer in the format.

It was also the joint largest euro bond issued this year by a non-sovereign issuer. The €42.5bn book was also the largest not only for the EIB but also across the whole supranational and agency sector this year, excluding the EU’s syndications.

It was executed to perfection, boosting the confidence for the whole SSA sector at the start of a year when issuers were keen to front-load in a market uncertain about absorbing such size.

SSA Sterling Bond of the Year

United Kingdom

£4.5bn tap of 1.25% November 2054 inflation-linked Gilt

BNP Paribas, JP Morgan, Morgan Stanley, Nomura

The UK’s record-breaking syndicated linker tap took place in a remarkably stable Gilt market just days after the country’s general election.

The market had certainly had its dose of political uncertainty in June and July, with elections taking place — expected and unexpected — on both sides of the English Channel.

But this deal broke new ground for the borrower as it landed the largest ever order book for a linker syndication for any European sovereign.

Gilt market participants have been in awe that the UK was able to land one record transaction after another this year, despite a change of government, low confidence over global growth and uncertainty over the path of interest rates. Gilt investor demand was consistently strong — a vote of confidence in the UK and its Debt Management Office.

The DMO itself had only just handed the reins to Jessica Pulay, who replaced Robert Stheeman as chief executive, at the time of this deal. Its success also showed the benefit of the DMO’s insistence on maintaining predictability, transparency and reliability in the market.

Sub-Sovereign Bond of the Year

State of North Rhine-Westphalia

€1bn tap of 3.4% March 2073

Bank of America, BNP Paribas, LBBW, Nomura, UniCredit

The ultra-long end of the curve is reserved for a select group of SSA issuers and Land NRW is one of them, having printed 40, 50, 60 and 100 year bonds in the past.

It also became the only issuer to have syndicated an ultra-long bond in 2024. It spotted this opportunity early in the year and managed to print €1bn more of its 3.4% March 2073s — an amount that those on the deal had been uncertain about achieving.

As interest rates have risen, investors have been able to hit yield targets at less risky, shorter maturities, weakening demand for ultra-longs.

But Land NRW’s deal was more than three times subscribed, even though the issuer paid a yield of less than 3.2% — only 60bp higher than where two year Schatz were at the time.

The issuer now has €3bn of 50 year money under its belt in this line — just as the yield curve is expected to steepen.

Agency Bond of the Year (for a borrower with a funding programme of more than €10bn)

KfW

€6bn 2.375% August 2027

€3bn 2.625% January 2034

Bank of America, Deutsche Bank, Goldman Sachs, HSBC

Front-loading was the name of the game for SSAs in 2024 and a €9bn transaction from KfW was the perfect example how the tactic served issuers better than ever this year.

The German agency demonstrated its flexibility by choosing a dual-tranche structure for its first euro transaction of 2024. It surprised some at the time, but the full benefits shone through as the year went on.

The issue landed KfW a big slug of what had started as a €90bn-€95bn funding task in one go.

KfW had only issued a dual trance deal once before in October 2023 when it priced $6bn.

The sale attracted €47bn of demand, leading bankers and peer issuers to describe it as “very impressive”.

The issuer’s prudence paid off, especially as the euro market turned softer after the summer break and SSA spreads against swaps widened drastically. By that time, KfW already had all the benchmark euro funding it needed.

Agency Bond of the Year (for a borrower with a funding programme of €10bn or less)

Bpifrance

€1.25bn 3.375% May 2034

BNP Paribas, HSBC, Morgan Stanley, Natixis, Société Générale

French agencies have had an extraordinary year as the country’s soaring budget deficit and political machinations sent OAT yields upwards. Come June’s parliamentary elections, one of their number even had to pull a deal, keeping the rest of the group out of action until the dust settled.

But a French issuer needed to reopen the market and that turned out to be Bpifrance.

The timing of its deal was critical and every detail had to be right if investors were to be persuaded back to French agency bonds.

The result was a success. The size hit the upper end of expectations and at a reasonable price. The bond encouraged other French agencies to make their own return to the primary market.

Bpifrance had also been tapping its old lines for well over €1bn — a smart move, especially given that it had one of the biggest chunks of funding left to do among its peers.

With such pragmatism, Bpifrance showed the way through one of the toughest markets for this group of SSA issuers in recent times.

Most Innovative SSA Bond of the Year

African Development Bank

$750m 5.75% perpetual non-call

10.5 year sustainable hybrid

Bank of America, Barclays, BNP Paribas, Goldman Sachs

It was the deal that the multilateral development bank (MDB) sector had been waiting for, as it hunts for ways to unlock lending power to address the world’s growing development needs.

The African Development Bank is no stranger to capital markets innovation and delivered the first publicly sold hybrid issue from an MDB in January this year after four years of work.

Some argued that buying hybrid capital, with the pick-up it offers over senior debt, was a no-brainer of an investment, given the credit quality of MDBs. The reality was far more complicated with matters of structuring, pricing, timing and audience to be resolved — not to mention how to execute such an unprecedented trade.

Certainly, the deal drew criticism — over whether other issuers should pay as much for similar capital and whether it was launched into the best window. Indeed, the bond would win no prizes for how it went on to trade in the secondary market and no other MDB has followed.

But none of that can detract from just how innovative this deal was. Indeed, first forays by other SSA issuers in now well-established products also drew criticism. But the AfDB established a market and there is talk of further deals in the first quarter of 2025. If an MDB brings another, it will owe thanks to the lessons offered by the AfDB.

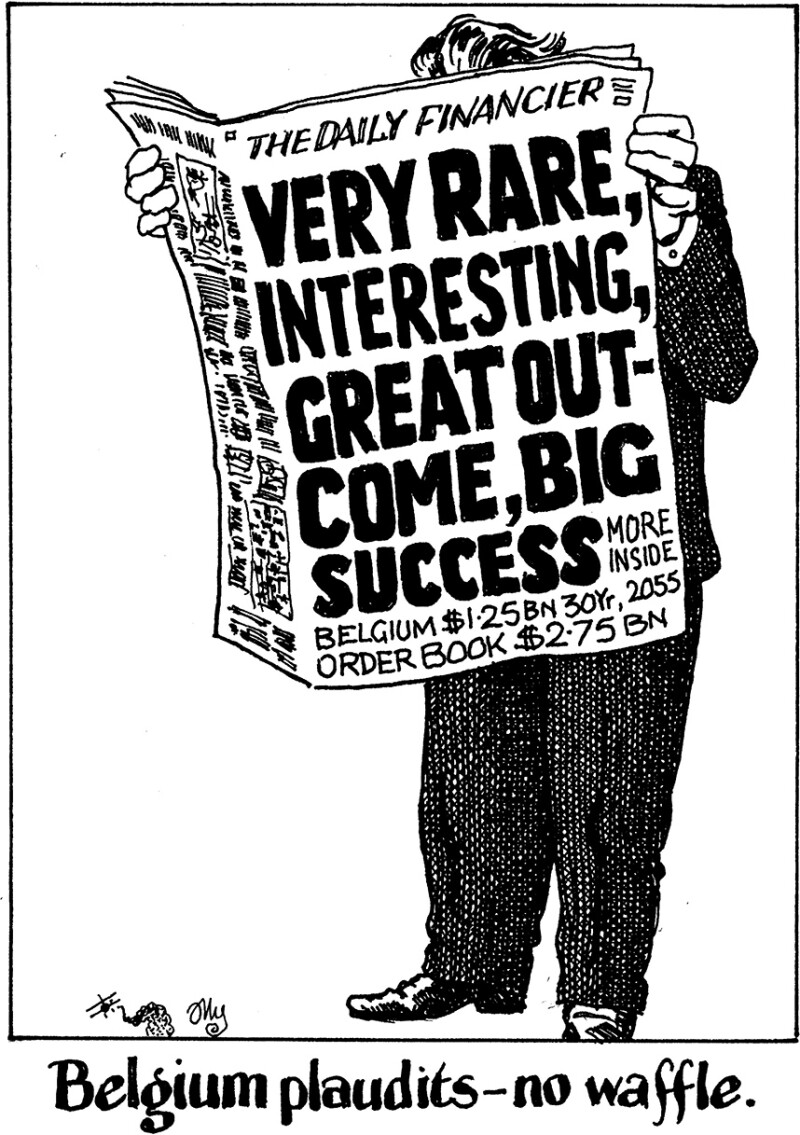

Sovereign Bond of the Year

Belgium

$1.25bn 4.875% June 2055

Morgan Stanley

It was a deal that no one saw coming, but one that everyone would have loved to have been involved in.

The transaction was rare, to say the least. Belgium had never issued 30 year dollar bonds before. In fact, no other semi-core sovereign had printed a dollar bond of this maturity this century; the last such deal came almost 30 years ago in 1996.

Belgium had also not issued in dollars for more than three years.

That all changed when Morgan Stanley found a bid at the long end of the curve — and at much longer than 10 years, where dollar demand often stops. Belgium demonstrated flexibility to hit that bid quickly.

What may have started with a reverse enquiry became an order book that was twice the deal size during a public bookbuild with 45 accounts involved. The bond brought the issuer investor diversification at a saving versus euro funding.

The original thinking and swift reaction resulted in a transaction that drew praise from across the Street with market participants calling it “the best deal this year without a doubt” and even “deal of the decade”.