Although French prime minister Michel Barnier is now gone, after the Fifth Republic’s second ever successful no confidence vote on Wednesday evening, the divided make-up of France’s National Assembly remains unchanged.

The pressure is now on President Emmanuel Macron to appoint a prime minister who can appease enough of the warring parties to pass 2025’s budget by the end of the year. But whomever he picks, the new PM cannot please everyone.

And unfortunately, under the French constitution Macron cannot call a snap election to break the deadlock until June at the earliest, a year after the last election. So unless the warring factions can come to a compromise, this turmoil could persist for at least the first half of next year.

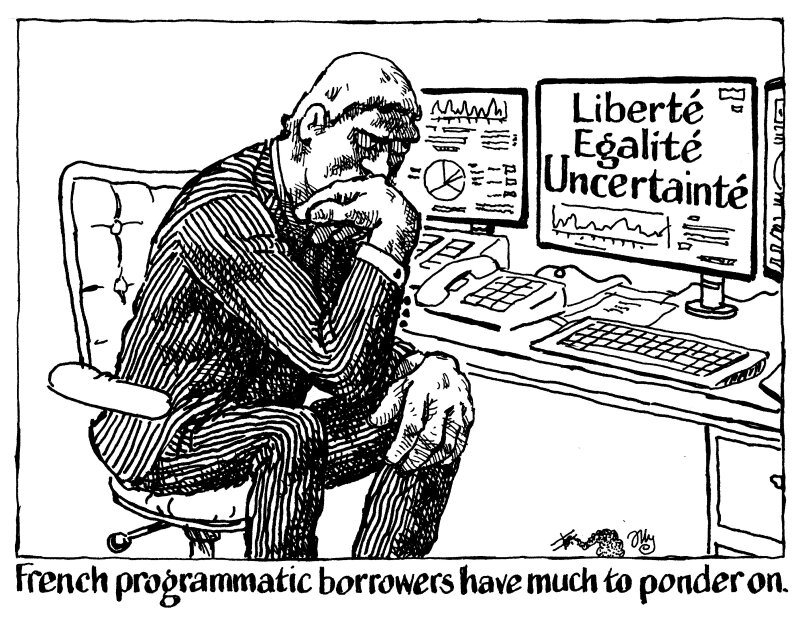

That is not ideal for France’s large programmatic borrowers — its banks and agencies, many of which like to get started with their funding as early as possible in the year.

Collectively, they have a lot of borrowing to do — analysts expect up to €37.5bn of covered bonds, plenty of unsecured paper, and as much as €50bn from the agency sector.

It would not be wise for these issuers to wait out the new year’s fresh start, hoping for French spreads to tighten.

However, there are signs that the market has got used to the French political brouhaha. On Thursday, OAT yields rose only a couple of basis points at three and 10 years, while falling at five years and 30, according to Tradeweb.

Meanwhile, the 10 year OAT spread over Bunds hovered around 80bp throughout the morning, tighter than the 87bp it hit earlier this week. It closed on Thursday at just above 78bp.

Of course, these yields and spreads are likely to mean high funding costs for the big French borrowers.

But with a real risk of further — and possibly worse — uncertainty later in the year, borrowers should accept these costs as inevitable in a rocky situation.

France's problems are not going to be resolved any time soon. Waiting is not always the prudent option — spreads can always move wider instead of tighter. France's programmatic borrowers need to bite the bullet and face the volatile market head on — impossible n'est pas français!