Investors are approaching some cyclical sectors as if they were ticking time bombs. But the roaring success of Heimstaden Bostad’s hybrid deal this week shows that even the most out of favour sectors have a way back into the bond market fold.

The auto sector is waving a red flag. There have been major product recalls, the threat of factory shutdowns and lay-offs. Meanwhile, more competition than expected is coming from China when it comes to electric vehicles.

Utilities are also in a tricky spot, with billions of euros needed for upgrades and the energy transition. The thin end of this wedge is the UK water sector, some of its companies are on the precipice of severe financial hardship, while others have already fallen over it.

Then there is the chemicals sector. This is much smaller, with only a handful of bond market issuers frequently using the market, but still one that investors are worried about, as demand falls for the materials they produce, particularly from China.

But there is good news from the real estate sector.

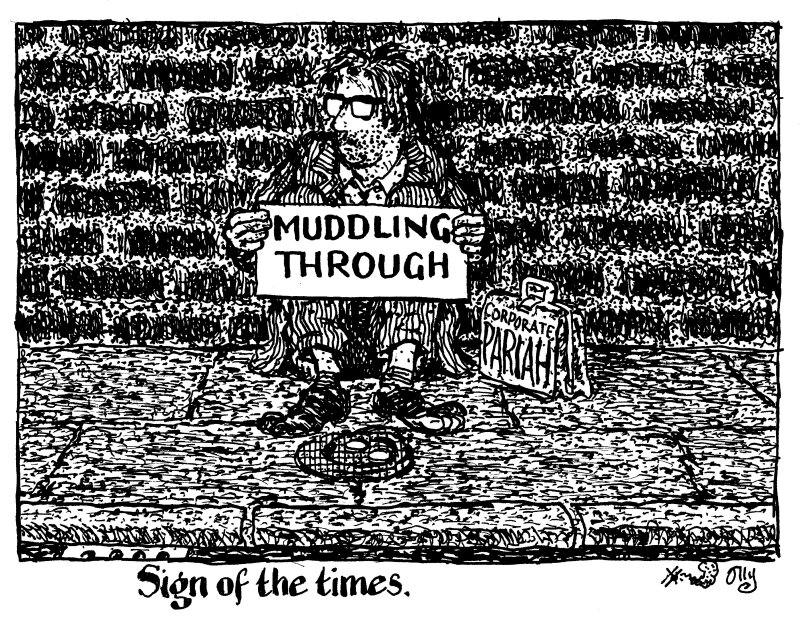

The industry rode high in the debt markets in 2021. It was one of the heaviest issuers of debt, having been a minnow five years earlier. But then interest rates rose, compounding fears about the future of its assets like offices and shopping centres. All of a sudden this highly indebted sector was a pariah, and there came almost no deals for two years, except from the best in class issuers.

Now, Heimstaden Bostad, a BBB-/BBB- rated company with negative ratings outlooks that specialises in residential property, has printed €500m of hybrid debt from around €2bn of demand. It is a remarkable turnaround for fixed income investors’ view on risk in the sector.

The lesson to the other industries now facing their own dark days is to muddle through — this too shall pass.

That might mean issuing debt at very high spreads if liquidity is tight or avoiding the bond market entirely if it isn’t. Either way, the bond market will welcome you back with open arms... eventually.