High grade corporate credit has had a fantastic year, except the sectors that are either crumbling or look like they are about to start. Get used to it — feast or famine is the new normal for corporate credit.

Corporate credit spreads have tightened by 11bp this year, going by the iTraxx Europe Main’s 57bp open on Thursday. At points they have been as much as 20bp tighter.

Money is everywhere in the asset class this year, with net outflows occurring in just a handful of weeks.

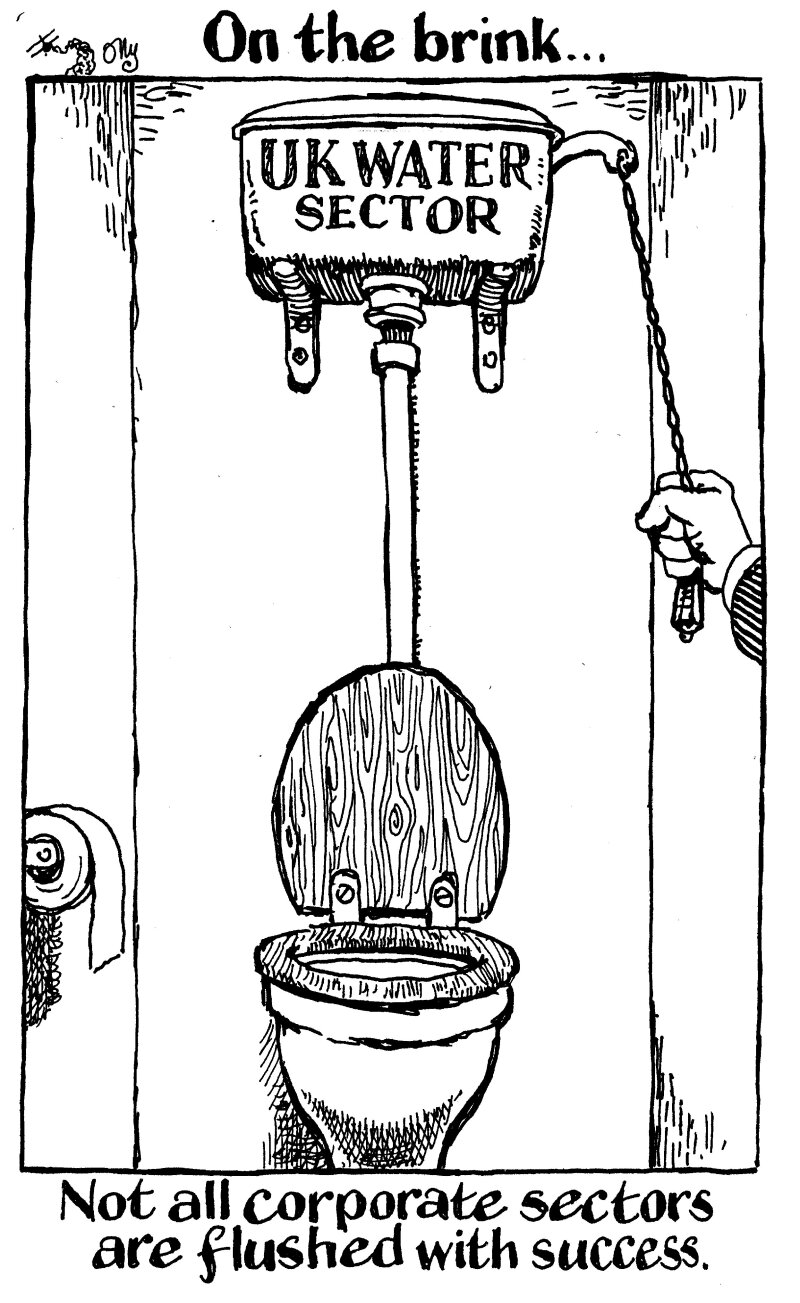

But on the ground some sectors are suffering. The UK water industry is in a dire state, with Thames Water on the brink of collapse. It has two creditor groups fighting over who should be allowed to lend it a €3bn lifeline.

Southern Water is peering over the abyss of junk credit ratings. That will push up its debt costs and will lead to punishment for breaching ratings thresholds.

Now, the auto sector is coming under intense scrutiny. Ford said this week it was cutting thousands of staff in Europe, while Volkswagen has caused uproar in its home country after saying it would need to shut three plants there. That could mean tens of thousands of redundancies.

Investors are worried. Bonds from the auto sector trade around 50bp wide of similarly rated ones from companies in other industries.

Chemicals, utilities and offices have all been flagged as problem sectors. If tariffs from incoming US president Donald Trump are as high and sweeping as feared, anything in a cyclical sector can expect operational and bond market grief.

But this is what a normalising market looks like after a decade of central banks buying up everything in sight.

It’s ugly, but a normal, properly functioning market needs winners and losers. For too long it didn’t have any of either. Welcome back to credit risk.