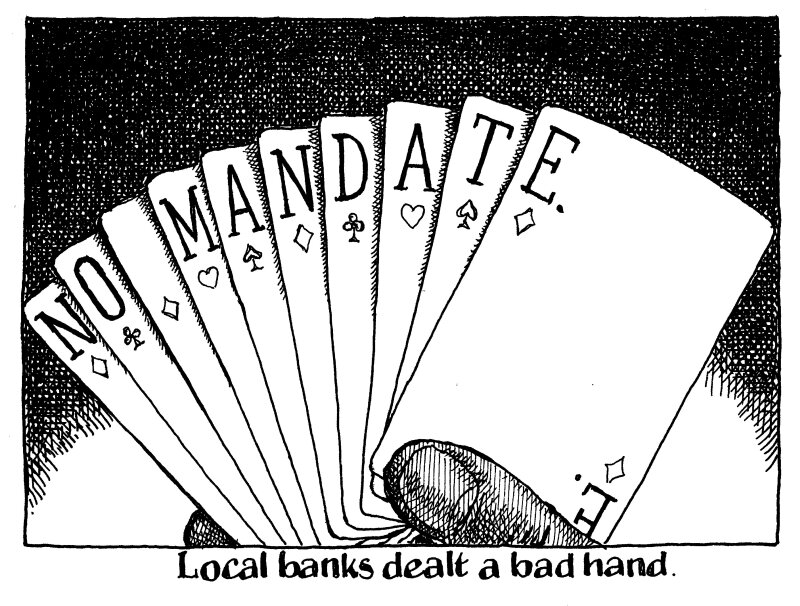

South Africa’s lack of local bookrunners on its bond this week may not have harmed the deal much in terms of raw numbers on the day, but it was still the wrong decision.

The sovereign chose Citi and Goldman Sachs to run its $3.5bn dual trancher on Tuesday, the first time since 2007 it has not had a local bank on the mandate. It has issued 14 separate times on international markets since then.

Nobody criticised Citi or Goldman’s execution on the day. South Africa attracted $10bn of orders, a solid figure, and the new issue premium paid was reasonable.

But not including South African banks was an odd choice for a country that has previously made development of local talent and local firms, thereby attempting to increase equality, a priority and has been lauded for doing so.

South Africa’s banks are the link between the country’s sizeable investor base and borrowers in the country. They are also primary dealers in local currency government debt and bring overseas investors into those bonds.

In past Eurobonds, they have also served as a bridge for domestic investors — many South African investors cannot gain approvals quickly enough to buy Eurobonds between books opening and pricing, so local banks have stepped in, hanging on to a portion of the deal before selling it down to locals.

They also play a key role in working with broad-based black economic empowerment partners in the local banking sector, helping foster and develop skills. That is something that South Africa insists upon for its mandates even when using international banks, but the links for these partners are arguably stronger for local banks than internationals.

And from South Africa’s point of view, why not include them? They pay the same total fee whether it hires two banks or 10. It builds confidence in the country’s banking system and ultimately that is a good thing for the sovereign too.

The upside to hiring local banks, or indeed a wide swathe of banks whether international or local, as far as deal execution on the day goes may be limited. But local banks offer more than just an extra voice on a pricing call.

These mandates are a bigger deal for a local bank than for an international behemoth, which although it will take the mandate seriously and do the deal to the utmost of its abilities, will do many others like it in a year. Local banks get few chances at such prestigious business and go the extra mile when they are hired.

South Africa may have done its deal but it missed an opportunity this week for furthering capital markets on its home turf.