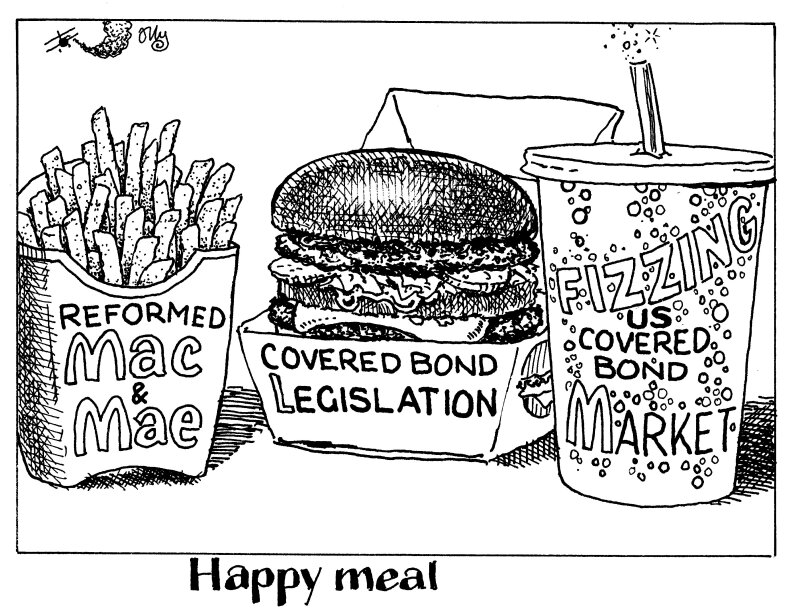

Fannie Mae and Freddie Mac, the two privately owned but government sponsored enterprises (GSEs), were bailed out by the US government during the 2008 sub-prime mortgage crisis and have been in conservatorship ever since.

However, if elected for a second time as US president next month, real estate mogul, occasional TV host and Republican candidate Donald Trump could revisit his plans to end the US government’s control of the two mortgage financing firms, and — inadvertently — birth a legislative US covered bond market.

Covered bonds have not taken off in the US to the same extent they have in Europe. Instead, US firms typically rely on securitization, the Federal Home Loan Bank system and the GSEs to fund their mortgage books.

Towards the end of his first residency at the White House in March 2019, Trump issued a presidential memorandum that would have paved the way to reforming the GSEs and increasing competition in the US housing finance market. A US Treasury reform plan followed six months later, which explicitly mentioned Danish style long-dated covered bonds as an alternative funding tool for the 30 year fixed rate mortgage.

Unfortunately for covered bond programme structuring teams and legislation nerds, these plans fell by the wayside, with GSE reform not high on the agenda for Trump’s successor, Joe Biden.

Of course, until the GSEs are reformed, the appetite for covered bonds and associated legislation within the US banking system will likely be low. Thanks to their implicit government guarantee, the GSEs can offer incredibly attractive financing to US banks.

And for now, the US has no covered bond legislation, despite pre-Trump attempts in 2011 and 2013.

But if Trump follows through with his GSE reform plans, such legislation could be back on table — and with it the rebirth of US covered bonds. Covered bonds have proven themselves in Europe — as well as further afield — to be a reliable, cheap (most of the time) and anti-cyclical source of funding. Such an alternative should be welcomed in the US with open arms.