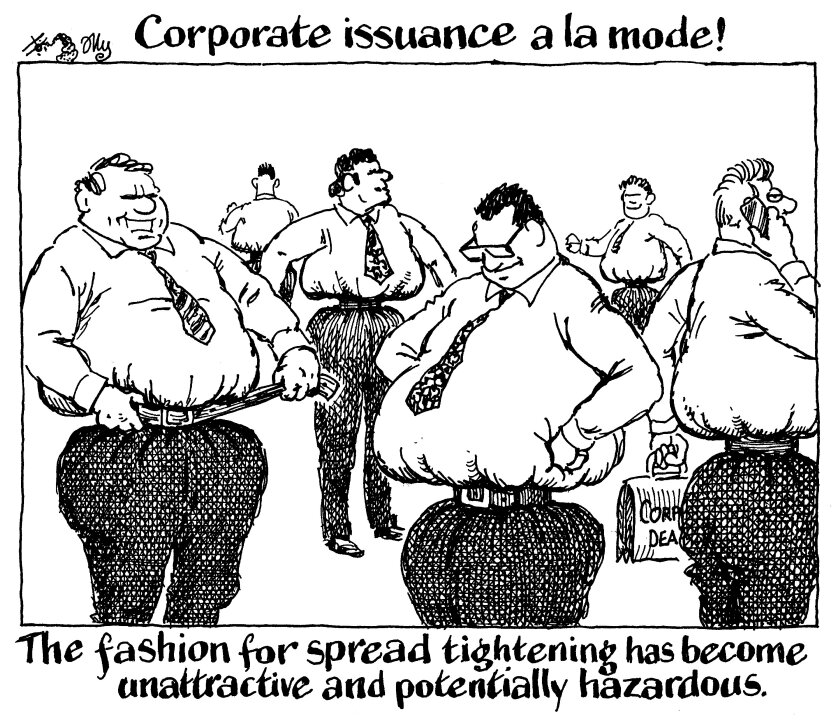

Euro high grade corporate spreads tightened by as much as 40bp this week during bookbuilding, which is a boon for borrowers but indicative of a bond market acting sub-optimally.

Starting a deal 40bp wide of where leads expect it to end is a great tactic during a bear market — investors are nervy and issuers need to get plenty of momentum going to encourage as much demand for their deal as possible.

In a bull market — like the one investment grade corporate bonds have been in all year — it doesn't work so well. Money has poured into corporate bond funds, so investors must buy them. There is no need to over-sweeten the pot.

Except for two idiosyncratic deals, the average senior euro spread move during bookbuilding this week was 35bp, above the 29bp average move over the past two years.

This problem may seem academic, as the deals got done, However, this approach is starting to prompt order book attrition, with demand from peak to final dropping at significantly higher rates than the market has seen for much of the year.

Some of this is down to investor fatigue after a frenetic month, but some is also down to investors at the periphery not wanting to go through the credit work only to see a deal tighten well above the market average and price them out.

Borrowers and investors wanting diametrically opposed things from a deal is right — ultimately, a borrower wants their deal to be as expensive as possible for an investor to buy, and vice versa.

Some of this gap in desires is bridged with intensive investor work, so all parties can have an idea of where their boundaries are — and ideally make the concessions needed to get good pick-up for deals.

Tightening trades by so much in a bull market is an unnecessary own goal for borrowers and syndicate bankers in eroding investor relationships. A better approach is to show more discipline and start marketing closer to where you want the deal to end.