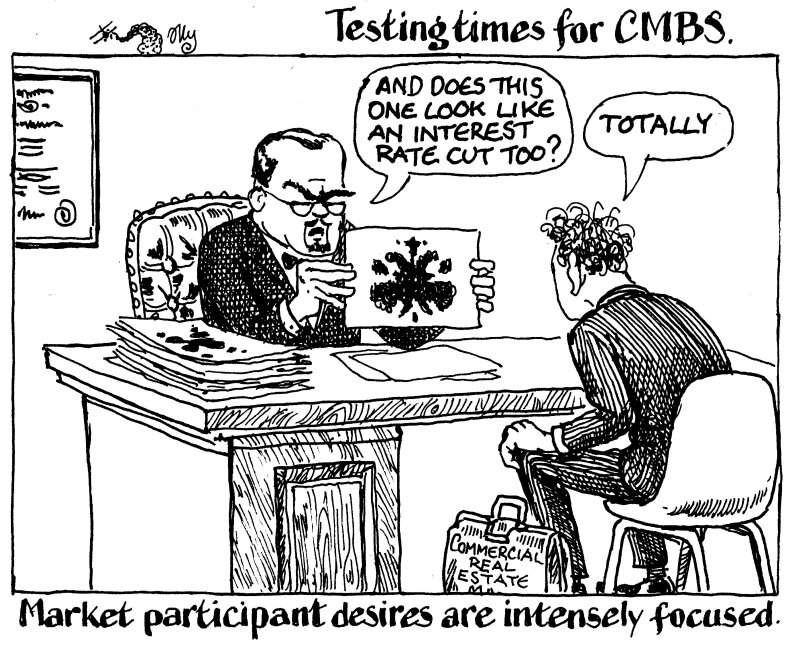

Amid all the recent market turbulence only one variable matters to the US CMBS market: interest rates. They’re only coming down, meaning the asset class can only go up.

The asset class has been through some tough times as shifts in working and retail habits have battered the economics of the sort of big buildings it finances.

As those changes bit during and after the pandemic, the market then had to contend with punitive funding costs as interest rates rocketed.

It’s tough to think it’ll get much worse from here for commercial real estate, even if a recession hits. It is arguable the sector has endured the grim conditions akin to a downturn for some time.

Market participants now see better times ahead, with badly needed rate cuts and cheaper financing seemingly imminent.

The end of the pain of higher borrowing costs cannot come quick enough, with interest rate cuts now expected as soon as September, rather than December.

All this explains why, despite a sharp increase in fear through the markets this week, there was cause for cheer in the US CMBS market as the weak non-farm payroll data last Friday hinted at lower interest rates ahead.

The sector couldn’t be in a much better spot. While issuance has been relentless this year as spreads came in, lower borrowing costs will likely juice up an already hot market inviting a breadth of participants.

Commercial real estate players with dry powder to spare should happily seize the moment to ink a deal at the first sign of the market moving favourably. The Fed cannot cut fast enough for US CMBS.