Real estate company Aroundtown shrugged off years of hurt to land more than €4bn of orders for its bond market comeback this week, with the company’s capital markets rehabilitation fast tracked by 2024’s bulletproof investor demand. But it is unlikely many others will follow suit.

Real estate is a highly leveraged industry. Companies in the sector with at least a BBB rating from S&P all had at least 10 times debt to Ebitda at the end of last year. Market darling Vonovia's ratio was 20.2 times.

Aroundtown was in the middle of the pack at 15.8 times. For most triple-B rated names globally, leverage is between four and five times, according to OECD estimates.

That level of indebtedness proved brutal when interest rates rose and it needed to be refinanced at a much higher cost to the borrower. For real estate issuers it was made much worse because one of the things Covid 19 fundamentally changed was demand for their assets.

With all this in mind, it seems counterintuitive that a company like Aroundtown could command €4.35bn of orders for its €650m 4.8% July 2029 deal this week, as investors fell over themselves to pick up the bonds.

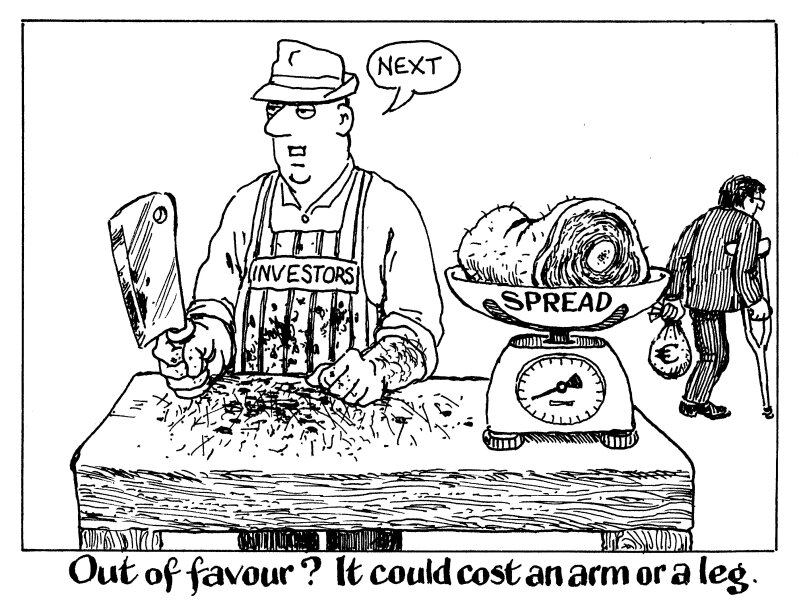

But investors demanded their pound of flesh in the form of spread. Aroundtown started 90bp wide of where Heineken, rated the same by S&P, started marketing a bigger deal that was also seven years longer a week earlier.

It means that Aroundtown has not in fact created a template for other out of favour names, such as any company in a cyclical sector that is not a market leader beyond the obvious — pay up if you want market access.

Therefore, it would be unwise to bet on too many other companies following Aroundtown's example, unless of course they absolutely have to.