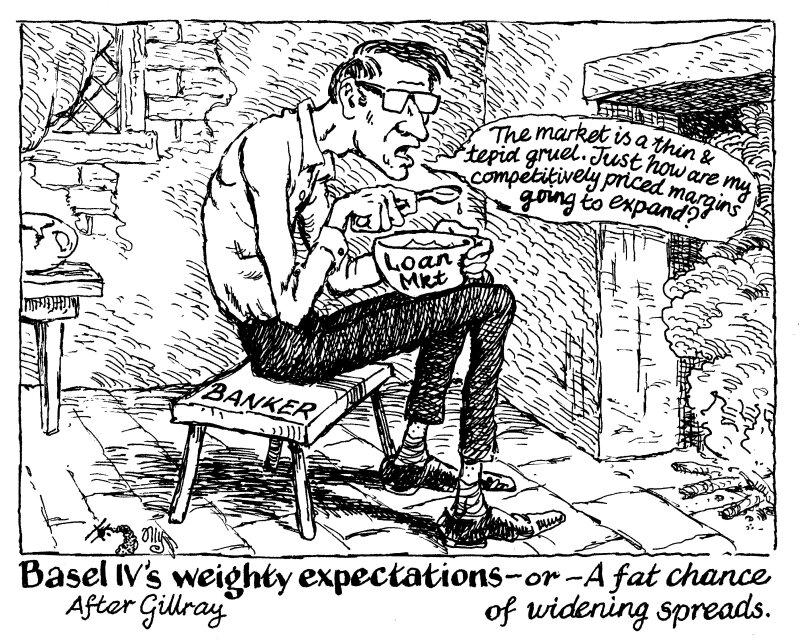

With Basel IV looming on the horizon, banks are bracing themselves for what they foresee as an inevitable rise in the cost of their risk-weighted assets and capital. The consensus among many bankers is that loan spreads will widen in response. But that is a brave bet in an uncertain market where volumes are low.

The reality is that relationship preservation remains paramount for lenders. In a market where volumes remain tepid and competition fierce, the pressure to maintain favourable pricing is unlikely to ease. Keeping major clients with good credit happy will always trump margin expansion.

Basel IV is set to standardise what has previously been left to banks to calculate for themselves in terms of their risk profiles, in theory creating a level playing field when it comes to the cost of capital. As some banks will have further to travel to comply than others, it should theoretically alter how competitive they can be in the loan market.

It will indeed be a wake-up call for those that have relied upon lenient risk management, but it won’t necessarily result in a widespread widening of loan margins.

History is a guide. The implementation of Basel III aimed to bolster banks' resilience, but it didn’t lead to a dramatic widening of spreads either. Instead, banks adapted, absorbed costs, and prioritised long-term relationships.

Under Basel IV, banks will find ways to cushion the impact without transferring the burden entirely on to treasured clients.

For US banks, Basel IV could be the joker in the pack. They seemingly have the most to lose from compliance with Basel IV and have been been campaigning against it.

But don't expect them to be priced out of the market. While the narrative of widening loan margins under Basel IV might sound compelling, it's a simplistic view that overlooks competitive market pressures and circumstance.

As Basel IV takes shape, and especially with M&A financing scarce and volumes low, expect banks to prioritise relationships and competition.