Lenders have been living for most of the past two years in a paradise — for borrowers. In the current syndicated loan market landscape, one word sums up the whole scene: tight.

Higher interest rates are inherently bad for borrowers, and might be expected to have led to wider margins.

In one respect, and in combination with the Covid pandemic and the Russia-Ukraine war, they have. Banks are having to pay more for funding than a few years ago, which means the cost of drawn debt for companies has gone up a little.

But higher rates have also put companies off borrowing — for M&A, for example. Meanwhile, banks are generally in good health, helped by fatter net interest margins.

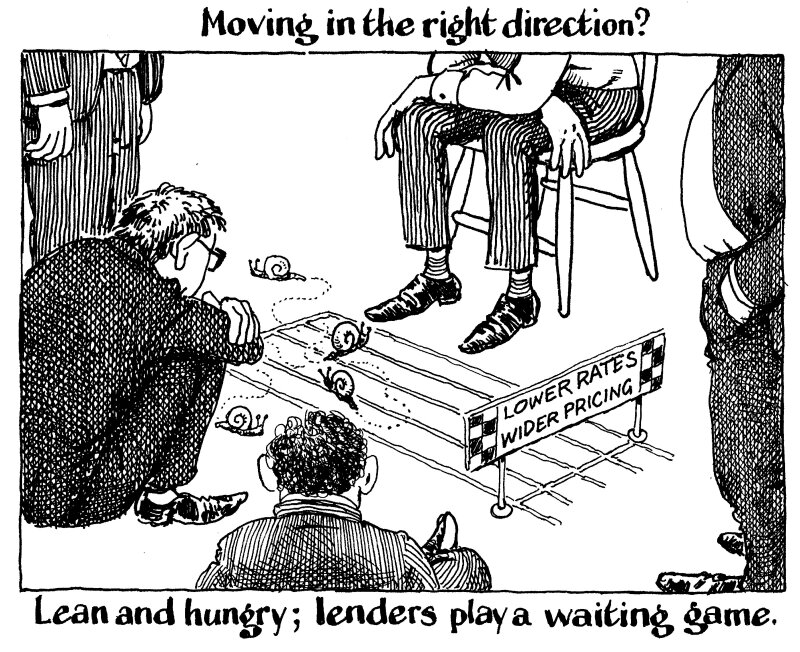

The result is that the slump in borrowing and simultaneous eagerness to lend have tightened syndicated loan pricing right back to pre-Covid and pre-Ukraine war levels, across the investment grade spectrum.

Loan bankers have little choice but to pay up and wait quietly for a surge in M&A activity.

Recent RCFs have been priced at margins inside where they were last refinanced, for borrowers such as Norsk Hydro, Axpo and Trafigura in recent weeks, to name a few.

Banks are taking the path of least resistance and saying yes even to pricing that seems too tight, to make sure they stay in the company’s syndicate and do not miss out on future business.

The present arid plateau of loan pricing may seem endless, but it is unlikely to last much longer. Two opposite forces could disrupt it.

Interest rates won’t remain on hold forever — and when they start to fall, companies are likely to rediscover their appetite to borrow.

The worst rate increase cycle in the eurozone’s history is now past. This should bring recovery and the summer will already mark a turning point. The current low volumes in the loan market will of course keep pressure on pricing, but demand will drive it wider again.

Less cheerful, but also potentially influential on loan pricing, is the rise of corporate defaults.

According to S&P Global, in 2024 more companies have defaulted on debt than in the equivalent period of any year since 2009.

Even though defaults are overwhelmingly on low grade credits, it would not take much more of a rise in credit risk for banks to start playing hard to get, even in the investment grade market.

Borrowers should enjoy the current favourable conditions while they last. Soon, the scale will tilt in favour of banks and companies will find their faces looking sterner.