The euro primary market for sovereigns, supranationals and agencies has slowed since the end of February. Only four issuers came last week for €15bn combined, but €8bn of that was from France alone.

This week, the volume was even quieter, at €6.75bn from three issuers, all of which were German. Again, the bulk of that came from the sovereign.

In comparison, the first week of March last year saw €15.8bn printed across eight deals. Between January and February this year, the average weekly SSA issuance volume had been over €24bn.

SSAs have front-loaded issuance aggressively, allowing them to take a breather.

Perhaps the market needed a break after nearly €230bn of benchmark supply in two months. In 2023, it took until the second half of April to reach that figure.

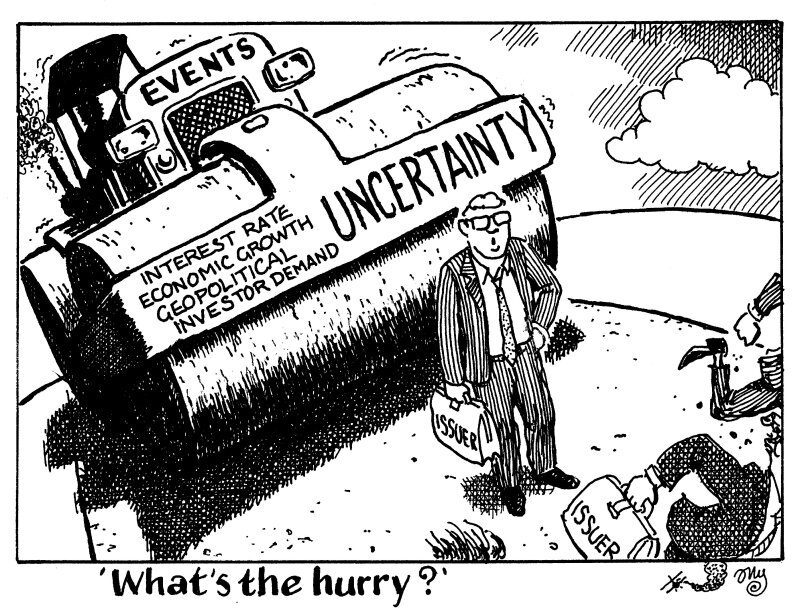

But issuers cannot rest on their laurels. Front-loading has bought them flexibility, but there is great uncertainty ahead and it would be sensible to keep printing while they can.

The EIB seems to have recognised this. In the last two weeks it has priced dollar and euro benchmarks for a captive audience, taking it to 50% done of its €60bn funding need. Typically, it might not expect to hit that level until a few weeks later, around Easter.

KfW, which has €90bn-€95bn to raise this year, has also been industrious in quiet markets, snapping up $5bn this week to be 37% funded for the year.

Issuers with less to do should take note of what the long-standing market leaders have been up to.

Uncertain economic growth, geopolitical situations and a bustling global election calendar mean markets cannot be taken for granted. Meanwhile, tighter swap spreads have raised questions over the longevity of the buoyant investor demand.

With the potential roadblocks ahead, issuers must keep advancing with their programmes.