Novo Banco plans to become a regular issuer of covered bonds following its debut on Wednesday. This week's €500m three year deal attracted one of the strongest covered bond books of the year as investors piled almost €5bn of orders into the trade.

“We chose to issue a covered bond to diversify our funding sources,” said Carla Ferreira, a member of the bank’s funding team. “This deal was the next natural step for the bank. Going forward we intend to be regular issuers of covered bonds.”

Ferreira added that she expects the bank “to come to the covered bond market up to maximum of two times a year”. A second deal in 2024 is possible, she added, but the bank currently has no plans to issue.

Novo Banco has a €7.5bn cover pool consisting of only prime residential mortgages in Portugal. Under its current programme, it can issue up to €10bn of covered bonds.

Although Wednesday’s deal was the bank’s public covered bond debut, it does have €5.5bn of retained deals outstanding. Of this, €1.55bn is set to mature this year, with a further €1bn maturing in October 2025.

Novo Banco has now issued subordinated and senior secured debt in the last eight months. However, there are no plans to issue benchmark senior unsecured debt for its minimum requirement for own funds and eligible liabilities (MREL) needs in the near future.

“Because of our dividend ban we’re currently building MREL with CET1 (common equity tier one), which means it is not optimal for us to issue senior unsecured debt at this stage,” said Maria Fontes, head of investor relations at Novo Banco.

As part of a contingent capital agreement agreed during the sale of Novo Banco in late 2017 the bank is subject to a ban on dividend payments. This ban is in place until December 2025. As of the end of 2023, Novo Banco has a fully loaded CET1 ratio of 18.2%, up 500bp from a year earlier.

Furthermore, the bank had a MREL ratio equivalent to 24.7% of its risk-weighted assets, of which tier one debt accounts for 18.5%. The bank currently has a 17.66% MREL target, which is set to rise to 23.47%, exclusive of buffer requirements, in January 2026.

Novo Banco has one senior unsecured bond outstanding issued since its restructuring in 2014, a €100m 5.5% December 2026 bond issued in late 2022. The bank also has a number of sub-benchmark 2043 and zero coupon bonds outstanding issued in 2013 and 2014 by its predecessor Banco Espirito Santo that count grandfathered into MREL stack.

A ‘fantastic result’

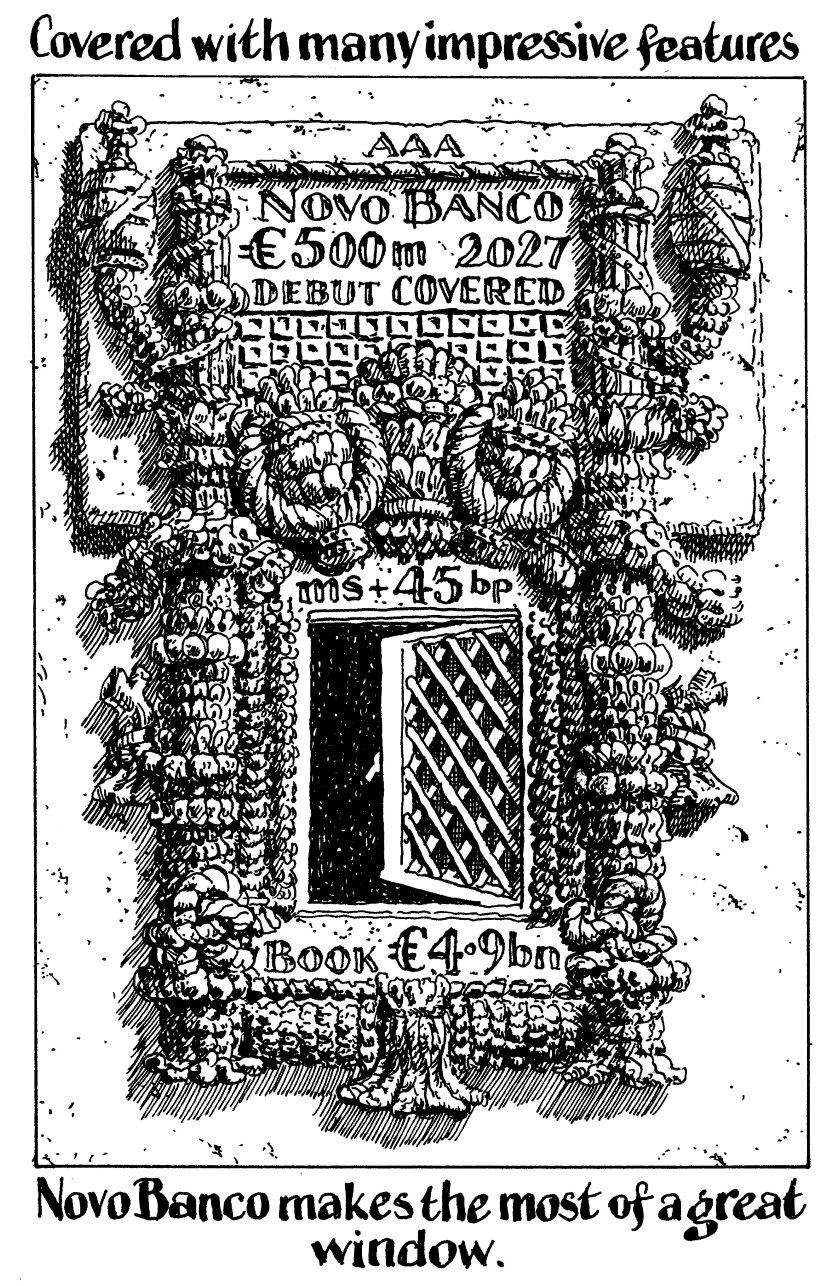

Novo Banco gathered a final order book in excess of €4.9bn for its inaugural deal on Wednesday, allowing it to price the €500m no-grow March 2027 bond at 45bp over mid-swaps, 10bp inside of the initial price thoughts.

“We felt this deal went extremely well and are really pleased with the outcome,” said Ferreira. “We’ve been meeting investors and preparing this deal for a while — and in the end the deal exceeded expectations.”

An orderbook in excess of €4.9bn is a “fantastic result” for a debut covered deal, said one FIG DCM head involved with the trade. “It’s a vote of confidence in the name and the process.”

This is the joint largest orderbook for a covered bond in euros so far this year, alongside Argenta Spaarbank’s €750m 10 year green covered bond from late January, data from GlobalCapital’s Primary Market Monitor shows. Furthermore, as Novo Banco’s deal is €250m smaller, its bid-to-cover ratio is even greater than Argenta Spaarbank’s, at 9.8.

“There were 10 triple digit orders in the book,” said Ferreira. “The book was very well diversified with central banks, asset managers and bank treasuries taking part. Even after we moved 10bp, the book didn’t drop, which shows just how strong it was.”

Ferreira spotted fair value for the deal at close to 45bp, suggesting the bank paid a minimal concession. The FIG DCM head felt that the deal went through fair value, adding that he spotted fair value at north of the 45bp final spread.

Despite the tight price and 10bp move, the book did not drop in size, “showing just how strong it was,” Ferreira said.

“Investors like the journey the bank is on,” Fontes added. “When you put everything together, it is not just the covered instrument itself but also the quality of the issuer that appeals to investors. These bonds are triple-A — we see ourselves as a normal player in the European financial market.”

For instance, Moody’s raised the bank’s senior unsecured rating by five notches between June 2022 and November 2023, taking it from B3 to Ba1. Over the same period, its covered bond rating rose from Aa2 to Aaa.

The recent upgrade “helped with the success of the trade” said a second banker involved with the deal. At Aaa, the covered bond is now liquidity coverage ratio (LCR) level 1 eligible, they added.