Transition bonds have not yet acquired a good name. Despite the obvious necessity of financing the economy’s transition to low carbon technology, market participants tend to shudder when they hear the term.

Even in Japan, where the market is most firmly established, issuance is slight and fell last year.

The Japanese government is setting out to change that. It has planned a transition strategy for its economy, paying particular attention to 10 high emitting sectors, setting out guidance on how companies should transform by the net zero deadline of 2050.

There remains a debate about whether Japan is ambitious enough about weaning itself off fossil fuels, or relying too heavily on unproven solutions.

But the thorough, detailed and consistent way Japan is planning ahead sets an example to other countries.

With the industrial strategy is a financial one: to build a transition finance market along official guidelines, led by the government, which will raise the ¥20tr ($133bn) it plans to invest with Climate Transition Bonds.

The launch of the first this week, raising ¥800bn ($5.3bn), offers a fresh start for transition bonds.

The European market, where the majority of sustainable finance activity has taken place so far, has done a poor job.

Confusion has long swirled about the difference between green and transition bonds. Of course, any ambitious transition bond is changing the economy towards low carbon, and therefore is green.

And as the International Capital Market Association pointed out in a guide to transition finance published this week, most green bonds are transition bonds — they finance decarbonising society, in one way or another.

The two terms ought to be synonymous.

Too green, too soon

Europe went wrong early in the life of the green bond market, through timidity. To protect the new asset class from criticism, market participants made sure to include only the assets everybody agreed were unimpeachably green — renewable energy, energy efficiency, green(er) buildings, rail and electric vehicle mainly.

Meanwhile it ducked tougher questions — what is a green paper mill, cement plant or aircraft, for example? Arguably, that was justifiable at the time: some of these sectors have barely begun to transition even now.

But the muddled idea took hold that “green” assets are green now, while “transition” assets are not yet but could be later.

The EU set the error in concrete when it weighed in with its misguided Taxonomy of Sustainable Economic Activities. Most of the Taxonomy describes in minute detail the small percentage of the economy that is green now, ignoring the pleas of environmental NGOs to ascribe shades of green to all the grey activities too.

As a result, green finance has "matured”, as market participants claim, as a two dimensional discipline, focused on identifying assets that can be called green now.

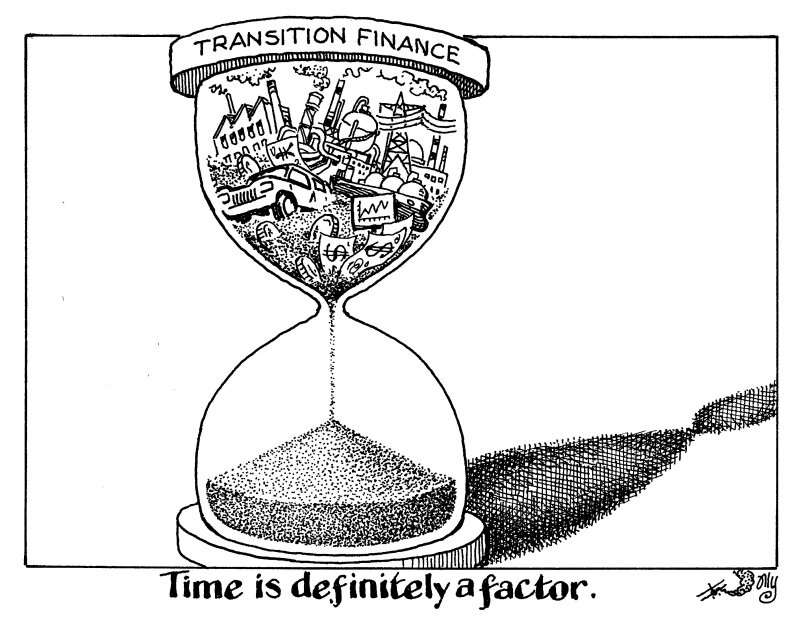

But the real world is not static. There is a third dimension — time.

Transition finance is a way of restoring that third dimension to how investors conduct green investment. If investors and banks embrace it, transition finance should create more opportunity, space and encouragement for companies that want to finance emissions reduction through a set of technologies that will change over time.

Transition finance is not just about being understanding to polluters and giving them time to change. It also means watching the clock. The intermediate solutions borrowers introduce have to be time-limited, and be genuinely replaced, on schedule, with the next generation of technology.

This 3D thinking demands much more of issuers, and of investors. But it is the only way for society to truly engage with the uncertain path ahead.