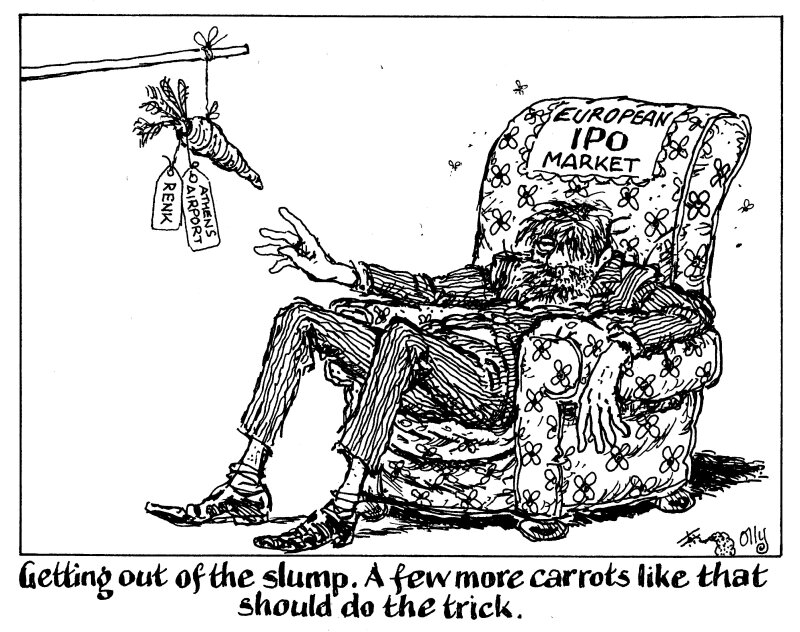

After a slump lasting several years, Europe’s battered IPO market is showing signs of life with the successful trading debuts of Athens International Airport and Renk this week. The IPO market needs more of these well priced deals for quality assets to ensure the momentum continues.

As of Thursday, Renk has surged by over 41% from the offer price in its €500m IPO while Athens International Airport has notched up a 14% gain following its €695m flotation, the biggest in Greece in decades.

These two sizeable European IPOs have provided a vital data point in a market that has been struggling with both confidence and relevance following the downturn in deal flow over the past two years caused by inflation, rising interest rates and the war in Ukraine.

But the most damaging thing for the market last year was that many of the IPOs that were priced, such as payments processor CAB Payments, performed poorly in the aftermarket. In the case of CAB Payments, it missed its numbers only months after the IPO, causing its stock to crater.

While every IPO is judged on its own merits, investors needed to be reminded that they can be a serious source of returns and would-be vendors need the confidence of a supportive buyer base for their portfolio companies.

Europe's equity capital markets needed a positive note to bolster confidence for a much bigger pipeline of large deals later in the year. In Renk and Athens Airport they have two.

To build on the success of those deals, issuers will need to move fast, with the looming US presidential election providing a heavy dose of political risk in November, and selling shareholders will need to be conservative on pricing to allow some normality to return to the IPO market after more than two volatile years.

Two swallows don't make a summer, as the saying goes. But there is finally some evidence that the IPO market is about to spread its wings once again.