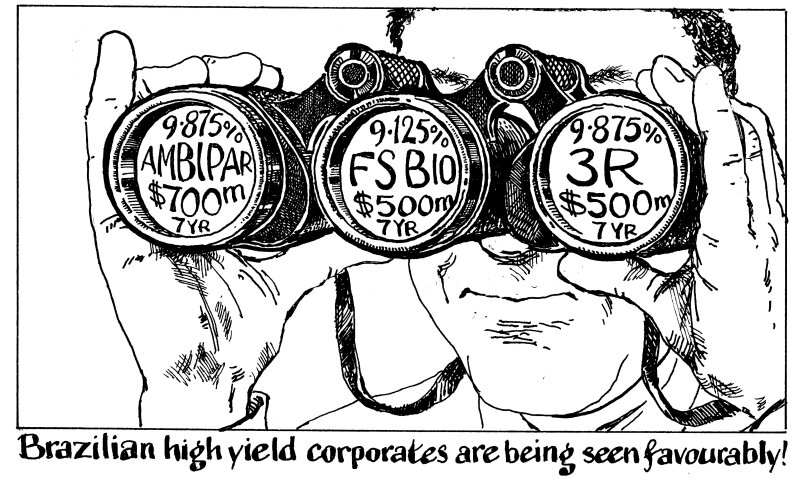

Some buyers of Latin American bonds are a little flustered. After two years of banks offering them a menu of sovereigns, quasi-sovereigns, and blue chips, three Brazilian high yielders turned up in two days dangling yields exceeding 9% for seven-year paper.

All three got their deals away but not without certain investors turning their noses up, proclaiming they were "too heavy on Brazil", or alleging that some of these companies were not mature enough for bond markets.

Financial journalists are not paid enough to make bets on whether environmental management company Ambipar, oil and gas junior 3R, or corn-based ethanol producer FS Bio are on the brink of greatness or collapse. But the appearance of young and funky credits in the bond market is welcome.

After a pretty scary 2023 for several Brazilian high yield credits — with cf Lojas Americanas, Light, and a bunch of others trading disproportionately below par — prescribing more supply from so-called "hairier" companies may appear counterintuitive. It's inevitable that such companies provoke a wide range of views on fair value and that for some accounts there will be no acceptable price.

But it's exactly what the LatAm bond market needs.

The beauty and skill in being an EM investor cannot be in calculating the appropriate number of basis points of new issue premium for top-tier companies like Chilean copper giant Codelco or Mexican bread firm Bimbo.

EM credit analysis absolutely should involve deciding if three-year old companies should be borrowing $500m, whether a management team can pull off ambitious-sounding business plans, and sussing out what exactly an "environmental, emergency response and industrial field service provider" a company like Ambipar is.

There's a key difference to 2021, when the last wave of Brazilian first-timers stormed the market. Several of those companies were domestic businesses lured by exceptionally low rates in dollars. This time, they are international businesses for which dollar funding makes perfect sense.

Channelling capital to companies like these is surely one of the raisons d'être of the EM corporate bond market.

Whatever the fate of this week's trio of high yield issuers, it is essential bankers and fund managers continue to invest the necessary time when opportunities of this nature surface.