It has been an extraordinary start to 2024 in the SSA market. The year’s first full week of issuance has already beaten last year’s equivalent volume by a country mile. Euro supply alone was up 90% compared to the same week in 2023.

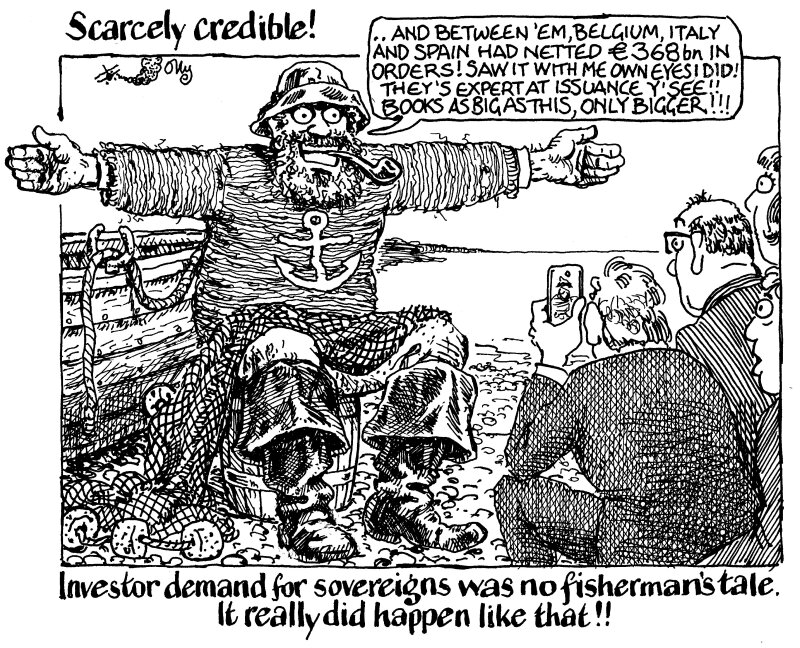

In terms of the volume being absorbed and the level of demand, conditions were reminiscent of when the European Central Bank was still buying bonds. Some of the numbers — Belgium’s €75bn book, Spain's of €138bn and Italy's €155bn — topped the fluffy order books of even the peak of quantitative easing.

Plenty struggled to explain it. But one thing was clear: SSA issuers reaped what they sowed.

Much of the demand for paper lay in the fact that SSAs boast the highest credit quality and valuations look attractive, especially when investors are trying to put a lot of money to work, as is the case in any January.

But more than that, not only are SSAs experienced and sophisticated issuers, but where they used to prize their predictability, they have now shown they can be flexible too.

They have taken an adaptable approach to issuance, not only in terms of timing and sequencing of deals, but in how they have met investors’ needs, using new pricing references, deal structures and execution strategies to drive orders and tight pricing, proving that it isn't just a question of new issue premium.

Whatever the approach, the tactics forged in the volatile rates market of 2023 are paying off again this year. More difficult markets than these lie ahead, no doubt. Those SSAs that shaped their issuance to investor needs and front-loaded their borrowing will be in an enviable position during those turbulent times.