Hopes soared at the end of last year that the US Federal Reserve was ready to cut rates, with bond markets rallying and lenders heading into 2024 with growing confidence. That was a boon to the bank lending market in Europe, which had a year to forget in 2023.

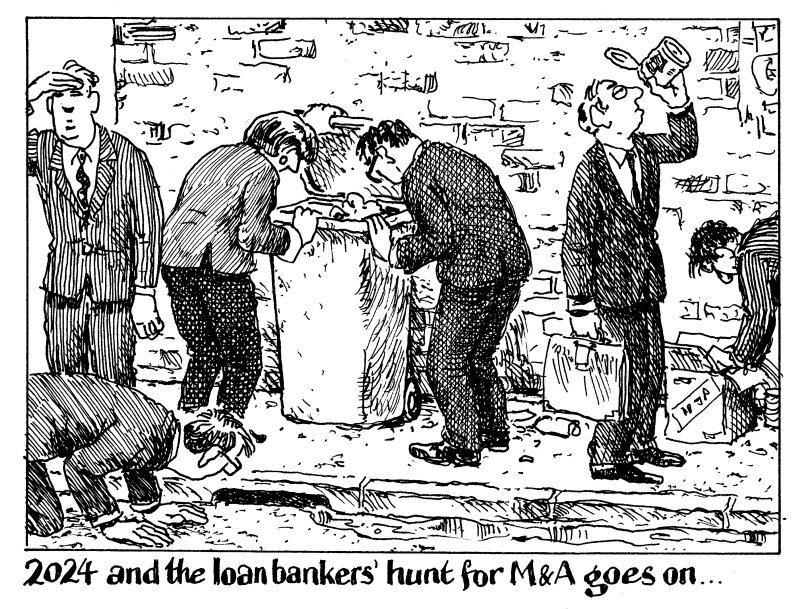

Global M&A activity, a big driver of fresh corporate borrowing, reached its lowest volume in 10 years in 2023, and there has been little sign that things will improve in the first quarter of this year. Therefore, there was hope that interest rate cuts this year might spur more deals.

But the minutes of the Federal Open Market Committee's December meeting threw water on that particular fire. While there was a consensus among Fed officials hinting at three anticipated 25bp cuts this year, most of them remained steadfast in their stance of maintaining borrowing costs at elevated levels for the foreseeable future.

But worse still is the level of caution surrounding corporate investment plans, which is unlikely to lessen even if rates fall. Corporate treasurers will be mindful of the potential for disruption facing the global economy this year, when about half the world’s population, across more than 60 countries, will go to the polls — the most ever in a single year. That is hardly the backdrop against which to do big ticket, cross-border M&A.

While some borrowers seem to have accepted that money costs more than it used to, that is a very different problem to assessing whether deploying it on a particular piece of capital expenditure, or piece of M&A, will work out in their favour with so much political uncertainty ahead.