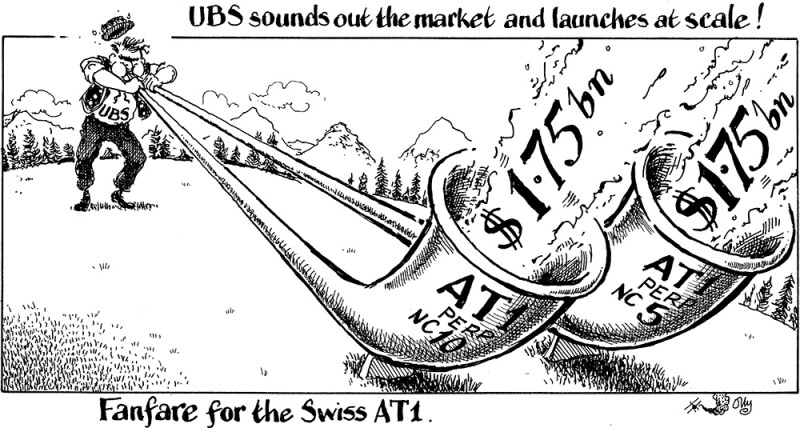

Additional Tier One Bond of the Year

UBS Group

$1.75bn 9.25% perpetual non-call November 2028

$1.75bn 9.25% perpetual non-call November 2033

UBS

The collapse of Credit Suisse in March was not only the first international systemically important bank failure since the global financial crisis. It also put additional tier one (AT1) capital — the most subordinated bank debt — under the spotlight, especially in Switzerland, when the regulator wiped out $17bn of the stricken bank’s AT1s as part of its forced merger into UBS.

UBS’s return to AT1 issuance had therefore been much anticipated. But when it did come to market, in autumn 2023, it made an emphatic statement that investors had put the Credit Suisse write-down behind them.

UBS attracted $36bn of orders to its pair of $1.75bn tranches — the biggest ever book for an AT1 sale. It showed a full restoration of confidence in the asset class, and was evidence that investors saw UBS as a reliable issuer.

Thanks to the overwhelming demand, UBS was able to crunch the pricing by about 25bp through fair value.

This deal not only paved the way for other European banks to follow with their own dollar AT1s, but also alleviated lingering concerns about Swiss bank capital.

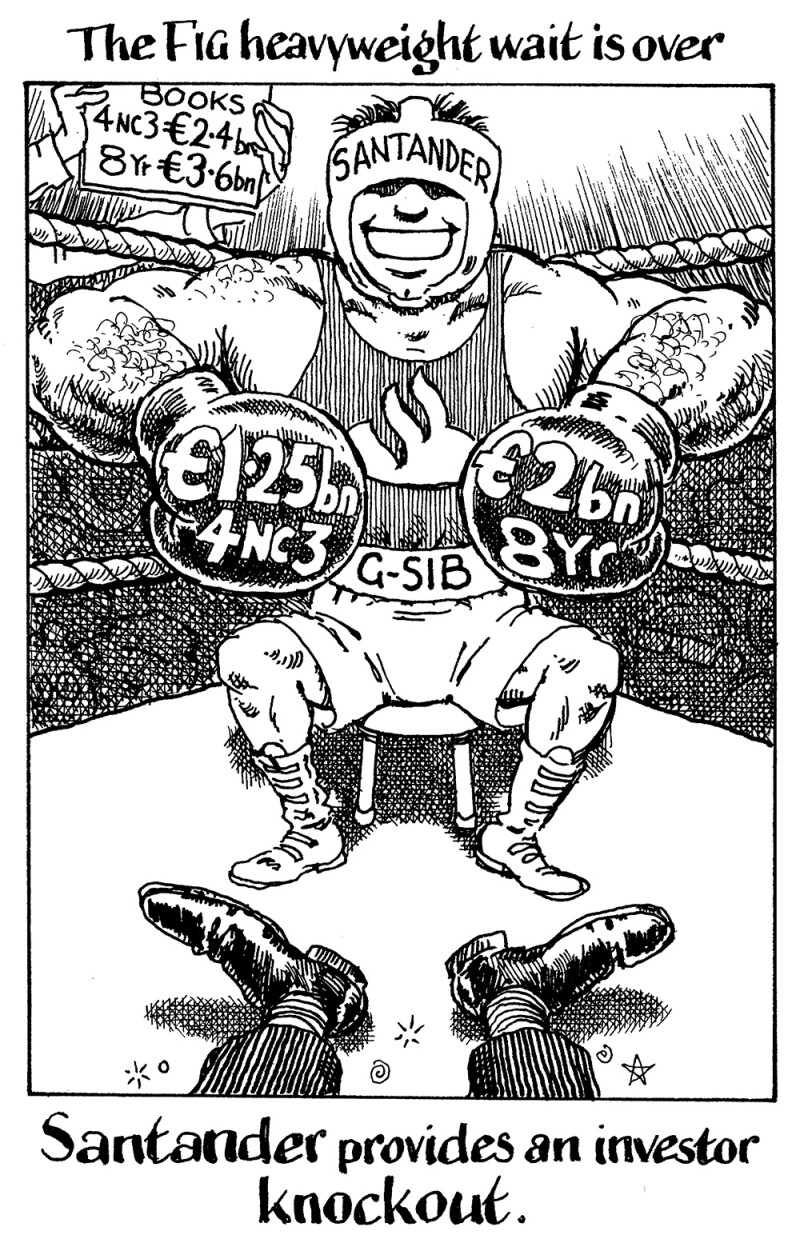

Senior Euro Bond of the Year

Banco Santander

€1.25bn 4.875% October 2027 non-call October 2026 senior non-preferred

€2bn 4.625% October 2031 senior non-preferred

ING, Natixis, NatWest Markets, Nomura, Santander, Société Générale, UniCredit

Banco Santander has a reputation as an astute issuer. In 2023, it timed its two senior outings in euros to perfection, printing both the largest and the second largest such deals in the currency.

After its €5bn senior preferred triple trancher in January, it returned in October with a €3.25bn two-part non-preferred trade.

The second deal was the first unsecured euro deal from a European bank after a spell of market inactivity and it revived Santander’s presence in the public euro senior non-preferred market, where it had not issued for two years.

Having an investor base starved of non-preferred paper from a European national champion was one ingredient in the deal’s success. The fast bookbuild, despite the concurrent interest rate volatility, highlighted investors’ clamour for the Spanish bank’s credit.

Choosing an eight year tranche was another key part of the recipe. At nearly double the size of the shorter piece, it helped Santander capture investors’ bid for duration, something that had not been a given in a market troubled by the rates outlook at the time.

Financial Institution ESG Bond of the Year

Bank of Ireland Group

€750m 4.625% November 2029 non-call November 2028 senior green bond

Davy, Goldman Sachs, JP Morgan, Mizuho, Morgan Stanley, UBS

The Irish economy has been thriving and its banks have served as proxies for investors looking to take exposure. Bank of Ireland, which has been instrumental in labelling almost all of its senior issuance green in recent years, took full advantage of the demand.

The green label allowed the bank to broaden its investor base, looping in investors that track ESG-labelled deals exclusively.

This deal, from November 2023, was the culmination of that effort after a number of visits to the primary market during the year. While demand was a touch stronger for its similar €750m 4.875% 5.5 year non-call 4.5 green senior outing in January, it was the November trade that drew the most plaudits.

It was priced in a more difficult market which, unlike January, was not one of abundant liquidity. Moreover, the note was longer than the January trade but, thanks to the additional demand that the green label generated, was priced at a spread 50bp tighter, allowing the issuer to print flat to, if not inside, fair value.

Non-Core Currency Bond of the Year

Banque Fédérative du Crédit Mutuel

¥65bn 0.82% October 2026 senior preferred Samurai

¥97.5bn 1.203% October 2028 senior preferred Samurai

¥4.5bn 1.648% October 2033 senior preferred Samurai

Daiwa, Nomura, SMBC Nikko

Banque Fédérative du Crédit Mutuel reaped the benefits of its long-term commitment to Japanese investors with its largest ever deal in the currency. This was no small feat, as the ¥167bn ($1.13bn) three tranche Samurai was priced in the middle of a spell of interest rate volatility.

The deal was a testament to the resilience of the Japanese bond market and the funding it offers to foreign issuers at times of stress elsewhere — but only those that have done their investor work and can therefore garner strong local name recognition.

The French bank fitted the bill perfectly and executed one of the largest public FIG deals during a volatile week that pushed banks in other markets to stand down from issuing at all.

BFCM’s choice to issue a Samurai paid off too, despite the arduous documentation requirements compared with other formats of yen bond. It allowed the issuer to reach a far larger number of investors, providing the issuer with crucial funding diversification.

The pricing was attractive too, with admirers suggesting that the issuer would not have achieved better levels for an equivalent deal in its home market of euros.