The European Union wrapped up its last syndication of 2023 on Tuesday. While its annual funding task is almost finished, the work is not yet done, and its issuance plan and funding approach for next year is becoming a key talking point in the SSA market.

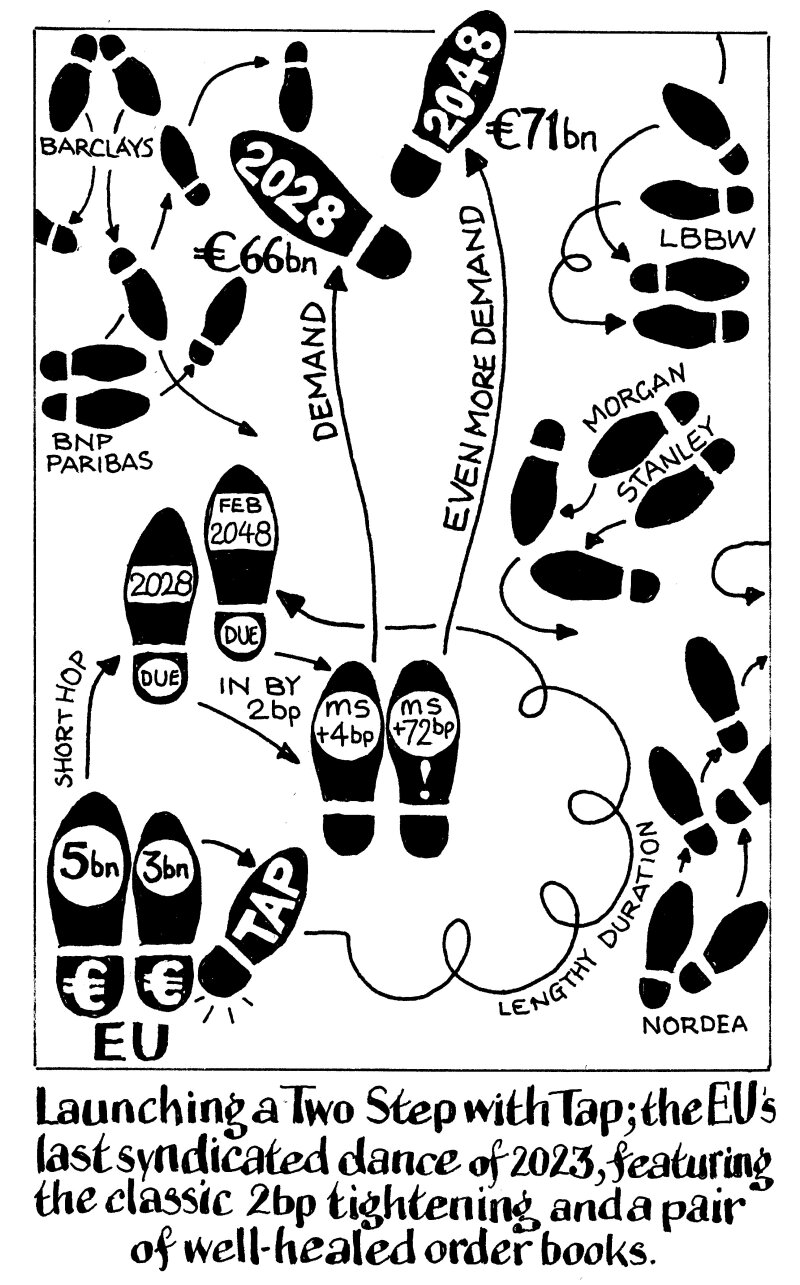

The €8bn dual-trancher was its 11th syndication this year. It has raised €71bn of its €120bn funding requirement this syndication. The remainder has been done through auctions, with one final €4bn exercise scheduled for November 27.

Some SSA market participants referred to the EU as “the elephant in the room” when speaking about it and others have even called it “a monster” when considering the size of its funding programme against theirs. Its transactions are closely watched by the whole public sector bond market, not only because of their impact on liquidity — the average size of EU syndication this year was nearly €6.5bn — but also on SSA spreads and general market sentiment.

“We are the fifth largest issuer in the European capital markets and are very close to reaching our €120bn target, similar to last year, but in more challenging market conditions this year,” an official at the European Commission told GlobalCapital.

“Despite still being a young issuer, we have established ourselves as a well-positioned issuer, and were able to navigate a volatile year to raise the funding we wanted to raise through well subscribed deals. We also managed to reopen the market at some difficult times for other SSA and government issuers.”

The market is keenly watching for the EU’s funding announcement for the first half of 2024 in December.

The Commission announces its funding plan half yearly, and had previously flagged an average annual issuance volume of about €150bn between 2024 and 2026 — a figure reaffirmed by the official based on the Recovery and Resilience Plans (RRP) submitted by member states.

But more specifically for next year, some market participants thought issuance could easily top that.

A senior SSA DCM banker saw “a good possibility” for next year’s EU funding to increase to €150bn, expecting a “pretty decent programme” of €70bn-€80bn for the first half. “They will start funding the €50bn Ukraine loan programme, and given Poland now has a more EU friendly government, there’s a high likelihood that €20bn-€25bn of frozen funds will be unlocked and paid out over the next two years,” he said. “All of these are adding to the funding needs.

“Looking at the approved loan applications, you could easily say that €150bn is the number for next year. But the big question remains whether individual governments can achieve the necessary milestones [to unlock the funding] — and that’s something not even known to the EU funding team, so there could be some adjustments for H2 just like this year.”

In addition to size, another big question mark is whether EU’s funding would be executed in a similar style. “There were so many funding windows this year,” he said. “Would the windows be slightly more consolidated and would they come less often to the market?”

Many of its syndications stood out in what has been a busy year for primary issuance from sovereigns, supranationals and agencies (SSAs). The €6bn tap of its green bond due 2048 in March had been identified by some bankers as one of the few outstanding long-dated trades this year. The €9bn dual-trancher in May was the largest non-sovereign trade in 2023 And in this week’s deal, the EU amassed €137bn of orders — another record.

“The EU’s evolution as an issuer was pretty impressive,” said a head of SSA syndicate. “Frankly, I was quite cynical about what could get done this year. But EU really cemented itself in that space between sovereigns and supras and doing all the things that a sovereign would do, and their trades have generally been pretty well received.”

Widespread impact

Having yet another large programme with frequent syndications for 2024 will continue to put pressure on the EU’s curve, bankers said. “The EU is going to be be the largest animal,” said a banker in Europe. “What we have to realise is that while governments like France and Germany also have high numbers for borrowings, the EU is the largest net issuer. They have only €3.2bn of redemptions next year, and everything that comes across will keep their spreads elevated.”

The main problem is that the EU “has gone large very quickly and it probably comes with a price”, he said. “The likes of France and Germany have been large issuers for a long time, but the EU went so big over just three years. The questions are how much credit line is available to investors, and how much willingness there is to increase those lines. The net issuance activity is so big that it feels like they are getting to a point where lines are essentially getting full, and people will have to sell in order to buy, which will have an impact on new issue pricing.”

But a London-based origination banker took comfort from this week’s trade, the response to which he was “shocked” to see. “The market gets into a froth about how much funding the EU has to do and how that might be impacting its curve,” he said. “But whenever they put something on screens, the reaction is huge.”

Nevertheless, the market remains wary of the impact that the EU — an issuer that is still rapidly growing — has on the rest of the public sector borrowers. For the majority of 2023 and throughout 2022, issuers making visits to the primary market in euros have typically given way to EU syndications. The likes of Germany, KfW and a handful of other sub-sovereign and agency issuers, however, have braved the market on the same day as the EU, and managed to sail through.

Issuers speaking to GlobalCapital said they would still very much like to avoid direct competition with the EU, a growing task given execution windows are already congested due to the sector’s large overall volume, a busy data and central bank calendar, and pockets of volatility.

“There’s a high correlation between the EU and the likes of KfW and EIB as well as other names, and whatever happens to the EU curve does affect other borrowers a lot,” said the senior DCM banker. “[But] the EU’s choices of size, tenor and timing have really become a key factor for EIB’s and KfW’s funding arrangements, and honestly, I don’t see that changing.”

A second Europe-based banker agreed that the EU’s funding behaviour will continue to influence that of other SSAs — and not just its biggest peers, but the smaller ones too.

“Every time the EU comes, it’s still a big liquidity event, even though it’s probably less the case compared to two years ago when they first started building their curves.” he said.

Lots done, more to do

Regardless of whether the market sees the EU as a revolutionary force or more of a disruptive factor, it has been acknowledged as a new benchmark for issuance. That, however, has resulted in some issuers having to pay up on their deals.

“The EU has been quite open in terms of how they approach the market so all issuers have been able to navigate them, but issuers clearly have started to pay a bit more,” said the syndicate head. “Our experience lately is that a number of investors are referencing the EU curve for relative value when looking at KfW. So it’s something to watch out for — the expectation is some issuers will have to cheapen up a bit.”

The EU official said that, as an issuer, it is trying to “remain as predictable as possible by sticking to the volume and funding windows we announced”, and that this is “something of value to our investor base especially in a volatile and uncertain market”.

He added: “At the same time [we try] keeping sufficient flexibility with each transaction by taking into account market conditions at the time when deciding on volume, maturities, and the single or dual tranche structure, to ensuring a smooth executions to give confidence to the market rather than creating more volatility and uncertainty."

The ‘EU effect’ is particularly pronounced in the long-end of the curve. It has been the most active duration issuer this year. Of the 16 bonds, including taps, sold across its 11 syndications, half had a tenor of 20 years or longer. The average maturity has been 16 years.

The banker in Europe said others may find it “problematic” to issue deals longer than 10 years. “There’s a steep spread curve, and for issuers like France, it’ll be difficult to get long-end funding done when their spreads are trading through the EU, although there is also the question of the ‘scarcity premium’.”

The EU plans to stay active in all parts of the curve up to 30 years. It also has a target to make 30% of its issuance green under NextGenerationEU — something yet to be achieved and which will lead to more green bonds printed through to 2026. This year, the EU only sold two green bonds, both via taps, for €9bn.

It is keen to position itself as a sovereign issuer, rather than as a supranational and it will carry out more work to achieve this in the coming months. “We have also made good progress in establishing the EU as an issuer closer to an EGB issuer and we received positive feedback from our investor survey in June,” said the official.

“We have taken the unified funding approach and adopted the single branded EU bonds, introduced a system for regular quotes of EU bonds on two interdealer trading platforms, with a plan to implement a repo facility as of summer next year,” he added. “We are also on track to approach relevant index providers before the year-end for inclusion of EU debt in government bond indexes.

“This transition does not happen overnight, and we continue the work in 2024.”