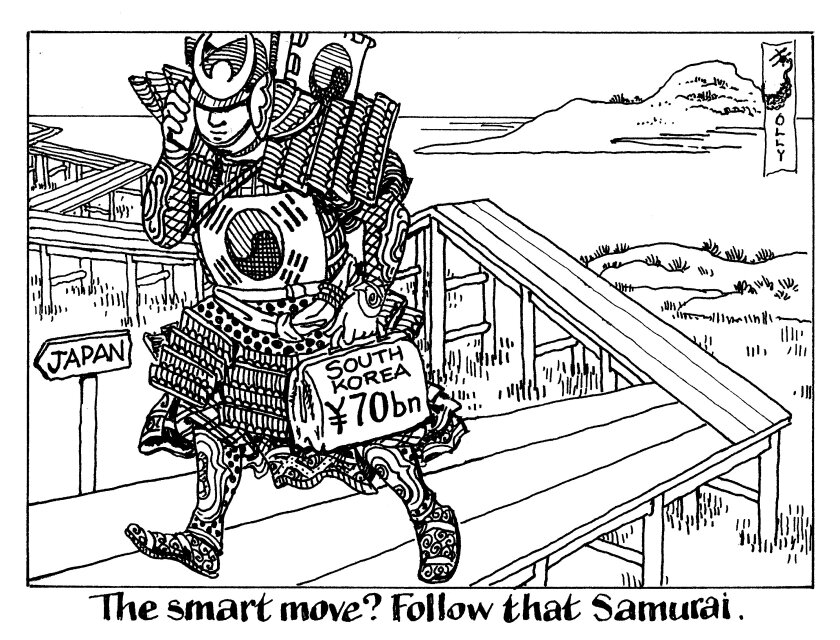

South Korea's debut ¥70bn ($480m) Samurai this week may have been small and perhaps more of symbolic benefit than financial to the sovereign but other issuers from the country should bring their own onshore yen bonds while they have a fresh benchmark.

That especially applies to issuers with links to the state, like South Korea's policy banks and utilities. Many of these have issued in yen before. Now, as the Japanese and South Korean governments mend their relationship and increase financial co-operation, South Korean issuers of all stripes have a good chance to diversify their funding by reviving relations with Japanese investors.

The benefits of investor diversification should not be underplayed. South Korean public sector bond issuers want to be seen as part of the SSA market. The top SSA issuers, large and small, are already well established in the Samurai and Uridashi markets.

The extra size available in the Samurai market, the brand building with Japanese investors the market brings will justify the lengthy process of filings versus the more easily accessible Euroyen market.

And although swapping the proceeds back to won may not be cheap, there will be South Korean companies that can make use of their yen. Of course, not all will need yen and choosing between swap costs versus FX risk for those without immediate needs is like being asked to pick between a rock and a hard place. But as economic relations blossom, so will the need for Japanese currency.

This week's deal fired the starting gun on a golden opportunity for South Korean borrowers.