The lowest rung of the high grade corporate bond market looks set to have its moment in the sun, as risk ramps up in the highest and lowest rated corners of the fixed income market.

Macroeconomic markers look bleak. In the UK, soaring wage growth of 7.8%, the highest since records began, is combining with still high inflation and low GDP growth. The risk of stagflation is lower in Europe, though it is still an outside possibility with inflation so stubbornly high.

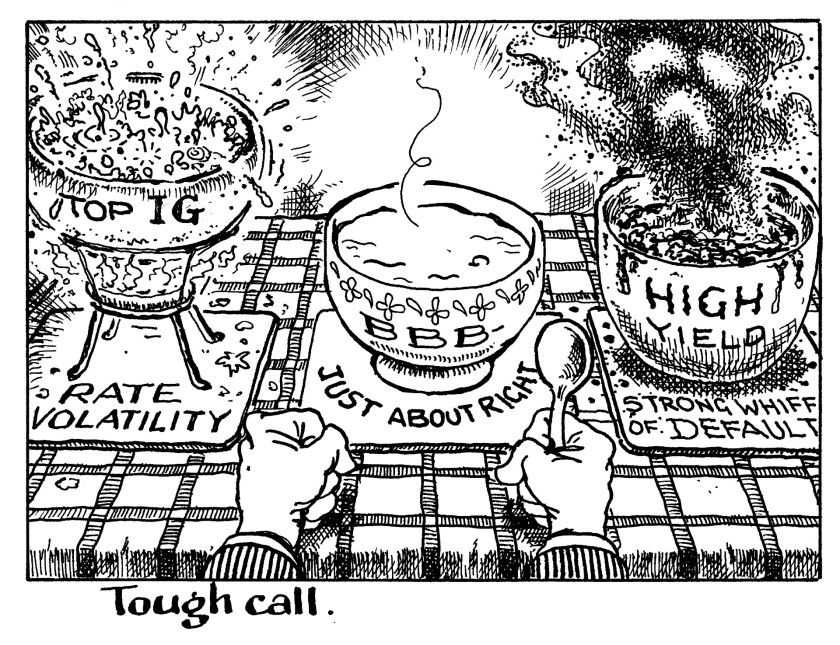

For much of the fixed income market, this is a problem. At the top end, the rates market and the highest rated investment grade issuers must deal with sharp interest rate volatility as central bankers battle rising prices.

With little wiggle room between government bond yields and their spreads, the best rated bond issuers will find it harder to convince investors to buy their debt.

One hedge for rates volatility is to buy bonds that offer a higher spread — if something is offering 300bp over Bunds, the thinking goes, it matters little if Bunds move by 5bp.

But the stagflation threat means that defaults are tipped to rise in the lowest rated corners of fixed income, making high yield and emerging markets a tricky prospect.

The high yield market looks particularly vulnerable with rates rising. Rates will be high for a while, meaning that a decent chunk of the high yield market will need to refinance before they come down again, locking in high coupons and eating away at the profitability of companies that, by definition, do not have the financial headroom to weather such a brutal storm for long.

But money keeps pouring into credit funds, and it must go somewhere. Step up, low rated investment grade issuers.

Issuers in the BBB- bracket are in the Goldilocks spot — trading wide enough to rates to offer volatility protection, while still having enough financial clout to let investors sleep at night if their funding costs rise.

Expect to see these issuers take advantage of the unusually favourable conditions.