Now is the time for bank treasurers to consider bringing forward any issuance they need to do that pays chunky spreads or higher yields that are pencilled in for the latter part of the year — or perhaps even revisit those postponed in the wake of Credit Suisse’s collapse in mid-March.

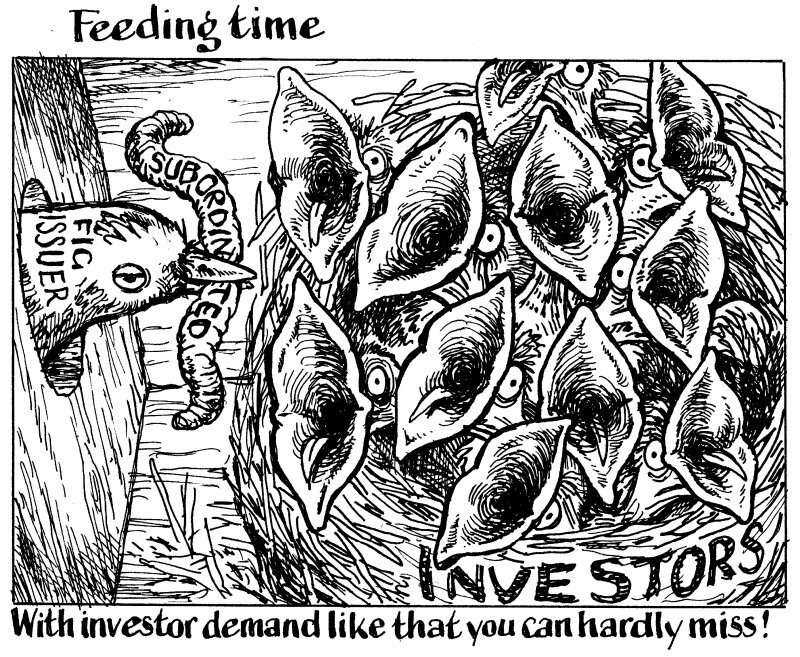

Famished investors are hungry for risk after months of suppressed supply. Just look at the rampant demand pledged to this week’s additional tier one (AT1) market reopeners from the Bank of Cyprus and BBVA.

Although the books on both deals peaked at close to €3bn, ultimately the pair left more than €4.6bn of orders unfilled, data from GlobalCapital’s Primary Market Monitor shows.

Investors have shown that if they are comfortable with the credit, then they are happy to gain exposure through risky instruments with high yields or wide spreads. BBVA, for instance, had no problem scooping €1.75bn of AT1 and tier two paper out of the market in less than six days.

FIG issuers should use this demand to their advantage. Capital products in euros have been, on average, four times covered since Santander reopened the subordinated debt market with a tier two trade last month, according to PMM data. Meanwhile, demand for their more senior cousins has averaged about two times covered over the same period.

And firms are harnessing this insatiable appetite to their advantage to ratchet in their spreads. Capital concessions averaged just under 10bp since mid-May, compared to 15.8bp in the senior market.

The primary market for bank debt is now fully reopen across the capital stack. Save those covered and senior preferred bonds for the next rainy day: the summer of subordinated debt is here. Popular deals and tight prices likely await any treasurer that chooses to tap this undersupplied part of the market.

Risk appetite is strong and investors are hungry. Bank treasurers listen up — now that the plague that shuttered the subordinated debt market has lifted, it’s time to bring out your spread.