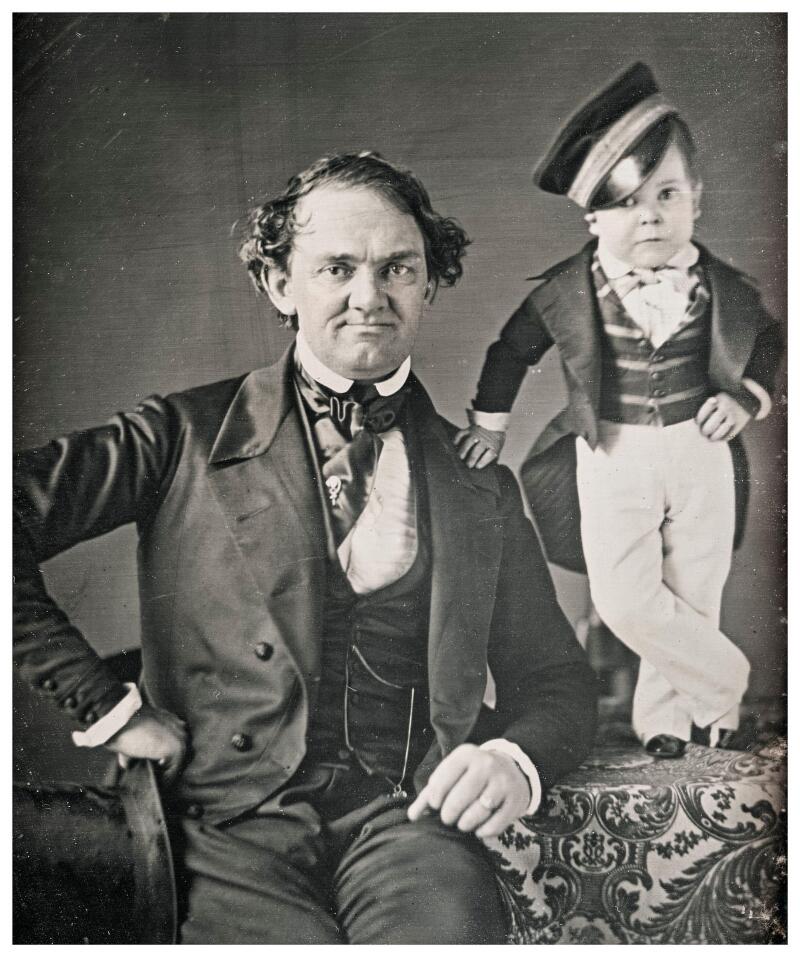

FIG issuers could learn a lot from legendary US showman PT Barnum (pictured), who knew how to draw a big audience. Many of the exhibits in Barnum’s spectaculars would be inappropriate, even illegal, for a modern circus but then Credit Suisse doesn't need to issue any more.

They would suit a sober and upstanding bank borrower even less. However, the two key lessons they can take from the maxim at the top of this page, which Barnum is said to have coined, are to offer certainty and scarcity.

Certainty is key in primary bond pricing. When faced with a deluge of lookalike new issues, investors want to know what they are getting into. In covered bonds this week, deals with sizes fixed from the outset did better than those that threatened investors with a benchmark size level of uncertainty. Investors like knowing how many bonds are likely to be swilling about after pricing.

Capping the size so as not to maximise volume means scarcity too — and that means performance.

Aktia Bank was able to rein in the spread by 4bp on its €500m no-grow four year deal, while ING Belgium — which did not set the size for its own deal at this tenor other than to promise a “benchmark” — could manage only 2bp, albeit it took €1.25bn. Both deals were priced at the same final spread, 17bp over mid-swaps.

Aktia collected a smaller book than ING Belgium — €1.1bn compared with €1.5bn — but its bid-to-cover ratio was almost double that of the larger deal, Primary Market Monitor data shows.

Bankers said that investors preferred Aktia’s honesty on its final size over ING Belgium’s offering, and were more “willing to engage... from the outset”.

And for issuers with a deal to do that is a little off the wall, it works too. Deutsche Bank’s €500m size cap helped it land the longest covered deal since February when the rest of the herd was crowding into the short end. The success of DZ Hyp’s own 10 year offering this week further cemented this belief.

Banks already come to the market several times a year, so leaving as little more funding to do should not be a worry. Instead, setting the size from the outset could mean a triumphant encore rather than a painful rerun.