NatWest Group launched Europe’s first FIG social bond linked to loans to businesses owned by women this week. The pricing of the deal on Tuesday coincided with International Women’s Day, which is celebrated globally on March 8.

Social deals have already found themselves a natural home in the SSA market, where supranationals — with their need to fund projects with social or environmental purpose — regularly place bonds linked to gender, health or education goals. But they are yet to take off in the FIG bond market.

Investors, with their ever-growing ESG mandates, are eager to see more of these highly specialised labelled deals and issuers can make use of this demand to their benefit. For example, NatWest’s latest offering attracted a €1.75bn book at its peak, allowing the UK lender to price the trade with a minimal concession.

But a bank’s commitment to social causes does not end once these — typically infrequent — deals are placed. If borrowers want to make firm their commitment to impact financing, then they must ensure that these deals are not merely one-offs issued to benefit from publicity associated with pricing on the relevant awareness days.

It is of course unreasonable to expect banks to churn out such deals on a frequent basis, given the loan pool for a highly targeted trade is bound to be smaller than its usual funding needs. NatWest, for instance, had just over £400m of loans available for its €500m (£442m) bond this week, with the rest set to be allocated over the next 12 months.

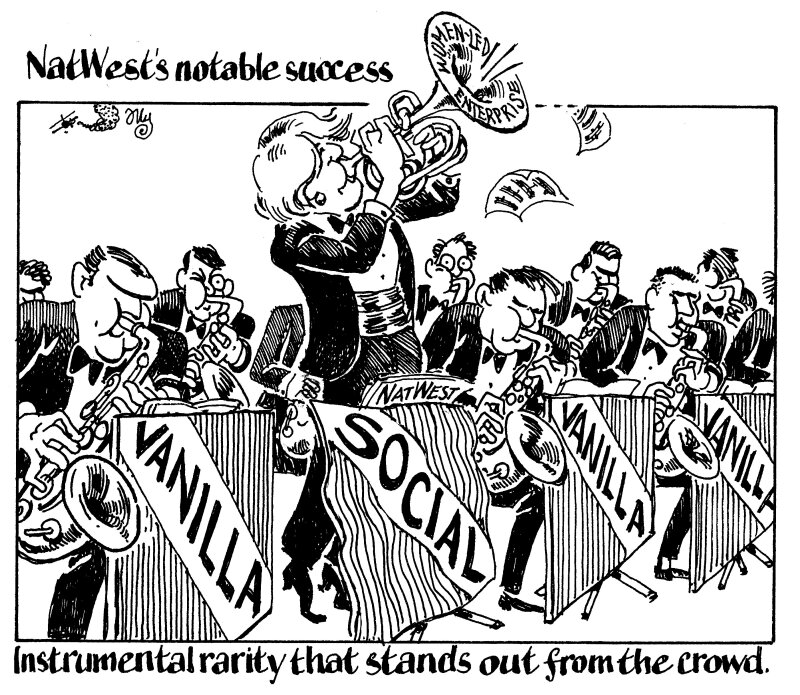

There are benefits to issuing such highly specific labelled debt, though, and in a market awash with labelled paper, these deals stand out. Social debt makes up a small proportion of the bank bond market in euros, yet banks fund all sorts of lending that could be classed as socially beneficial.

It takes time for a bank to build up a large enough pool of assets to justify a themed bond — NatWest has committed to £2bn of lending to women-owned business — but this week’s eye-catching trade should encourage lenders to make more out of this market niche.