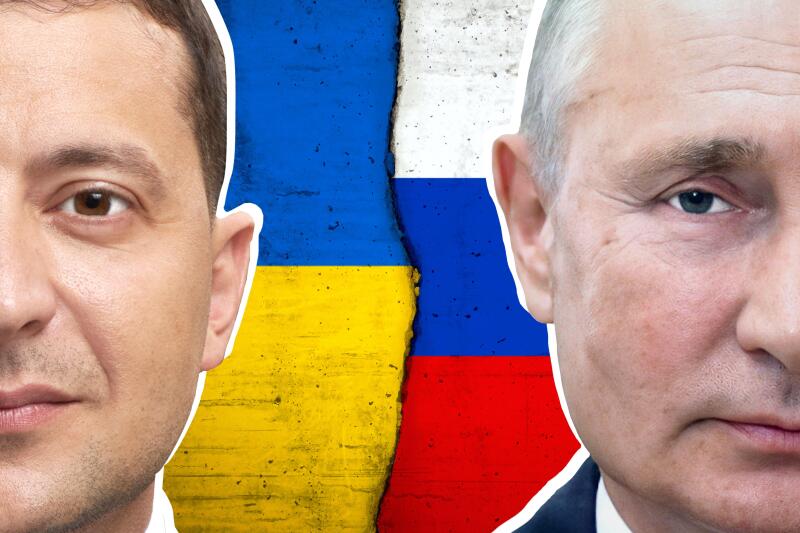

Russia shocked the world a year ago today when it invaded Ukraine. The world has felt the effects, including the capital markets. To mark the occasion we look into three areas of the markets profoundly changed by the war and question how they will develop as the conflict rumbles on.

The pandemic also had a profound effect on how we live our lives, in particular how and where we work. This is now starting to affect the securitization market in the US where deals backed by commercial mortgages are facing rising delinquencies because of the move to hybrid working and rising interest rates. We dissect this market and look at what lies on store.

Finally, it’s all change at the top of the World Bank as it searches for a new president to replace David Malpass who resigned earlier in the week. It may not be the biggest issuer in the capital markets but it is certainly among the most influential institutions on the planet both as borrower and lender.

Moreover, the change comes at a time when some are urging multilateral development banks to borrow even more. We look into the surprise nominee for the presidency, Ajay Banga, and what his appointment, if it happens, means for the world’s development banks and their place in the capital markets.

Subscribe to GlobalCapital's Podcast

You can listen and subscribe for free on your favourite podcast platform including: