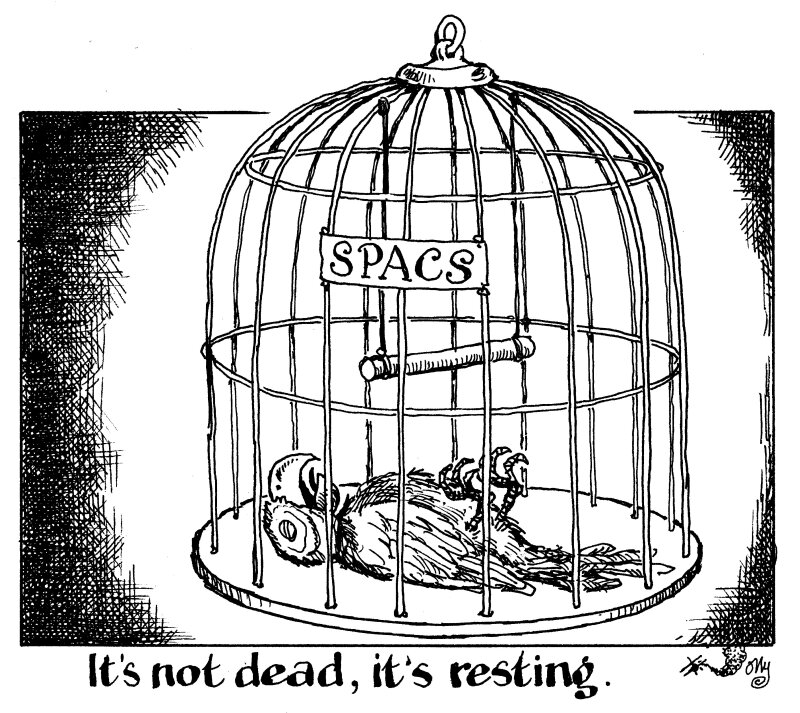

The European Spac Conference in London this week had all the qualities of a funeral: black suits, fond memories and, in some cases, denial. "It’s just a bad IPO year," argued one delegate.

The market for special purpose acquisition vehicles, at least in their incarnation of the past two years, is dead.

It was a far cry from the pandemic boom, which led to more than 900 Spac listings, but a renaissance is coming.

Spacs are shell companies without operations or revenue. They list on the stock market as a way to collect investors' money with the promise to buy another company within a set timeframe, usually an unprofitable high-growth business, often in the tech sector.

Spacs boomed in the US. To a lesser extent, the hype spilled over into Europe but this year, hardly any have come to the market.

In November, S&P counted 15 US Spacs, listed for $3.6bn, nearing the date at which they need to repay investors. Billions of dollars of mergers have collapsed, most recently the acquisitions of two Spacs backed by businessman Alec Gores.

Markets have turned against growth companies. On average, Spacs trade at less than half of their initial offer price. The US Securities and Exchange Commission is working on tougher regulations for blank check companies too.

Redemptions have risen from 38% in 2020 to 84% in 2022, draining the pool of cash for buying targets. Once merged, there is scant trading in the newly listed companies' shares, especially in Europe.

But Spacs are more likely to evolve than to become extinct because they are malleable.

Deals will become smaller — think $50m rather than $500m — and they will compete with venture capital rather than IPOs.

Their part in bigger transactions could be as cornerstone investors; committing to buy a chunk of an IPO before books open. In a volatile market, they will help guarantee a successful listing.

It will be a textbook example of survival of the fittest sponsors, who truly know their sector and, when choosing a company, how to tell the good from the glossy.

Spacs will prove more like the phoenix than the dodo.