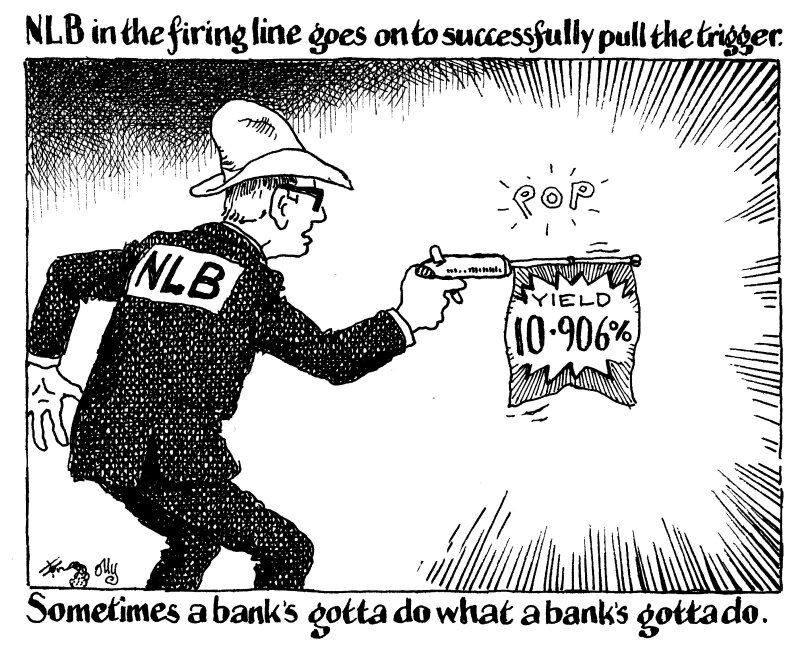

Slovenia’s NLB on Monday did something naughty. Having postponed its tier two bond at the end of last week, it popped back up the next trading day having fired all the banks on the mandate apart from Bank of America, which had offered it an underwritten deal.

BofA priced the deal with a yield of 10.906%, whereas it had been marketed at 10.25% the week before.

The other banks — Erste Bank and JP Morgan — are undoubtedly and understandably hopping mad. They had done a large ampunt of the legwork in preparing the issuer and the market for this deal.

Now, not only will they not collect the fee associated with the bond and the league table credit but they also, to a cynic, look like they tried to push investors into a deal that was more than 65bp too rich.

So far, so grim. But the entity with something really at stake here was NLB and, from its perspective, its course of action was understandable.

It’s been an awful year for emerging market bonds. Yields have rocketed while issuance windows have been small, and few and far between. Year-end is approaching fast and NLB needed to execute.

When BofA offered an underwritten note this week, it was too good an offer to refuse, even if it meant a higher yield than hoped for

Of course, had the issuer started its first attempt at the deal with a yield near 11%, it might have been able to price the trade first time and keep its dealers happy too.

Then again, such a high price might have triggered investor fears about why a borrower would want to pay that much for debt, ending in the same result — a scuppered first go.

We will never know for sure, but what NLB can be sure of is that it now has its deal. Despite any possible relationship costs with dealers of investors, it did the right thing for its own balance sheet.

It is unlikely that either constituency will punish NLB the next time it is in the market. For while syndicates may only be as good as their last deal, issuers are only as valuable as their next.