Although dealers are eager to push through the primary market every issuer that they can before Christmas, borrowers must remember that this is not a risk-free choice.

Issuers and investors need to strike a balance to price a deal well. And finding that equilibrium can be tricky after such a torrid year.

Fixed income portfolios are in the red as interest rate rises and persistent inflation have eaten away at returns. The iBoxx investment grade euro bond index, for instance, has fallen 14.9% so far this year.

With only a few weeks — if not days — of potential issuance windows remaining, the amount of liquidity left to go round is quickly diminishing as investors wind down.

Yes, some larger borrowers are attracting solid order books and cranking in their spreads, but household names such as SEB or Adidas can access the market at any time.

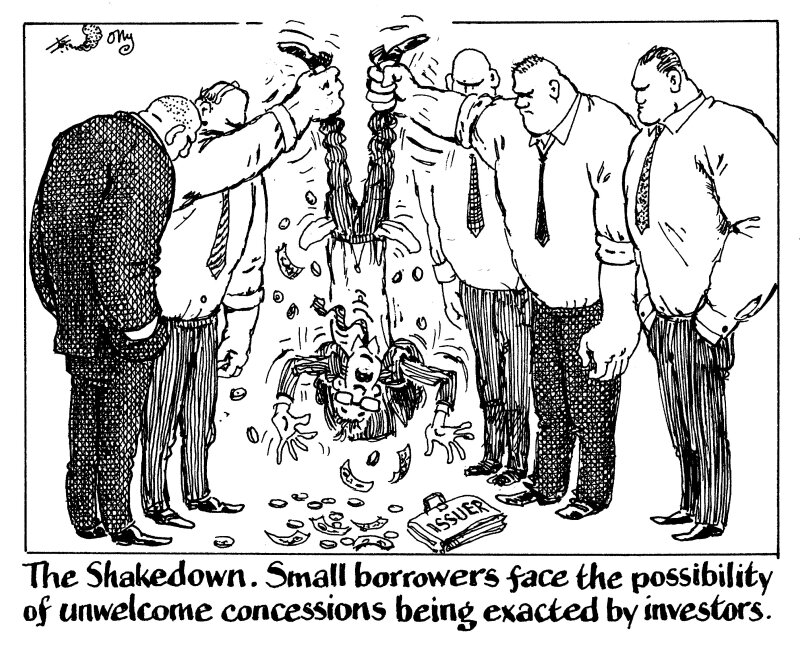

This level of demand, however, doesn’t extend to every issuer. Smaller, rarer names will have to be more wary about rushing in. The prices and concessions demanded by investors to make up for this year’s poor performance are too much for some issuers to stomach.

Piraeus, for instance, raised a five year non-call four senior bond at 8.5% on Thursday, just 25bp tighter than where it issued the first ever Greek additional tier one note last June.

For borrowers that might visit the market only once or twice a year, timing is key.

Conditions may have looked good for issuers lately, but borrowers know they have also traditionally been stronger in January — when investors have hordes of fresh cash to unleash.

For issuers that are not household names, the benefits of bringing a deal in a rush before year-end must be very carefully weighed.