The collapse last week of crypto currency ‘exchange’ FTX — surprising only by its late date — has led to a storm of headlines about Armageddon in cryptoland and even to some predictions that it is game over for cryptocurrencies.

Observers — including Rostin Behnam, chairman of the US Commodity Futures Trading Commission — have attributed the mayhem to rising interest rates and the ebbing of the vast tide of money invented by central banks since 2008.

People sitting at home during the pandemic blew the crypto bubble using cheap money, they argue. Expensive money and the end of the tech bull run have burst it.

All the doomy headlines have a strangely light tone, however. No wonder: the crumbling of crypto is a non-event for markets. Mainstream markets, that is.

Since the beginning of November 8, when the price of FTX’s token FTT fell off a cliff, never to recover, Bitcoin has fallen 21%.

The S&P 500 index, on the other hand, has risen 3.9%. Shares of two banks that like to talk confidently about blockchain, decentralised finance and ‘digital assets’, Goldman Sachs and JP Morgan, are up 5.5% and 1.9%. As FTX was melting on November 8 itself, all three rose.

This is reassuring. Of the four big dangers posed by cryptocurrencies, probably the worst is that conventional financial firms could be tempted into this workshop of chaos and take risks that could damage mainstream banking and saving.

Could lunatics take over?

In the decade since crypto became widely known, many signs have pointed to that happening. Led by the US, the Western financial establishment has shown an astonishing leniency and eagerness towards cryptocurrencies, even though they break all the rules of financial robustness and probity.

From the major banks to regulators and central banks, fear of missing out on the next technological arms race has led most influential financial players to embrace blockchain and crypto in some way, set up labs to research applications, engage in experimental transactions and make investments.

Cryptocurrencies have even made inroads into regular finance.

FTX’s investors reportedly included — alongside serial foot-shooter Softbank — Ontario Teachers’ Pension Plan and BlackRock. Yes, the same BlackRock whose chief executive Larry Fink regularly reminds the world that the firm’s action on climate change is constrained by its pious observation of fiduciary duty to clients.

CME Group, the world’s largest derivatives exchange, offers Bitcoin futures and options. Several exchange-traded funds conveying Bitcoin exposure are regulated by the US Securities and Exchange Commission.

Dennis Kelleher, chief executive of Better Markets, a US NGO that lobbies for fairer and better regulated financial markets, put out a statement this week pointing out that FTX’s US arm, formerly LedgerX, was “licensed by and registered with” the US Commodity Futures Trading Commission, which he said had “failed miserably” in supervising it.

For several years, the CFTC and the SEC — as well as the US prudential banking regulators — have been jostling over which should get to regulate crypto.

Certainly, both Behnam at the CFTC and Gary Gensler, chair of the SEC (and former CFTC chair) have spoken enthusiastically about the need to regulate it.

Hankering for safety

Although regulation has begun — Gensler argued in a speech in April that, under existing securities law, “most crypto tokens are investment contracts” and hence should be regulated — the authorities have not yet taken the plunge and developed any all-encompassing regulatory architecture for the crypto world.

The kneejerk reaction of many who are wary of crypto is “regulate it”. They are alarmed by the smallest of the four big risks — that innocent people will lose money on crypto.

These protective souls might hesitate if they knew that regulation was also the dearest wish of Sam Bankman-Fried, whose star burned briefly as the brightest in the crypto heaven before his FTX empire fell to dust.

Regularising and legitimising crypto tokens, issuers and ‘exchanges’ — many of which, as commentators have pointed out, are more like market makers — would be a boon for those who have already made fortunes in this underworld. Their activities would be recognised as valid and consumers would feel much safer dabbling.

Above all, the big battalions — institutional investors — would be likely to arrive en masse.

Don't go there

But to regulate the crypto world, certainly at this stage, would be to multiply its risks.

Behnam and Gensler both want to protect the consumer. But almost the only thing that is unequivocally good about crypto at the moment is that players know they are taking real risk. No one is going to bail them out if they mess up.

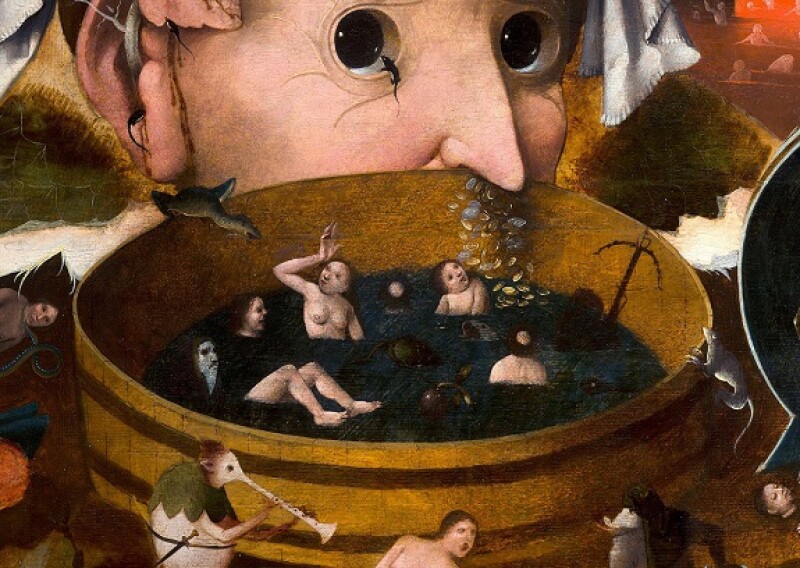

In this respect, the crypto pond is like financial markets of old, before there was much regulation or supervision. Prices can fluctuate wildly. Confidence runs are an ever-present threat. Thefts are common. (FTX seems to have been hit with one last weekend, on top of its self-inflicted woes.) But, delighting the heart of any true blockchain libertarian, there is no moral hazard or nanny state.

This brings many benefits. The cryptosphere acts as a playground, science lab, cage fighting ring and object lesson.

Remember November 8, 2021? If the answer is yes, you’re a crypto player. But to anyone in regular markets, the date means nothing.

That was when the total cryptocurrency market cap hit its all time high of $2.9tr, according to CoinMarketCap.com. Since then it has plunged 70%.

The lack of any safety net is likely a big reason why more than $2tr of notional value has been destroyed in the past year without it provoking any detectable harm in the real economy.

Many crypto nuts may have lost a lot of money — on screens. But most of them probably only played with money they could afford to lose, and with only a portion even of that.

Of course there are sad exceptional cases of people losing huge sums and committing suicide. But so there are with sports betting, poker and ordinary stocks and shares.

If crypto investors had had the reassurance of believing that the government had checked these products and made them safe, not only would far more money have poured into flimsy coins and tokens, but when disasters happened, the victims would have looked to the authorities (meaning taxpayers) for compensation.

Now, you have to make a conscious decision to put any of your hard-earned cash into crypto. If it was officialised, the governance would immediately become far worse.

Ninety-nine percent of people, financial journalists included, have only the dimmest idea of what is in their pension funds or investment portfolios. Investment intermediaries and fund managers would be including crypto as part of a “balanced allocation” before you know it.

Herding cats

For the time being, crypto’s bombs have exploded only in the crypto world.

Regulating the field would bring it — and its havoc — into the official financial markets. When I last checked, the ordinary markets had quite enough instability already.

But if crypto was regulated, wouldn’t it actually be safer? Somewhat. But actually safe? Please.

Even normal markets have had Nick Leeson, Enron, Parmalat, Libor rigging, Bernie Madoff, Jérôme Kerviel, Wirecard, NMC Health… not to mention the more innocent failures, from Northern Rock to Lehman Brothers.

These were all companies and people with actual functions that everyone could understand, at least to begin with. They could, if they had behaved differently, have been law-abiding, productive and successful.

How do Behnam and Gensler propose to turn the surreal Bacchanalia of crypto into a Sunday school tea party?

Form over substance

Gensler seems to be in the grip of arguments drawn from abstract philosophy.

He points to the Howey Test established by the Supreme Court in 1946: “an investment contract exists when there is the investment of money in a common enterprise with a reasonable expectation of profits to be derived from the efforts of others”.

Today, he adds, “many entrepreneurs are raising money from the public by selling crypto tokens, with the expectation that the managers will build an ecosystem where the token is useful and which will draw more users to the project”.

He omits the word “reasonable” this time — perhaps it would have provoked chuckles.

Gensler believes that because, for many crypto tokens, it is difficult to prove that they do not have the form of investment contracts, they should be treated as such.

But to believe that issuing tokens is an innocent and necessary way for companies with clever technological ideas to raise capital is startlingly naïve.

Venture capital, crowd funding and every other kind of regular financial investment are available to such companies, and are used by many crypto players.

Creating tokens is an end in itself. The promoter, who generates the coin out of nothing, and all who invest in it, have one hope — that it will become popular and rise in value. The bubble is the point.

To put this kind of confidence trick into the same category with legitimate businesses trying to provide people with a service is disturbing.

Funny money

With a few of the coins, including the most successful ones, Bitcoin and Ether, many users believe they have a valuable function. But the systems rely on the validators that support the network being rewarded with coins, which have value only if they are seen as scarce and desirable by others.

Apart from speculative betting — holding and hoping for a bubble — the coins themselves have one potential attraction. They are a way of paying for things, not in ordinary money.

Who would want to do that — and why?

In a passage on stablecoins — those that track the value of ordinary currencies — Gensler gets to the point. “Stablecoins raise issues on how they potentially can be used for illicit activity. Stablecoins primarily are used for crypto-to-crypto transactions, thus potentially facilitating platforms and users avoiding or deferring an on-ramp or off-ramp with the fiat banking system. Thus, the use of stablecoins on platforms may facilitate those seeking to sidestep a host of public policy goals connected to our traditional banking and financial system: anti-money laundering, tax compliance, sanctions, and the like.” No, really?

Banning cryptocurrencies at birth might have been wise. Now, it is too late.

Some claim they are about to die out from their own flaws, or for macroeconomic reasons.

Look again at the graph of the Bitcoin price, or total value of cryptocurrencies. They have had four big crashes — December 2017 to February 2018, April to July 2021, November 2021 to January 2022 and April to June this year.

None of these corresponds with any obvious event or trend in conventional markets. Just as economics did not create the crypto bubbles, it cannot stop them either.

There will always be people with some spare money to play with. Cryptocurrencies shrivelling away from lack of interest is about as likely as humans growing out of folly.

Bridle the beast

No technology, however dangerous, can ever be dis-invented. In fact, threat is often what keeps things popular. We will always have to live with plutonium, Novichok and facial recognition software. Society has to find ways to control them, limit their harm, and allow the good they can do.

With cryptocurrencies, there are two other big dangers. One is their appalling energy intensity. There are ways to reduce this now — Ether switched in September from proof of work validation, as used by Bitcoin, to proof of stake, which is estimated to use up to 1,000 times less electricity.

But blockchains are still many times more power-thirsty than conventional computing, and the industry has to address that — or be made to.

The other is crime — all the ills Gensler listed, and more. This is where regulation should be focused. Sanitising crypto and integrating it with the real financial world is exactly the wrong way to go.

Keep it separate, walled off, and there is a chance that, as with FTX, its disasters will stay contained.

And those walls are where the watchers should watch. Crypto is a paradise for criminals and tax dodgers. But they want to move regular money into the cryptoverse, and take wealth out, either as money or real assets.

A new regulatory regime should be devised with strict controls of any conversion between daylight assets and crypto tokens. If you change pounds to dollars at the airport you need to show your passport. The hurdles for crypto-to-cash exchange should be higher.

Crypto appeals to the adventurous, the curious, the greedy, the optimistic and the inventive. Many of them are naïve, but as long as they only fool themselves and each other, they will not harm society. Society can afford to be tolerant — but not to get swept up in the enthusiasm.

Crypto also appeals to the corrupt. There, the tolerance of the last 13 years is inexplicable. It’s time to catch some rogues.