This week held an important reminder for corporate bond issuers that volatility works both ways, with a market now infamous for slamming shut overnight proving itself capable of accepting jumbo transactions at a moment’s notice.

The Netherlands’ Tennet sold €3bn across four tranches on Wednesday, with maturities ranging from six to 20 years.

Tennet is a well loved by many investors — it is the largest corporate green bond borrower by amount issued.

Nonetheless, market volatility has frequently overcome creditworthiness in this autumn’s issuance window, with borrowers of all kinds having to navigate their way through the stormy seas of high inflation and quantitative tightening.

The market appeared so poor by Monday afternoon that a lead on the Tennet deal said they did not expect to be running any more trades this week. Two days later, they were arranging the first four tranche deal in a month.

This is a market that can quickly change — and not always for the bad.

And Tennet even got away with decent new issue concessions, considering how ropey sentiment has been. The shorter tranches paid 25bp-30bp, which is in line with others at that maturity, while the 20 year portion — the longest since quasi-government agency issuer Deutsche Bahn printed debt a month ago — paid 60bp in concession.

While a 60bp premium is fairly eye-catching for an A3/A- issuer, it seems reasonable given the ambition of the maturity and the fact that the deal came so soon after participants were writing off the market for the week.

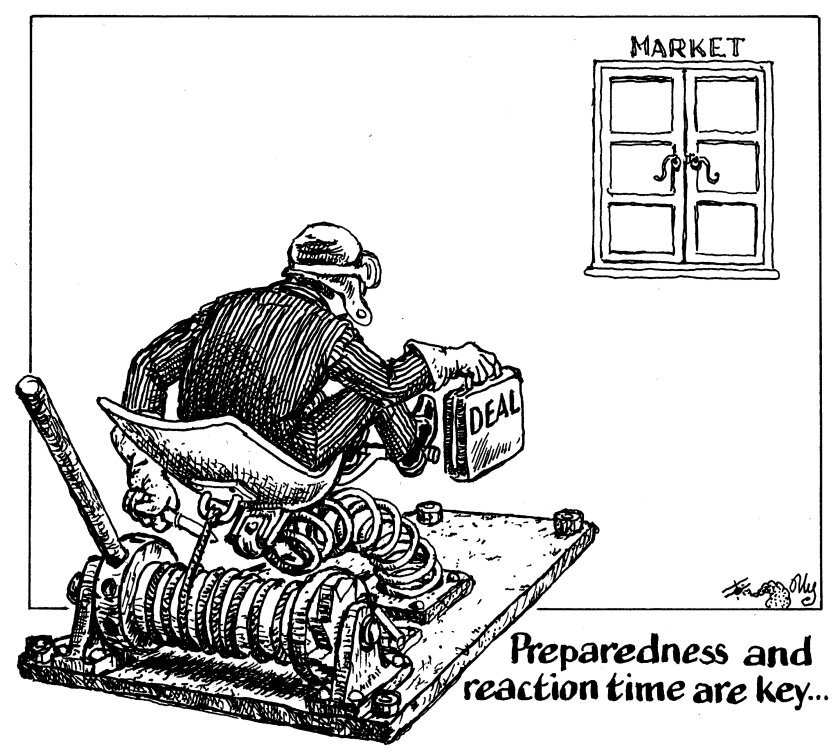

Tennet’s success again highlights how important it is for issuers to remain nimble. There are few issuance days left for 2022, with central bank meetings, public holidays and official data dumps all considered no-go days for the rest of the year. When the pendulum of market volatility swings in their favour, borrowers must quickly gather the troops and attack.